FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

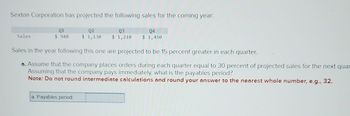

Transcribed Image Text:Sexton Corporation has projected the following sales for the coming year:

Q4

Q3

$1,210 $ 1,450

Sales

01

$ 940

Q2

$ 1,130

Sales in the year following this one are projected to be 15 percent greater in each quarter.

a. Assume that the company places orders during each quarter equal to 30 percent of projected sales for the next quar

Assuming that the company pays immediately, what is the payables period?

Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.

a. Payables period

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company caps three-month LIBOR at 10% per annum. The principal amount is S20 million. On a reset date three-month LIBOR is 12% per annum. What payment would this lead to under the cap? When would the payment be made?arrow_forwardYield Calculation i. Assume that newly issued three - month (90 days) T - bills with a par value of $1,000 sells at discount rate of 3%. a) What is the price of this three -month T-bills? b) What is the 90-day holding period return of this T - bill? c) What is the annualized yield of this three-month T - bill? ii. Assume that an investor purchased a three-month commercial paper with a face value of $1,000,000 for $940,000. This investor held the commercial paper for 60 days before he sold it at a price of $980,000. What is the annualized yield of this investment? iii. Assume that Canada is in a strong economic condition, and you expect the economy to continuously grow over the next six months. Given your expectations and your calculation for the yield of the three-month T-bills and the three-month commercial paper (note: annualized yield for the three-month commercial paper if the investor chose to hold it till maturity is different from the one you calculate in part ii ), would you…arrow_forwardFor the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales amount each year and they expect their sales to increase by 5% each year over the next three years. Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. 17.306 x billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207 Round your answer to three decimal places. 16.858 x billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer 447 x billion dollarsarrow_forward

- Annual credit sales of Nadak Co. total $680 million. The firm gives a 2% cash discount for payment within 10 days of the invoice date: 90% of Nadak's accounts receivable are paid within the discount period. Required: a. What is the total amount of cash discounts allowed in a year? (Enter your answer in millions rounded to 2 decimal places.) Total amount million b. Calculate the approximate annual rate of return on Investment that Nadak Co's cash discount terms represent to customers who take the discount. (Assume a credit period of 30 days and 360-days year). (Round intermediate calculations to nearest whole percentage.) ROIarrow_forwardA firm is borrowing $1 million to expand its operations. The annual interest on the loan is 13% and the loan will be repaid in quarterly installments over the next for ten years. What will the quarterly payments be? Select one: A. $43,262 B. $44,246 C. $45,028 D. $58,492arrow_forwardA company is launching a new sales initiative and expects sales of $598,427 during the first year. To prepare for this, they plan to acquire 35 days worth of inventory. If their gross profit margin is 29%, how much inventory must they acquire as part of their initial investment? Enter your answer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is $90.1234, enter 90.1234 Type your answer...arrow_forward

- Receivables Investment Snider Industries sells on terms of 2/10, net 35. Total sales for the year are $1,400,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 40 days after their purchases. Assume a 365-day year. What is the days sales outstanding? Do not round intermediate calculations. Round your answer to the nearest whole number. days What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What would happen to average receivables if Snider toughened its collection policy with the result that all nondiscount customers paid on the 35th day? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forwardThe MacDonald Corporation’s purchases from suppliers in a quarter are equal to 60 percent of the next quarter’s forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 40 percent of sales, and interest and dividends are $124 per quarter. No capital expenditures are planned. Projected quarterly sales are: Q1 Q2 Q3 Q4 Sales $1,230 $1,380 $1,470 $1,680 Sales for the first quarter of the following year are projected at $1,350. Calculate the company’s cash outlays by completing the following: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward(Annual percentage yield) Compute the cost of the following trade credit terms using the compounding formula, or effective annual rate. Note: Assume a 30-day month and 360-day year. a. 2/5, net 60 b. 4/15, net 30 c. 3/10, net 75 d. 4/15, net 60. BETER a. When payment is made on the net due date, the APR of the credit terms of 2/5, net 60 is%. (Round to two decimal places.)arrow_forward

- Suppose that a company borrows $100,000 from investment pool at 14% compounded quarterly over 3 years. If the average quarterly general inflation rate is expected to be 0.35%, determine the equivalent equal quarterly payment series in constant dollars.arrow_forwardFor the year ending December 31, 2017, sales for Corporation Y were $68.01 billion. Beginning January 1, 2018 Corporation Y plans to invest 7.5% of their sales amount each year and they expect their sales to increase by 6% each year over the next three years. Corporation Y invests into an account earning an APR of 1.4% compounded continuously. Assume a continuous income stream. How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. billion dollars How much interest did Company Y earn between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollars Submit Answer View Previous Question Question 10 of 10 Home My Assignments +Request Extension…arrow_forwardBluewater, Inc. has the following estimated quarterly sales for next year. The accounts receivable period is 60 days. What is the expected accounts receivable balance to the nearest dollar at the end of the third quarter? Assume that each month has 30 days. Q2 Q3 Q4 $1,300 $1,425 $2,200 Ⓒa. $800 b. $367 c. $950 d. $733 Qe. $867 Q1 Sales $1,850arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education