Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

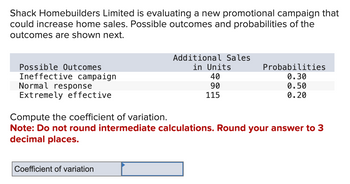

Transcribed Image Text:Shack Homebuilders Limited is evaluating a new promotional campaign that

could increase home sales. Possible outcomes and probabilities of the

outcomes are shown next.

Possible Outcomes

Ineffective campaign

Normal response

Extremely effective

Additional Sales

in Units

40

90

115

Coefficient of variation

Probabilities

0.30

0.50

0.20

Compute the coefficient of variation.

Note: Do not round intermediate calculations. Round your answer to 3

decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Angela's Pet Shop is considering the purchase of a new delivery van. Angela Smith, owner of the shop, has compiled the following estimates in trying to determine whether the delivery van should be purchased: Cost of the van Annual net cash flows Salvage value Estimated useful life Cost of capital Present value of an annuity of 1 Present value of 1 Click here to view PV tables. (a) Net present value Angela's assistant manager is trying to convince Angela that the van has other benefits that she hasn't considered in the initial estimates. These additional benefits, including the free advertising the store's name painted on the van's doors will provide, are expected to increase net cash flows by $500 each year. $40,100 Should the van be purchased? Van 6,800 $ should not 4,800 Your answer has been saved. See score details after the due date. 8 years 10% Calculate the net present value of the van, based on the initial estimates. (Enter negative amounts using either a negative sign preceding…arrow_forwardDo not provide solution in imge format. and also do not provide plagarised content otherwise i dislike.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Suppose the figure to the right represents the market for a particular brand of soap such as Zest, Dove, or Ivory. Suppose also that the market is monopolistically competitive and the firm behaves optimally to maximize profit. Use the rectangle drawing tool to shade in the firm's economic profit or loss. Properly label the object. Carefully follow the instructions above, and only draw the required objects. Price and cost (per pack) 4.00- 3.80 3.60 3.40 MC 3.20 ATC 3.00 2.80 2.60 2.40 2.20 2.00- 1.80- 1.60- 1.40- 1.20- 1.00- 0.80- 0.60- 0.40 0.20 0.00+ MR 0 6 8 10 12 14 16 18 Quantity (packs of soap in thousands) 20arrow_forwardWhich of the following are reasonable ways to deal with excess supply? (select ALL correct answers) reduce prices increase advertising use all available capacity to make the product with the highest CM per unit of capacity find special orders at a discounted price "fire" small customersarrow_forwardPlease don't give image based answer.. thankuarrow_forward

- A beauty product company is developing a new fragrance named Happy Forever. There is a probability of .52 that consumers will love Happy Forever, and in this case, annual sales will be 1.02 million bottles; a probability of .37 that consumers will find the smell acceptable and annual sales will be 228,000 bottles; and a probability of .11 that consumers will find the smell unpleasant and annual sales will be only 50,000 bottles. The selling price is $36, and the variable cost is $11 per bottle. Fixed production costs will be $1.08 million per year, and depreciation will be $1.15 million. Assume that the marginal rate tax is 27 percent. What are the expected annual incremental after-tax free cash flows from the new fragrance?arrow_forwarddont uplode any image in answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education