Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

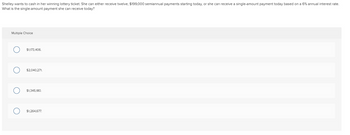

Transcribed Image Text:Shelley wants to cash in her winning lottery ticket. She can either receive twelve, $199,000 semiannual payments starting today, or she can receive a single-amount payment today based on a 6% annual interest rate.

What is the single-amount payment she can receive today?

Multiple Choice

$1,173,406.

$2,040,271.

$1,345,180.

$1,264,677.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- For the Years 1,2,3,4, and 5, the index numbers are 108, 112, 116, 124, and 131 respectively. Based on the data, if the index were rebased so that Year 3 is 100, the index for Year 1 would be a. 93.1 b. 100 c. 112.9 d. 116arrow_forwardFind the future value of each using the future value of an ordinary annuity formula. Shelly deposits the $2,000 she got as a birthday gift from her grandmotherinto an account earning 3.6% interest compounded monthly. She decides to also deposit $200 at the end of each month into the same account. How much will be in the account in 10 years? Julian won the lottery! He deposits some of his winnings intoan account earning 2.75% interest compounded quarterly. He makes his deposit of $25,000 and also decides to start making deposits of $1,000 into the same account at the end of each quarter. How much will he have after 5 years?arrow_forward3. Give your answers to parts (a) to (e) to the nearest dollar. On Jake's 16th birthday his parents gave him options of how he might receive his monthly allowance for the next two years. Option A $50 each month for two years. Option B $5 in the first month, $10 in the second month, $15 in the third month, increasing by $5 each month for two years. Option C Investing $1000 at a bank at the beginning of the first year, with an interest rate of 6% per annum, compounded monthly. Jake does not spend any of his allowance during the two year period.arrow_forward

- Raymond wants to save the college tuition fees his child will need in ten years by starting with a deposit of $7,500 today and depositing another $200 at the beginning of each month. How much will Raymond have in ten years if he gets a rate of return of 4% per annum? a. $37,201 b. $39,057 c. $40,537 d. $40,441arrow_forwardPlease answer question 13 first and then 12 and 11. Thank youarrow_forwardYuli plans to purchase a vehicle, and she is working with two bank offers. . Bank One Loan Offer: $73,800, 6% annual interest, 60 months. . Bank Two Loan Offer: $73,800, 3% annual interest, 84 months. Yuli's ultimate financial goal is to select the loan with the lowest monthly payment regardless of duration. Based on her financial goal, which loan will Yuli choose? O A. Bank One: Loan Offer O B. Bank Two: Loan Offer OC. Both monthly payments are the same. O D. Not enough information given to answer the question.arrow_forward

- Without using Excel and using the formula, Cheryl is setting up a payout annuity and wishes to receive $1200 per month for 20 years. A. How much does she have to deposit if her money earns 8% interest compounded monthly? B. Find the total amount Cheryl will receive from her payout annuity.arrow_forwardJose wants to cash in his winning lottery ticket. He can either receive eight, $6,000 annual payments starting today, or he can receive one lump-sum payment today based on a 3% annual interest rate. What would be the lump-sum payment?arrow_forwardDan is planning to buy a new home that costs $130000 Find the following if Dan make a 5% downpayment. How much will Dan's down payment be? (Round to the nearest cent) How much will Dan owe after he makes the down payment? (Round to the nearest cent)arrow_forward

- 6) Susan is looking to purchase her first home five years from today. The house costs $1,550,000. She will have to make a down payment of 10% of this amount and plans to take a loan from the bank for the difference. Bank charges are approximately 15% of the loan amount. She plans to start saving from today to cover both the down payment and the bank charges. a. How much will she need to save to cover both the down payment and bank charges? b. If she currently has $195,000 in her account and will make no further deposits over the next five years, what rate of interest must she earn on this account in order to achieve the savings target calculated in part (a) above?arrow_forwardAhmed Al Khatib has just won the lottery and must choose among three award options: lump sum of $61 million today 10 end-of-year payments of $9.5 million 30 end-of-year payments of $5.5 million If Ahmed can earn 7% annually, which option should he choose? If Ahmed can earn 8% annually, which option should he choose? If Ahmed can earn 9% annually, which option should he choose? Explain how interest rates influence Ahmed’s choice.arrow_forwardJane Bauer has won the lottery and has the following four options for receiving her winnings: Receive $100,000 at the beginning of the current year Receive $108,000 at the end of the year Receive $20,000 at the end of each year for eight years Receive $10,000 at the end of each year for 30 years Jane can invest her winnings at an interest rate of 8% compounded annually at a major bank. Use the appropriate present or future value table: FV of $1, PV of $1, FV of Annuity of $1 and PV of Annuity of $1 Calculate the Present value for each of the above options. Round all answers to the nearest dollar. Present Value Option 1 $fill in the blank 1 Option 2 $fill in the blank 2 Option 3 $fill in the blank 3 Option 4 $fill in the blank 4 Which of the payment options should Jane choose?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education