FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

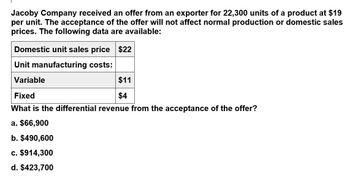

Transcribed Image Text:Jacoby Company received an offer from an exporter for 22,300 units of a product at $19

per unit. The acceptance of the offer will not affect normal production or domestic sales

prices. The following data are available:

Domestic unit sales price $22

Unit manufacturing costs:

Variable

$11

$4

Fixed

What is the differential revenue from the acceptance of the offer?

a. $66,900

b. $490,600

c. $914,300

d. $423,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accept Business at Special Price Product A is normally sold for $42 per unit. A special price of $33 is offered for the export market. The variable production cost is $24 per unit. An additional export tariff of 16% of revenue must be paid for all export products. Assume there is sufficient capacity for the special order. a. Prepare a differential analysis dated March 16 on whether to reject (Alternative 1) or accept (Alternative 2) the special order. If required, round your answers to two decimal places. If an amount is zero, enter "0". Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Reject Accept Differential Order Order Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues, per unit Costs: Variable manufacturing costs, per unit Export tariff, per unit Profit (loss), per unit $ b. Should the special order be rejected (Alternative 1) or accepted (Alternative 2)?arrow_forwardA business received an offer from an exporter for 10,000 units of product at a special price of $15.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $21 Unit manufacturing costs: Variable 12 Fixed 5 What is the amount of the gain or loss from acceptance of the offer? a. $8,000 loss b. $15,000 loss c. $35,000 gain d. $30,000 gainarrow_forwardJacoby Company received an offer from an exporter for 20,500 units of product at $19 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $24 Unit manufacturing costs: Variable $9 Fixed $5 What is the differential revenue from the acceptance of the offer? a.$389,500 b.$881,500 c.$102,500 d.$492,000arrow_forward

- Stryker Industries received an offer from an exporter for 24,000 units of product at $18 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available: Domestic unit sales price $21 Unit manufacturing costs: Variable 11 Fixed 6 What is the amount of income or loss from acceptance of the offer? a.$168,000 b.$264,000 c.$504,000 d.$432,000arrow_forwardStryker Industries received an offer from an exporter for 21,000 units of product at $19 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $23 Unit manufacturing costs: Variable Fixed 9 4 The amount of profit or loss from acceptance of the offer is a a. $483,000 Ob. $189,000 ○ c. $399,000 Od. $210,000arrow_forwardJacoby Company received an offer from an exporter for 29,500 units of product at $18 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Line Item Description Amount Domestic unit sales price $25 Unit manufacturing costs: Variable 9 Fixed 4 The differential revenue from the acceptance of the offer is a. $1,268,500 b. $206,500 c. $737,500 d. $531,000arrow_forward

- Stryker Industries received an offer from an exporter for 26,000 units of product at $16 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $22 Unit manufacturing costs: Variable Fixed 13 6 The amount of profit or loss from acceptance of the offer is a Oa. $78,000 Ob. $338,000 Oc. $416,000 Od. $572,000arrow_forwardAccept Business at Special Price Product A is normally sold for $47 per unit. A special price of $30 is offered for the export market. The variable production cost is $25 per unit. An additional export tariff of 16% of revenue must be paid for all export products. Assume there is sufficient capacity for the special order. a. Prepare a differential analysis dated March 16 on whether to reject (Alternative 1) or accept (Alternative 2) the special order. If required, round your answers to two decimal places. If an amount is zero, enter "0". Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Reject Acсept Differential Order Order Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues, per unit Costs: Variable manufacturing costs, per unit Export tariff, per unit Profit (loss), per unit $ b. Should the special order be rejected (Alternative 1) or accepted (Alternative 2)?arrow_forwardStryker Industries received an offer from an exporter for 21,000 units of product at $17 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: Domestic unit sales price $21 Unit manufacturing costs: Variable Fixed 9 4 The differential cost from the acceptance of the offer is O a. $189,000 O b. $441,000 O c. $84,000 O d. $357,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education