FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

c. Calculate the taxable income for State X for each company.

|

|

|

|

|

|||||||||||

|

|

|

d. Determine the tax liability for State X for the entire group.

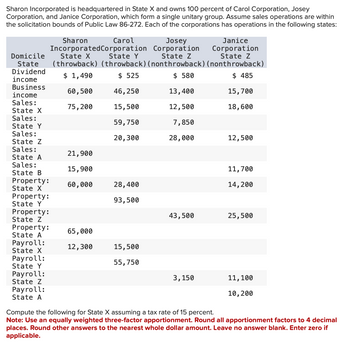

Transcribed Image Text:Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey

Corporation, and Janice Corporation, which form a single unitary group. Assume sales operations are within

the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states:

Domicile

State

Dividend

income

Business

income

Sales:

State X

Sales:

State Y

Sales:

State Z

Sales:

State A

Sales:

State B

Property:

State X

Property:

State Y

Property:

State Z

Property:

State A

Payroll:

State X

Payroll:

State Y

Payroll:

State Z

Payroll:

State A

Sharon

Carol

Josey

Incorporated Corporation Corporation

State X State Y

State Z

(throwback) (throwback) (nonthrowback)

$ 1,490

$ 525

$ 580

46,250

15,500

59,750

20,300

60,500

75,200

21,900

15,900

60,000

65,000

12,300

28,400

93,500

15,500

55,750

13,400

12,500

7,850

28,000

43,500

3, 150

Janice

Corporation

State Z

(nonthrowback)

$ 485

15,700

18,600

12,500

11,700

14, 200

25,500

11,100

10, 200

Compute the following for State X assuming a tax rate of 15 percent.

Note: Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal

places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if

applicable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The account that should be credited for the total income tax withheld from employee's earnings is o a. FICA Tax Expense. o b. Employee Income Tax Expense. . FICA Tax Payable o d. Employee Income Tax Payable.arrow_forwardThe self-employment tax base is 100% of self-employment income (Schedule C net income). True or False True Falsearrow_forwardQuestion2: Income tax The taxable income of Ahmed, Badriya and Sameer is $20,000, $45,000, $100,000 respectively. Use the following tax rates: 5% for income from 0 - $20,000 10% for income from $20,001 - $50,000 15% for income above $50,000 Calculate the tax payable by each person. Explain the type of taxation system applicable in this situation. Is this system of taxation fair? Explain why this system is being criticised?arrow_forward

- Which of the following taxes is paid by the employee and the employer? a.SUTA b.Federal withholding taxes c.FUTA d.FICA 3arrow_forwardIn T1 General Tax Form, Total Income is reported on Line??arrow_forwardReproduce the tax formula include for individual taxpayers in good form and briefly describe each for the components of the formula. Discuss the differences between the tax formula for individuals and that for corporations.arrow_forward

- Please answer. Follow instructions carefullyarrow_forward1.Explain the intake process to completing a tax return. using the form 13614-c, w2's, form 1099-R, Form SSA-1099, form 1099-c, Form W-2G, Form 1098-T Just explain for to process this thing all together.arrow_forwardCompute for the tax due of the following individuals using the RA 10963 tax table. Show computations. 1. A business has net income before tax of P2,410,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education