Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do not give solution in image format thanku

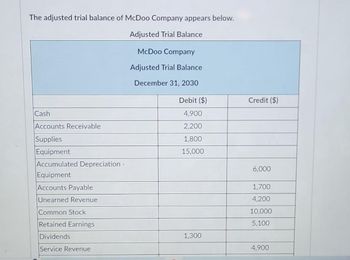

Transcribed Image Text:The adjusted trial balance of McDoo Company appears below.

Adjusted Trial Balance

McDoo Company

Adjusted Trial Balance

December 31, 2030

Cash

Accounts Receivable

Supplies

Equipment

Accumulated Depreciation -

Equipment

Accounts Payable

Unearned Revenue

Common Stock

Retained Earnings

Dividends

Service Revenue

Debit ($)

4,900

2,200

1,800

15,000

1,300

Credit ($)

6,000

1,700

4,200

10,000

5,100

4,900

Transcribed Image Text:Service Revenue

Salaries and Wages Expense

Depreciation Expense

Rent Expense

Total

31,900

Using the information from the adjusted trial balance, prepare an income statement

for the moth ending December 31, 2030.

Revenues

. When typing your responses, do NOT include a dollar sign. For example, if your answer

is $10,000, you should be typing 10,000 or 10,000.00 without any dollar sign.

. When listing expenses, you MUST list them in the order they appear in the adjusted

trial balance

- For a negative amount, include a negative sign or parentheses. For example, if your

answer is -$50, you should be typing -50 or (50).

Expenses

Total Expenses

Net Income/(Loss)

3,700

1,000

2,000

31,900

Income Statement.

McDoo Company

Income Statement

For the Month Ended December 31, 2030

Income Statement.

McDoo Company

Income Statement.

For the Month Ended December 31, 2030

$

$

$

$

4,900

$

$

man Chase.co

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to the following data of SG Company: Assets to be realized1,375,000Liabilities liquidated1,875,000Assets acquired825,000Liabilities not liquidated1,700,000Assets realized1,200,000Liabilities to be liquidated2,250,000Assets not realized1,375,000Supplementary charges3,125,000Liabilities assumed1,625,000Supplementary credits2,800,000Compute the beginning cash balance assuming that the ending balance of ordinary share and retained earnings are P1,200,000 and (400,000), respectively.arrow_forwardThe Kelly Services, Inc., and subsidiaries partial statement s of earnings from its annual report are presented below. 2020 2019 Revenues from services 4314.8 5517.3 Cost of services 3613.1 4539.7 Gross Profit 701.7 977.6 Selling and administrative expense 794.7 967.4 Asset impairments 53.1 80.5 Net earnings (loss) (164.1) (70.3) Prepare a horizontal common size analysis, and comment on the trend.arrow_forwardUnusual income statement items Assume that the amount of each of the following items is material to the financial statements. Classify each item as either normally recurring (NR) or unusual (U) items. If unusual item, then specify if it is a discontinued operations item (DO). a. Interest revenue on notes receivable. b. Gain on sale of segment of the company's operations that manufactures bottling equipment. c.Loss on sale of investments in stocks and bonds. d. Uncollectible accounts expense. e. Uninsured flood loss. (Hood insurance is unavailable because of periodic Hooding in the area.)arrow_forward

- Following are accounts and year-end adjusted balances of Cruz Company as of December 31. NumberAccount TitleDebitCredit101Cash$ 18,000 126Supplies 12,000 128 Prepaid insurance 2,000 167 Equipment23,000 168 Accumulated depreciation Equipment $ 6,500301A. Cruz, Capital 47, 343302A. Cruz, Withdrawals 6,000 403Services revenue 33,300612Depreciation expense Equipment2, 000 622Salaries expense19, 414 637 Insurance expense 1,399 640 Rent expense2, 231 652Supplies expense 1,099 Totals$ 87, 143$ 87,143 Prepare the December 31 closing entries. The account number for Income Summary is 901. Prepare the December 31 post - closing trial balance. Note: The A. Cruz, Capital account balance was $47,343 on December 31 of the prior year.arrow_forwardDirectly Compute Nonoperating Return with Noncontrolling Interest Selected balance sheet and income statement information from Abbott Laboratories for 2018 follows ($ millions). $ millions Net income Net income attributable to Company shareholders Net operating profit after tax (NOPAT) Net nonoperating expense (NNE) $3,078 3,078 3,822 744 Average net operating assets (NOA) 62,689 Average net nonoperating obligations (NNO) 22,506 Average total equity 40,183 Average equity attributable to Company shareholders 39,924 Compute the following measures a through h. a. Return on equity = (Net income attributable to Company shareholders/Average equity attributable to Company shareholders) Net income attributable to Company shareholders Average equity attributable to Company shareholders ROE %arrow_forwardBased on IAS 19 (Adjustment 2014) and the following data: Balance as of December 31, 2014: Current service cost Rp 6.000.000 Interest costs Rp 2.000.000 Past service costs Rp 1.000.000 10% Amortization of net actuarial losses Rp 500.000 Unrecognized actuarial losses Rp 17.000.000 Curtailment Rp 1.000.000 Adjustment Rp 1.500.000 What post-employment benefits should be recognized in the income statement for the year ended December 31, 2014 (the Company provides a post-employment benefit plan - defined benefit): A. Rp 29.000.000 B. Rp 12.000.000 C. Rp 9.000.000 D. Rp 6.000.000arrow_forward

