FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The owners are concerned about the movement in the company’s

cash and cash equivalent given that the

increase or decrease in this area. The company uses the indirect method to prepare the statement of

expected that this should be able to provide the needed clarity required by the owners.

1.Prepare a complete statement of cash flows for October 2021 using the indirect method based on the information

and guidance provided above.

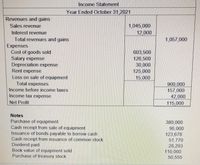

Transcribed Image Text:Income Statement

Year Ended October 31,2021

Revenues and gains:

Sales revenue

1,045,000

12,000

Interest revenue

Total revenues and gains

Expenses

Cost of goods sold

Salary expense

Depreciation expense

Rent expense

1,057,000

603,500

126,500

30,000

125,000

15,000

Loss on sale of equipment

Total expenses

900,000

157,000

42,000

115,000

Income before income taxes

Income tax expense

Net Profit

Notes

Purchase of equipment

Cash receipt from sale of equipment

Issuance of bonds payable to borrow cash

Cash receipt from issuance of common stock

Dividend paid

Book value of equipment sold

Purchase of treasury stock

380,000

95,000

123,678

51,770

28,293

110,000

50,555

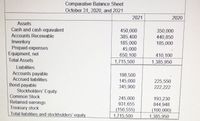

Transcribed Image Text:Comparative Balance Sheet

October 31, 2020, and 2021

2021

2020

Assets

Cash and cash equivalent

Accounts Receivable

450,000

385,400

185,000

45,000

650,100

1,715,500

350,000

440,850

185,000

Inventory

Prepaid expenses

Equipment, net

410,100

1,385,950

Total Assets

Liabilities

Accounts payable

198,500

145,000

345,900

Accrued liabilities

225,550

222,222

Bond payable

Stockholders' Equity:

Common Stock

Retained earnings

Treasury stock

Total liabilities and stockholders' equity

245,000

931,655

|(150,555)

1,715,500

193,230

844,948

(100,000)

1,385,950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The comparative balance sheet and income statement of Sign Language Hearing Co Ltd, have just been prepared and presented to the owners by the company’s Accountant. The owners are concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. The owners are requesting clarification and have put presented the following financial information. In comparison to investing and financing activities, it is often said that cash from operating activities must be the main source of cash to achieve long term success of the company. Do you agree or disagree with this statement? Give reason or reasons to support your answer taking into consideration the possible consequences of the cash being…arrow_forwardView previous at Required information Assume a company prepares the statement of cash flows using the indirect method. The company purchases its Inventory on credit from suppliers. How should a decrease in accounts payable be reflected In the section that reconciles net income to cash flow from operating activitles? Multiple Choice It would be added if the section starts with net income and subtracted if it starts with a net loss It would be added in reconciling net income to cash flow from operafing activities It would be subtracted in reconciling net income to cash flow from operating activities A change in accounts payable does not affect the reconciliation of net income to cash flow from operating activities < Prev 15 of 15 Next Form 1040Sch...pdf 6 Form1040 Sch...pdf B1040 Sohedul...pdf Form8829 (1).pdf MacBook Airarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- State the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions: Note: Only consider the cash component of each transaction. Use the minus sign to indicate amounts that are cash out flows, cash payments, decreases in cash, or any negative adjustments. If your answer is not reported in an amount box does not require an entry, leave it blank or enter "0". a. Received $120,000 from the sale of land costing $70,000. Investing activities $fill in the blank 2 Operating activities $fill in the blank 4 b. Purchased investments for $75,000. Investing activities $fill in the blank 6 c. Declared $35,000 cash dividends on stock. $5,000 dividends were payable at the beginning of the year, and $6,000 were payable at the end of the year. Financing activities $fill in the blank 8 d. Acquired equipment for…arrow_forwardReview the statement of cash flows for Tesla Motors Inc. in ATC 14-1 on page 688. Discuss the cash position of the company by considering the following: Review the statement of cash flows for Tesla Motors Inc. in ATC 14-1 on page 688. Discuss the cash position of the company by considering the following: How can you explain the difference between cash flow from operating activities and the net loss for this company?arrow_forwardYou are an auditor. Please identify 3 unaudited financial statement items for 2023 that you consider to have the highest risk of material misstatement. Explain in detail why they are higher risk,arrow_forward

- I know in order to find the cash flow from operating activities using the indirect method you start with the net income then add your depreciation expense and your loss on disposal equipment. Then you subtract increases in account receivable and decrease in account receivable and that gives you your net income. However, when I compute this it says all my answers are incorrect. I thought I was doing this correctly but clearly I need assistance.arrow_forwardPlease help to answer the questions pictured in the attached images (cash at beginning and end of year are also required, it wouldn't fit in the two allowed images):arrow_forwardThe comparative balance sheet and income statement of Sign Language Hearing Co Ltd, have just been prepared and presented to the owners by the company’s Accountant. The owners are concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners. The owners have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information grouped according to your surname initial. (Hint!!!! Example surname Brad will use the initial B and that person should only use the info presented in line with the heading with their surname initial. If you have a double barrel surname for example Campbell-Brown, use the initial for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education