FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

a. Determine the activity cost per patient for the coronary bypass treatment.

Activity cost per patient $

b. Assume the hospital was able to make improvements such that the average length of stay in the hospital for the bypass was reduced from 6 days to 5 days. Further assume that additional improvements in medical technology reduced the operating room time for a bypass to 2½ hours. Determine the activity cost per patient for the coronary bypass treatment under these revised conditions. What is the cost improvement?

The cost of treating a patient for a coronary bypass declined from $ to $, or $.

Transcribed Image Text:Setup is reengineered so that it takes 60% of the original cost per setup.

n

Production control software will allow production control effort and cost per production rur

to decline by 60%.

Moving distance was reduced by 40 %, thus reducing the cost per move by the same amount

a. Determine the revised activity cost per unit under the proposed changes.

b. Did these improvements reduce the activity cost per unit?

C. What cost per unit for setup would be required for the solution in (a) to equal the base

solution?

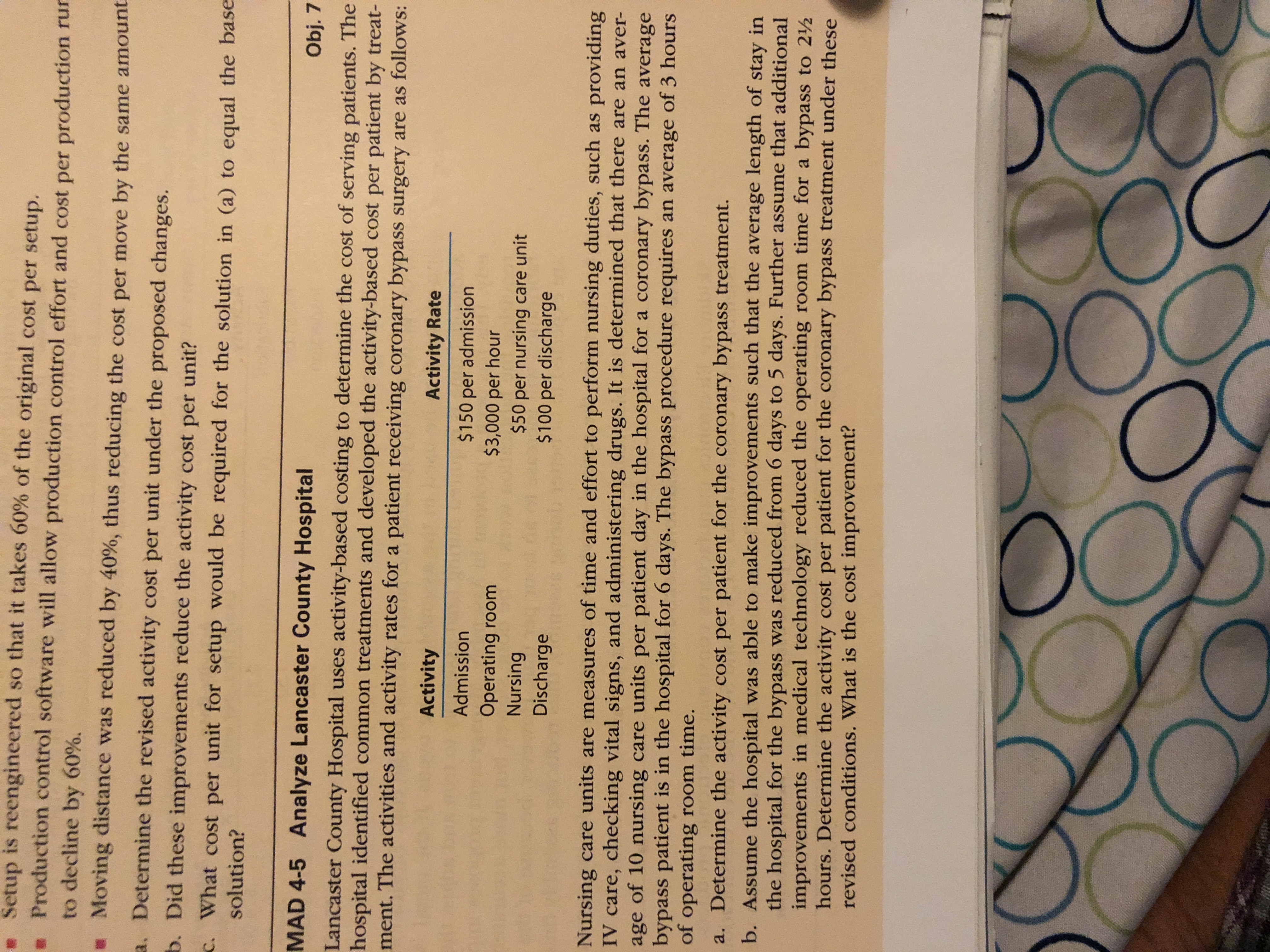

MAD 4-5 Analyze Lancaster County Hospital

Obj. 7

Lancaster County Hospital uses activity-based costing to determine the cost of serving patients. The

hospital identified common treatments and developed the activity-based cost per patient by treat-

ment. The activities and activity rates fora patient receiving coronary bypass surgery are as follows:

Activity

Activity Rate

Admission

$150 per admission

$3,000 per hour

$50 per nursing care unit

$100 per discharge

Operating room

Nursing

Discharge

Nursing care units are measures of time and effort to perform nursing duties, such as providing

IV care, checking vital signs, and administering drugs. It is determined that there are an aver-

age of 10 nursing care units per patient day in the hospital for a coronary bypass. The average

bypass patient is in the hospital for 6 days. The bypass procedure requires an average of 3 hours

of operating room time.

a. Determine the activity cost per patient for the coronary bypass treatment.

b. Assume the hospital was able to make improvements such that the average length of stay in

the hospital for the bypass was reduced from 6 days to 5 days. Further assume that additional

improvements in medical technology reduced the operating room time for a