- Changes in various accounts and gains and losses on the sale of assets during the year for Argon Companyare given below:Item AmountAccounts receivable ............................... $90,000 decreaseAccrued interest receivable ................... $4,000 increaseInventory ................................................ $120,000 increasePrepaid expenses .................................. $3,000 decreaseAccounts payable ................................... $65,000 decreaseAccrued liabilities ................................... $8,000 increaseDeferred income taxes payable ............. $12,000 increaseSale of equipment .................................. $7,000 gainSale of long-term investments ............... $10,000 lossRequired:Prepare an answer sheet using the following column headings:Item Amount Add DeductFor each item, place an X in the Add or Deduct column to indicate whether the dollar amount should beadded to or deducted from net income under the indirect method when computing the…arrow_forwardThe following pretax amounts pertain to Company for the year ended December 31, 2020:Sales –P800,000; Distribution and administrative costs –P84,000; Other income –P40,000; Interest expense –P4,000; Cost of goods sold –P480,000; Correction of prior period error (credit) –P16,000; Discontinued operations (debit) –P40,000; Cumulative effect of change in accounting policy (credit) –P28,000; Retained earnings, January 1 (not restated) –P160,000; Dividends declared –P12,000; Income tax rate is 30%. How much retained earnings would be shown on December 31, 2020 statement of financial position?arrow_forwardMultiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On Decem- ber 31, 2019, Opgenorth Company listed the following items in its adjusted trial balance: E5-7 LO 5.4 $ 17,000 160,000 LO 5.6 $ 8,000 2,500 14,000 95.000 2,000 General and administrative expenses Sales Unrealized decrease in fair value of available-for-sale securities Loss from fire (pretax) LO 5.7 Interest revenue Selling expenses Cost of goods sold Loss on sale of equipment (pretax) 1,800 SHOW ME HOW Additional dara: 1. Seven thousand shares of common stock have been outstanding the entire vear. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a 2019 multiple-step income statement 2. Prepare a 2019 single step income statement, 3. Prepare a 2019 statement of comprchensive incomc.arrow_forward

- Selected current year company information follows: Net income. Net sales Total liabilities, beginning-year Total liabilities, end-of-year Total stockholders' equity, beginning-year Total stockholders' equity, end-of-year The total asset turnover is: (Do not round Intermediate calculations.) $ 16,753 720,855 91,932 111, 201 206,935 133,851arrow_forwardCompute RNOA with Disaggregation Refer to the balance sheet information below for Home Depot. Jan. 28, Feb. 3, 2019 2018 $14,357 $13,918 Operating assets Nonoperating assets Total assets Operating liabilities Nonoperating liabilities Total liabilities Net sales Operating expense before tax Net operating profit before tax (NOPBT) Other expense Income before tax Tax expense Net income $ millions NOPAT $ Numerator a. Compute return on net operating assets (RNOA). Assume a statutory tax rate of 22%. Note: 1. Select the appropriate numerator and denominator used to compute RNOA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute 2018 RNOA. RNOA Numerator Average NOA $ Numerator Net income $ 605 1,222 $14,962 $15,140 $5,671 $5,456 9,929 9,190 $15,600 $14,646 $36,789 31,509 ◆ Average NOA x S ♦ OPAT x S 5,280 331 4,949 1,168 $3,781 b. Disaggregate RNOA into components of profitability (NOPM) and productivity (NOAT). Assume a statutory tax rate of 22%.…arrow_forwardthe income statement of x ltd for the year ended was as follows: net sales 4032000, cost of sales 3168000, depreciation 96000, salaries and wages 384000, opex 128000, provision for taxation 140800, net operating profit 11520. compute net profit before working capital changesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning