FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

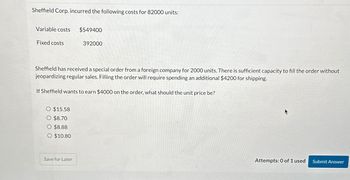

Transcribed Image Text:Sheffield Corp. incurred the following costs for 82000 units:

Variable costs

Fixed costs

O $15.58

O $8.70

O $8.88

O $10.80

$549400

Sheffield has received a special order from a foreign company for 2000 units. There is sufficient capacity to fill the order without

jeopardizing regular sales. Filling the order will require spending an additional $4200 for shipping.

If Sheffield wants to earn $4000 on the order, what should the unit price be?

Save for Later

392000

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Concord Music produces 59600 blank CDs on which to record music. The CDs have the following costs: Direct Materials $10000 Direct Labour 15700 Variable Overhead 3300 Fixed Overhead 6600 None of Concord’s fixed overhead costs can be reduced, but another product could be made that would increase the operating income by $4500 if the CDs were acquired externally. If cost minimization is the major consideration and the company would prefer to buy the CDs, what is the maximum external price that Concord would be willing to accept to acquire the 59600 units externally? $31100 $40100 $35600 $33500arrow_forwardStryker Industries received an offer from an exporter for 27,000 units of product at $19 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available: Domestic unit sales price $25 Unit manufacturing costs: Variable 9 Fixed 6 What is the amount of income or loss from acceptance of the offer? a.$675,000 b.$513,000 c.$243,000 d.$270,000arrow_forwardStryker Industries received an offer from an exporter for 29,000 units of product at $19 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $25 Unit manufacturing costs: Variable Fixed 14 5 The differential cost from the acceptance of the offer is Oa. $145,000 Ob. $551,000 Oc. $725,000 Od. $406,000arrow_forward

- Stryker Industries received an offer from an exporter for 22,000 units of product at $17 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price Unit manufacturing costs: Variable Fixed $23 12 3 The amount of profit or loss from acceptance of the offer is a Oa. $110,000 Ob. $264,000 Oc. $506,000 Od. $374,000arrow_forwardplease answer the following question thanksarrow_forwardWaltman Co. produces 5,000 units of part A12E. The following costs were incurred for that level of production: Direct materials $ 55,000 Direct labor 160,000 Variable overhead 75,000 Fixed overhead 175,000 If Waltman buys the part from an outside supplier, $40,000 of the fixed overhead is avoidable. If the outside supplier offers a unit price of $68, net income will increase (decrease) by O ($50,000) decrease $125,000 increase O $85,000 increase O ($10,000) decreasearrow_forward

- Give me correct answer for this questionarrow_forwardA buyer from another country offered to purchase 2,000 units of product for $ 2.50 per unit. The normal selling price is $ 3.00 per unit. The company's regular variable costs of $ 1.50 per unit would not change, however overall fixed costs would increase by $ 500 if his order is accepted. How much will net income increase if this special order is accepted? Multiple Choice $ 2,500. $ 2,000. $1,500. $ 3,000. $ 1,850.arrow_forwardwhat is the answer out of multiple choice above^arrow_forward

- Please help me with show all calculation thankuarrow_forwardVaughn Music produces 60800 blank CDs on which to record music. The CDs have the following costs Direct Materials $10600 Direct Labour 14800 Variable Overhead 2800 Fixed Overhead 6800 None of Vaughni's foxed overhead costs can be reduced, but another product could be made that would increase the operating income by $4400 if the CDs were acquired externally If cost minimization is the major consideration and the company would prefer to buy the CDs, what is the maximum external price that Vaughn would be willing to accept to acquire the 60800 units externallyarrow_forwardCarmen Co. can further process Product J to produce Product D. Product J is currently selling for $21.15 per pound and costs $16.40 per pound to produce. Product D would sell for $42.80 per pound and would require an additional cost of $9.55 per pound to produce. The differential cost of producing Product D is Oa. $9.55 per pound Ob. $5.73 per pound Oc. $7.64 per pound Od. $11.46 per poundarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education