hours. Determine the activity cost per patient for the coronary bypass treatment under these

revised conditions. What is the cost improvement?

bypass to 2/

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Capitol Healthplans, Inc., is evaluating two different methods for providing home health services to its members. Both methods involve contracting out for services, and the health outcomes and revenues are not affected by the method chosen. Therefore, the incremental cash flows for the decision are all outflows. Here are the projected flows: Year Method A Method B 0 ($300,000) ($120,000) 1 ($66,000) ($96,000) 2 ($66,000) ($96,000) 3 ($66,000) ($96,000) 4 ($66,000) ($96,000) 5 ($66,000) ($96,000) (a) If the cost of capital of both methods is 9%, which method should be chosen? Why?arrow_forwardThe table below shows the various levels of a city's pollution cleanup along with the marginal benefit and marginal cost. Pollution Cleanup Marginal Benefit (dollars) $500 400 300 200 100 Quantity of Pollution Cleanup (units) 25 50 100 150 200 Marginal Cost (dollars) $100 200 300 400 500 Instructions: Enter your answers as a whole number. a. Suppose the city decides to undertake a cleanup level of 25 units. The marginal benefit of cleaning up the 25th unit is $ The marginal cost of cleaning up the 25th unit is $ Since the marginal benefit is [(Click select) the marginal cost, the city should clean up (Click to select) b. Suppose the city decides to undertake a cleanup level of 200 units. The marginal benefit of cleaning up the 200th unit is $ The marginal cost of cleaning up the 200th unit is $ Since the marginal benefit is (Click to select) c. The optimal level of pollution cleanup is the marginal cost, the city should clean up units. (Click to select) pollution. pollution.arrow_forwardA cost analysis is to be made to determine what, if anything, should be done in a situation offering three "do-something" and one "do-nothing" alternatives. Estimates of the costs and benefits are as follows: End-of- Uniform Useful- Life Benefit Salvage (years) Value Useful First Alternatives Cost Annual Life -$500 $135 -600 100 250 5 -700 100 180 10 4 Use Present Worth Analysis with the Least Common Multiple Method to select the best alternative. Use MARR=6%. (Note: You MUST describe your answers with conversion factor notations and you DON'T NEED TO calculate the values of PW for supporting a decision. Simply describe your selection criterion with PW expressions.) 1.arrow_forward

