Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

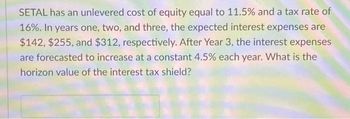

Transcribed Image Text:SETAL has an unlevered cost of equity equal to 11.5% and a tax rate of

16%. In years one, two, and three, the expected interest expenses are

$142, $255, and $312, respectively. After Year 3, the interest expenses

are forecasted to increase at a constant 4.5% each year. What is the

horizon value of the interest tax shield?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Wilde Software Development has a 12% unlevered cost of equity. Wilde forecasts the following interest expenses, which are expected to grow at a constant 4% rate after Year 3. Wilde’s tax rate is 25%. Year 1 Year 2 Year 3 Interest Expenses $80 $100 $120 a. What is the horizon value of the interest tax shield? b. What is the total value of the interest tax shield at Year 0?arrow_forwardA firm will report annual Net Income of $50 and depreciation expense of $20 forever in the future. With a tax rate of 30%, how much is the present value of all future “tax shields”? Assume r = 4%.arrow_forwardAfter tax cash flows are 100,000 a year for 5 years. There is no terminal value. The payback period occurs exactly at the end of 3 years. Calculate the internal rate of return, net present value, and profitability index. Use an interest rate of 10%.arrow_forward

- Please give me answerarrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardAn investment of $1,000 earns annual interest of 5% (no capital gains). Assuming accrual taxes of 30%, the expected after-tax value of the investment in ten years is closest to: In Question 1, the tax drag in percentage terms is closest to:arrow_forward

- Corona Cookies has a book value of equity of $11,000.Residual income one year from now is expected to be $500.Residual income is expected to grow at 1.5% annually, forever. If the correct required return is 17%,What is the value of Corona according to the residual income model? please do not give solution in image formatarrow_forwardA company is financed with equity of $4.5 million and a bank loan of $2.5 million with an interest rate of 8.6% per annum. The EBIT is $1.12 million. The applicable tax rate is 19%. Use the above information to calculate the following: a) change in the return on equity and the degree of financial leverage given a 15% increase in EBIT next year, b) change in the return on equity and the degree of financial leverage given a 5% decrease in EBIT in the following year (the year following the year in which EBIT grew by 15%).arrow_forward9. If a firm borrows $50 million for one year at an interest rate of 9%, what is the present value of the interest tax shield? Assume a 30% tax rate. a) Compute the PV of interest tax shieldarrow_forward

- If a firm borrows $50 million for one year at an interest rate of 9 percent, what is the present value of the interest tax shield? Assume a 21 percent marginal corporate tax rate.arrow_forwardThe Farmer Co. has a payout ratio of 65% and a return on equity (ROE) of 16% (assume that this is expected ROE for the upcoming year). What will be the appropriate price-to-book value (PBV) based on return differential if the expected growth rate in dividends is 5.6% and the required rate of return is 13% ?arrow_forwardBBA Ltd has just issued $10 million in debt (at par or face value). The firm will pay interest only on this debt. BBA’s marginal tax rate is expected to be 30% for the foreseeable future. a) Suppose BBA pays interest of 6% per year on its debt. What is its annual interest tax shield? b) What is the present value of the interest tax shield, assuming the tax shield’s risk is the same as that of the loan? c) Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case? Ten years have passed since BBA issued $10 million in perpetual interest-only debt with a 6% annual coupon. Tax rates have remained the same at 30% but interest rates have dropped so BBA’s current cost of debt capital is 4%. d) What is BBA’s annual interest tax shield now? e) What is the present value of the interest tax shield now?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT