Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

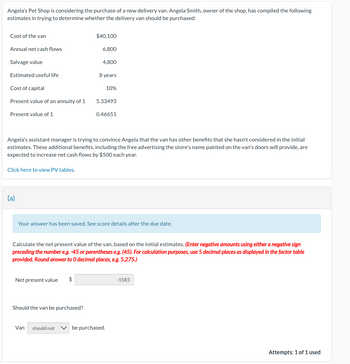

Transcribed Image Text:Angela's Pet Shop is considering the purchase of a new delivery van. Angela Smith, owner of the shop, has compiled the following

estimates in trying to determine whether the delivery van should be purchased:

Cost of the van

Annual net cash flows

Salvage value

Estimated useful life

Cost of capital

Present value of an annuity of 1

Present value of 1

Click here to view PV tables.

(a)

Net present value

Angela's assistant manager is trying to convince Angela that the van has other benefits that she hasn't considered in the initial

estimates. These additional benefits, including the free advertising the store's name painted on the van's doors will provide, are

expected to increase net cash flows by $500 each year.

$40,100

Should the van be purchased?

Van

6,800

$

should not

4,800

Your answer has been saved. See score details after the due date.

8 years

10%

Calculate the net present value of the van, based on the initial estimates. (Enter negative amounts using either a negative sign

preceding the number e.g. -45 or parentheses e.g. (45). For calculation purposes, use 5 decimal places as displayed in the factor table

provided. Round answer to O decimal places, e.g. 5,275.)

5.33493

0.46651

✓ be purchased.

-1583

Attempts: 1 of 1 used

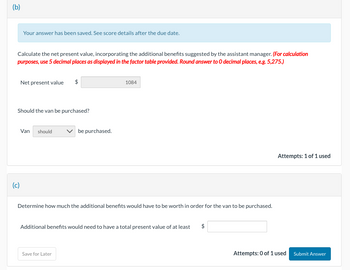

Transcribed Image Text:(b)

Your answer has been saved. See score details after the due date.

Calculate the net present value, incorporating the additional benefits suggested by the assistant manager. (For calculation

purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, e.g. 5,275.)

(c)

Net present value $

Should the van be purchased?

Van should

be purchased.

1084

Determine how much the additional benefits would have to be worth in order for the van to be purchased.

Save for Later

Additional benefits would need to have a total present value of at least $

Attempts: 1 of 1 used

Attempts: 0 of 1 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your Question: QUESTION: 1. Work Related Car Expenes (3800 Km + 500 Km) * $0.72 per Km? May know which method are you choose cents per km method or logbook method? which method better? 2. why no medical levy ? 3. Work-related mobile phone expense? How to calculate? 4.Work-related car expense?How to calculate?arrow_forwardMore real estate Consider the Albuquerque home sales from Exercise 29 again. The regression analysis gives the model Price = 47.82 + 0.061 Size. a) Explain what the slope of the line says about housing prices and house size. b) What price would you predict for a 3000-square-foot house in this market? c) A real estate agent shows a potential buyer a 1200-square- foot home, saying that the asking price is $6000 less than what one would expect to pay for a house of this size. What is the asking price, and what is the $6000 called?arrow_forwardThe number of properties newly listed with a real estate agency in each quarter over the last four years is given below. Assume the time series has seasonality without trend. Quarter 1 2 3 4 Year 1 73 89 123 92 Year 2 81 87 115 95 Year 3 76 91 108 87 Year 4 77 88 120 97 a. Develop the optimization model that finds the estimated regression equation that minimize the sum of squared error. b. Solve for the estimated regression equation. c. Forecast the four quarters of Year 5. *Please solve in excelarrow_forward

- A taxi cab charges $0.80 for the first 1/5 of a mile and $0.10 for each additional 1/10 of a mile. What is the cost of a 3 mile trip? Use $ sign and round your answer to the nearest cent (i.e., two decimal points)arrow_forwardRevise your worksheet to reflect these updated assumptions and then answer the questions that follow. Sales Sale Price 9,400 units 27 Date Number of Units Unit Cost Total Cost Beginning 1,500 10.30 $15,450 March 12 2,700 10.20 27,540 June 5 1,400 10.10 14,140 October 22 5,300 9.90 52,470 Totals 10,900 $109,600 Required: 1. Use your spreadsheet to recalculate the Cost of Goods Sold, Inventory balances, and Gross Profit under each method and enter your results below: (Round your answers to the nearest whole dollar amount.). FIFO LIFO Weighted Average Cost of Goods Sold Ending Inventory Gross Profit < Prev ♡ 14 of 14 Nextarrow_forwardPlease help with the income statement based on info below: Pricing Actual # Revenue Grooming 25 4 3,000 Daycare 18 22 11,880 Boarding 25 12 9,000 Total January Revenue 23,880arrow_forward

- CUI... All Branches - Fall 2020/21.. A Saved Help Save & Exit Submit Douglas Noel went to Home Depot and bought eight doors at $43.19 each and eight bags of fertilizer at $8.70 per bag. (Round your answers to 2 decimal places.) What was the total cost to Douglas? a. Total cost :14 b. If Douglas had $450 in his pocket, what does he have left to spend? Balance cost Next > < Prev 4 of 10 08:07 e O ENGarrow_forwardCan you help me with question 6? It’s Financial Math.arrow_forwardActivity Answer the following five (5) questions in complete sentences: 1. When would leasing a vehicle be a better option than buying? 2. Describe in at least five sentences how you will prepare to purchase your next vehicle in order to (1) get the appropriate vehicle, (2) to get the best deal, and (3) to avoid getting ripped off. For the Questions 3-5 assume you want to finance (borrow) $12,000 for your next car and your interest rate will be 6%. 3. What will be your monthly payment and the total amount paid over the life of the loan if you finance for 48 months? Provide the car payment and the TVM inputs you used to calculate the payment. Payment Total of all payments PV FV RATE/INTEREST PERIODS/N (See next page for Questions 4 and 5)arrow_forward

- For this question, you must use the data package "Cars93" available in the R package "MASS" followed by "dplyr" package. Find the number of car models that are Van and whose max price is below 20. Hint: Use "filter" function. 07 3 1 5 Pregunta 2 For this question, you must use the data package "Cars93" available in the R package "MASS" followed by "dplyr" package. Find the number of cars that have Drive train type of 4WD. Hint: Use "filter" function. 20 15 05 10arrow_forwardi need the answer quicklyarrow_forwardPlease tell me what type of the analysis is if the analysis wants to know which customer purchased over $5000 last year but bought nothing this year. Descriptive analytics. B. Diagnostic analytics. Predictive analytics. D. Prescriptive analyticsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education