- What is the net present value of the cost of treatment A. Treatment A costs $1000 now, $1000 after one year, and $1000 in year 2? (apply a discount rate of 5%). This is for healthcare management area of focus. Please show steps.arrow_forwardA privately run, for-profit, prison is considering ways in which it can cut its monthly costs and therefore increase profit. One idea it is considering is to pay a judge to guarantee convicted prisoners in poor health win their appeals and are set free. The prison believes it can realize the monthly cost savings below over the initial year of the plan. What is the present value of the first year's monthly cost savings? My answer is suppose to come up with 49701. This is the third time I have sent this problem threw I need to be credited for the other two times. I am waisting my questions by having to resubmit the questions 2 to 3 times. Please help thanks!! Month Savings ($) 1 3,500 2 6,000 3 6,500 4 9,000 5 9,000 6 9,000 7 9,400 8 9,800 9 4,800 10 5,000 11 2,000 12 3,500 Total 77,500arrow_forwardView Policies Current Attempt in Progress A hospital is considering purchasing a new medical dispensing cabinet that will cost $290,000. It believes that this cabinet will reduce the amount of labor required to track and administer medications and will also result in fewer expired medicines. It estimates the medical dispensing cabinet will result in a savings of $34,000 at the end of year one and that the savings will increase by $8,000 per year for each of the 8 years that the machine will be used. What is the IRR of this investment? Click here to access the TVM Factor Table calculator. % Carry all interim calculations to 5 decimal places and then round your final answer to 1 decimal place. The tolerance is ±0.3. If the hospital's MARR is 12%, should they invest in this cabinet?arrow_forward

- Help please. My answer is wrong Required information Vancouver Shakespearean Theater's board of directors is considering the replacement of the theater's lighting system. The old system requires two people to operate it, but the new system would require only a single operator. The new lighting system will cost $115,700 and save the theater $24,000 annually for the next eight years. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Suppose the Vancouver Shakespearean Theater's board is uncertain about the cost savings with the new lighting system. Required: How low could the new lighting system's annual savings be and still justify acceptance of the proposal by the board of directors? Assume the theater's hurdle rate is 12 percent. (Round final answer to 2 decimal places.) X Answer is complete but not entirely correct. Annual $ 27,829.36 x savingsarrow_forwardMajor medical complexes and their service providers continue to move toward advanced health informatics - acquiring, managing, and using information to provide better healthcare. A new analyzer for researching and evaluating patient samples, and making informed recommendations in the treatment of complex blood cancers, is purchased for $215,000. It is estimated to have a useful life of 6 years and to be sold at the end of that time for $10,000. Part a Develop a table showing the depreciation and book value for each year using both the Excel® DDB worksheet function and the Excel® SLN worksheet function such that the depreciation switches from double declining balance to straight-line at the optimum time. Year 1 2 3 4 сл $ $ $ $ $ $ Depreciation $ $ $ $ $ $ Book Valuearrow_forwardSuppose in a given state's new insurance marketplace, with community rating and no restrictions on who can buy at the community rate, the risk pool (distribution of expected health costs) is as follows: 20% of eligible enrollees' expected health costs = $1,000 (per year) 50% of eligible enrollees' expected health costs = $2,000 10% of eligible enrollees' expected health costs = $3,000 20% of eligible enrollees' expected health costs = $6,000 What would the community premium rate for this risk pool be if we also assume 10% loading costs for the insurer to cover its admin costs.arrow_forward

- Net Present Value and Internal Rate of Return. Below are the projected revenues and expenses for a new clinical nurse specialist program being established by your healthcare organization. The nurses would provide education while patients are in the hospital and home visits are on a fee-for-service basis after patients have been discharged Should the hospital undertake the program if its required rate of return is 12%? Note: it must be assumed that the revenues and costs in this problem represent cash flows. Present value analysis is based on cash, not revenue or expenses. Provide a response to support the findings in the table listed below. Your response should be at least a half page long in addition to the table. Please include citations. Year One Year Two Year Three Year Four Total Revenue $100,000 $150,000 $200,000 $250,000 $700,000 Costs $150,000 $150,000 $150,000 $150,000 $600,000 $ <50,000> $0 $50,000 $100,000…arrow_forwardFrom the Case Study"DISTRICT HEADQUARTER HOSPITAL: FINANCIAL FEASIBILITY STUDY" Prepare in as much detail as possible, the projected financial statements, for District Headquarter Hospital for the next six years. The financial statements should comprise projected Balance Sheets, Income Statements and Cash Flow Statements for each of these years.arrow_forwardPls helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education