Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

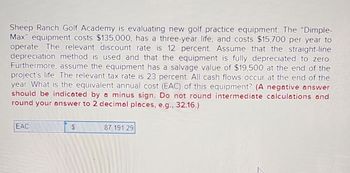

Transcribed Image Text:Sheep Ranch Golf Academy is evaluating new golf practice equipment. The "Dimple-

Max" equipment costs $135,000, has a three-year life, and costs $15,700 per year to

operate. The relevant discount rate is 12 percent. Assume that the straight-line

depreciation method is used and that the equipment is fully depreciated to zero.

Furthermore, assume the equipment has a salvage value of $19,500 at the end of the

project's life. The relevant tax rate is 23 percent. All cash flows occur at the end of the

year. What is the equivalent annual cost (EAC) of this equipment? (A negative answer

should be indicated by a minus sign. Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

EAC

$

87.191.29

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $71,000. The machine would replace an old piece of equipment that costs $18,000 per year to operate. The new machine would cost $8,000 per year to operate. The old machine currently in use is fully depreciated and could be sold now for a salvage value of $26,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%) 1. Depreciation expense 2. Incremental net operating income 3. Initial investment 4.…arrow_forwardRust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $220,000, has a four-year life, and requires $70,000 in pretax annual operating costs. System B costs $312,000, has a six-year life, and requires $64,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever system is chosen, it will not be replaced when it wears out. The tax rate is 25 percent and the discount rate is 8 percent. Calculate the NPV for both conveyor belt systems. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. > Answer is complete but not entirely correct. System A $ 15,579.69 x System B $ 713,268.58 x Which conveyor belt system should the firm choose? System A✔ System Barrow_forwardYou are evaluating a potential investment in equipment. The equipment's basic price is $126,000, and shipping costs will be $3,800. It will cost another $18,900 to modify it for special use by your firm, and an additional $6,300 to install it. The equipment falls in the MACRS 3-year class that allows depreciation of 33% the first year, 45% the second year, 15% the third year, and 7% the fourth year. You expect to sell the equipment for 23,300 at the end of three years. The equipment is expected to generate revenues of $115,000 per year with annual operating costs of $61,000. The firm's marginal tax rate is 30.0%. What is the value of the after-tax cash flow associated with the sale of the equipment? ANSWER CHOICES $8,715 $16,310 $12,450 $19,565 $7,115 Correct answer is $19,565. Need help with the steps to solve the problemarrow_forward

- Iron Company is considering a new equipment which will cost $75,000 today. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero-salvage value, and would require additional net operating working capital of $18,000. The annual sales revenues of the project are $100,000, and annual operating cost except depreciation is $45,000. Revenues and other operating costs are expected to be constant over the project's life. Iron Company tax rate is 35.0% and its cost of capital is 13.35 percent. What is the project's NPV, what the project's MIRR? (MUST show and explain all steps)- Please and thank you!arrow_forwardChoose the correct answer for the following question: Your company is analyzing two machines to determine which one it should purchase. Whichever machine is purchased will be replaced at the end of its useful life. The company requires a 10 percent rate of return and uses straight-line depreciation to a zero book value over the life of the machine. Machine A has a cost of $300,000, annual operating costs of $42,000, and a 5-year life. Machine B costs $265,000, has annual operating costs of $50,000, and a 4-year life. The company currently pays no taxes. Which machine should be purchased and why? (Hint: consider the equivalent annual cost-EAC of the two machines) A. Machine A; because it will save the company about $8,783 a year B. Machine A; because it will save the company about $14,670 a year C. Machine B; because it will save the company about $11,482 a year D. Machine B; because it will save the company about $9,916 a year E. Machine A; because it will save the company about…arrow_forwardAthena Books Company is contemplating the installation of a wastewater recycling system. The amount to be invested in this system is $400,000. The system is expected to last 8 years and has no salvage value. Which of the following situations supports the installation of the recycling system? Assume the present value factor for an annuity of $1 at 10% for 8 periods is 5.3349 and the present value factor for $1 at 10% for 8 periods is 0.4665. The total cash flow savings expected from the recycling system is $700,000. The annual maintenance cost for the system is $40,000. The annual maintenance cost for the system is equal to the cost of the existing water system. The recycling system will yield a savings of $78,000 per year.arrow_forward

- Rust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $260,000, has a four-year life, and requires $80,000 in pretax annual operating costs. System B costs $366,000, has a six-year life, and requires $74,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 25 percent and the discount rate is 9 percent. Calculate the EAC for both conveyor belt systems. Note: Your answers should be negative values and indicated by minus signs. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. System A $ 38,562.29 X System B $ 25,802.08 x Which conveyor belt system should the firm choose? System A System Barrow_forwardFilkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $220,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $97,000 per year; and Machine 360-6, which has a cost of $320,000, a 6-year life, and after-tax cash flows of $93,400 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins's cost of capital is 12%. Calculate the two projects' extended NPVs. Do not round intermediate calculations. Round your answers to the nearest dollar. Machine 190-3: $ Machine 360-6: $ Should the firm replace its old knitting machine? If so, which new machine should it use? The firm -Select- By how much would the value of the company increase if it accepted the better machine? Do not round intermediate calculations. Round your answer to the…arrow_forwardA private gym is looking at a new set of sports equipment with an installed cost of $465,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sports equipment can be scrapped for (TIP: "scrapped for" = sold for) $61,000. The sports equipment will save the gym $143,000 per year in pretax operating costs, and the equipment requires an initial investment in net working capital of $27,000. If the tax rate is 22 percent and the discount rate is 10 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forward

- The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,000,000, and it would cost another $20,000 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $576,000. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $424,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 35%. Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ If the project's cost of capital is 11 %, what is the NPV of the project? $arrow_forwardA construction company is evaluating two options for an elevator, each of which has a useful life in 10 years. Option 1 costs $45, 000 to install and $2700 annually, with a salvage value of $ 3000 in year 10. Option 1 also requires a significant overhaul in year 6 with a cost of $8, 000. Option 2 costs $54, 000, costs $2, 800 annually, and has a salvage value of $5000 in year 10. Annual interest is 4%, compounded monthly. Which option would you choose? Show your work.arrow_forwardCaradoc Machine Shop is considering a four-year project to improve itsproduction efficiency. Buying a new machine press for $410,000 isestimated to result in $150,000 in annual pre-tax cost savings. The pressfalls into Class 8 for CCA purposes (CCA rate of 20% per year), and it willhave a salvage value at the end of the project of $55,000. The press alsorequires an initial investment in spare parts inventory of $20,000, alongwith an additional $3,100 in inventory for each succeeding year of theproject. If the shop’s tax rate is 35% and its discount rate is 9%.Calculate the NPV of this project. (Do not round your intermediatecalculations. Round the final answer to 2 decimal places. Omit $ sign inyour response.)NPV $ Should the company buy and install the machine press?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education