FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

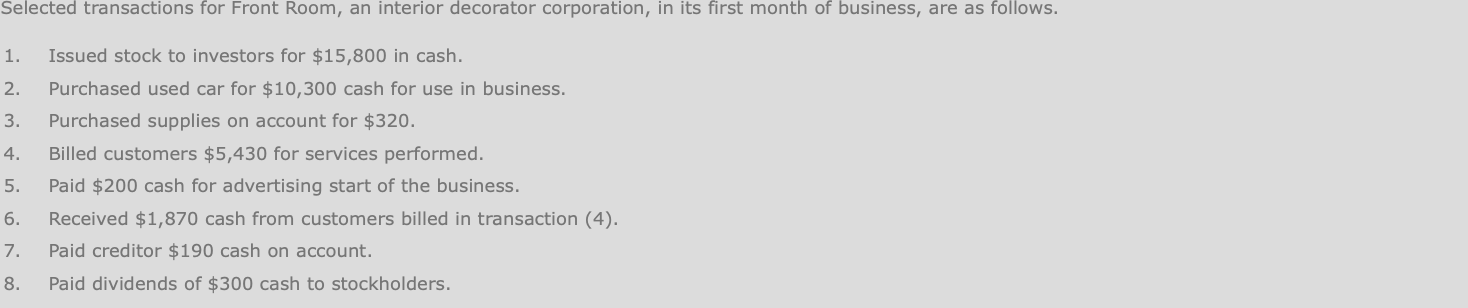

Transcribed Image Text:Selected transactions for Front Room, an interior decorator corporation, in its first month of business, are as follows.

Issued stock to investors for $15,800 in cash.

Purchased used car for $10,300 cash for use in business.

1.

2.

Purchased supplies on account for $320.

3.

Billed customers $5,430 for services performed.

4.

Paid $200 cash for advertising start of the business.

5.

Received $1,870 cash from customers billed in transaction (4).

6.

Paid creditor $190 cash on account.

Paid dividends of $300 cash to stockholders.

7.

8.

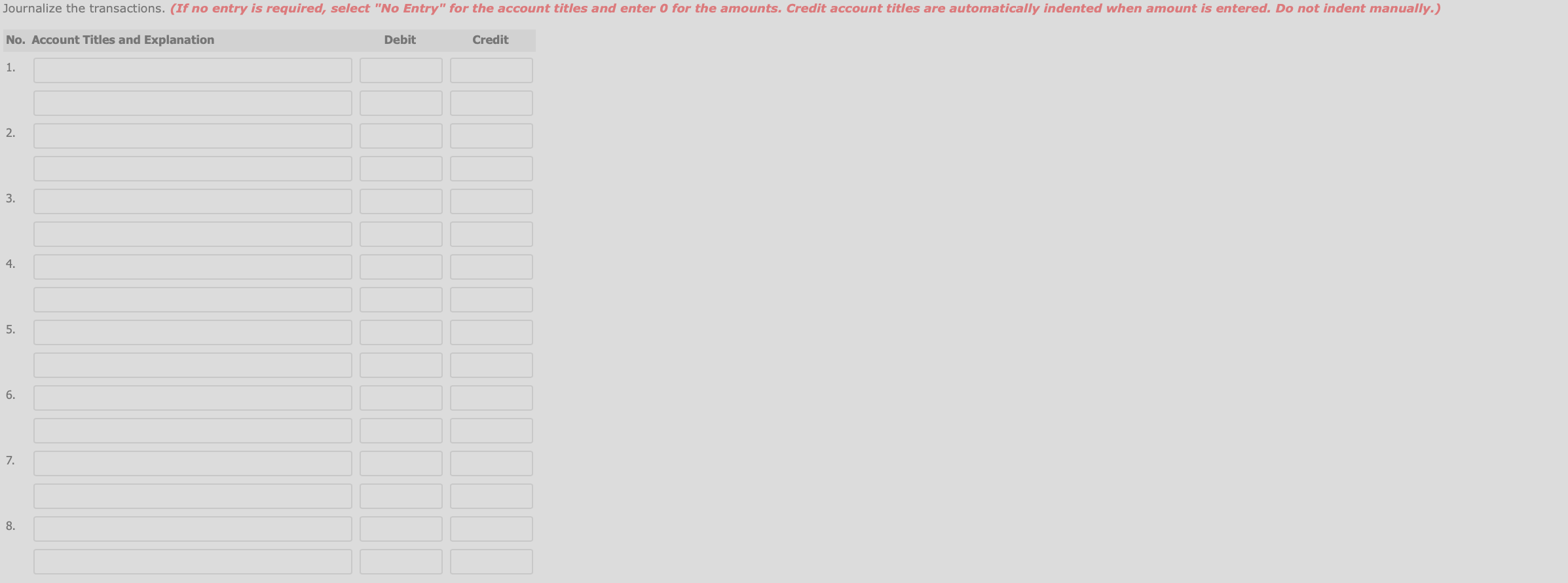

Transcribed Image Text:Journalize the transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Debit

No. Account Titles and Explanation

Credit

1.

2.

3.

4.

5.

6.

7.

8.

3.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- kai.3arrow_forwardThe following are the job cost related accounts for the law firm of Cullumber Associates and their manufacturing equivalents: Law Firm Accounts Supplies Salaries and Wages Payable Operating Overhead Service Contracts in Process Cost of Completed Service Contracts Cost data for the month of March follow. 1. 2. 3. 4. 5. 6. Manufacturing Firm Accounts Raw Materials Factory Wages Payable Manufacturing Overhead Work in Process Cost of Goods Sold Purchased supplies on account $2,400. Issued supplies $1,680 (60% direct and 40% indirect). Assigned labor costs based on time cards for the month which indicated labor costs of $89,600 (80% direct and 20% indirect). Operating overhead costs incurred for cash totaled $51,200. Operating overhead is applied at a rate of 90% of direct labor cost. Work completed totaled $96,000.arrow_forwardSubject : - Accountarrow_forward

- Do not give answer in imagearrow_forwardPlease Introduction and show work without plagiarism please i request please sir urgently help mearrow_forwardPresented below is information related to the purchases of common stock by Carla Company during 2020. Cost Fair Value (at purchase date) (at December 31) Investment in Arroyo Company stock $107,000 $88,000 Investment in Lee Corporation stock 230,000 278,000 Investment in Woods Inc. stock 190,000 200,000 Total $527,000 $566,000 (Assume a zero balance for any Fair Value Adjustment account.) (a) What entry would Carla make at December 31, 2020, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? (b) What entry would Carla make at December 31, 2020, to record the investments in the Lee and Woods corporations, assuming that Carla did not select the fair value option for these investments?arrow_forward

- (b) To record estimated liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Period 1 Account Titles and Explanation Period 2 Account Titles and Explanation Save for Later Debit Debit Credit Credit Attempts: 0 of 1 used Submit Answerarrow_forwardPharoah Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The following purchase transactions occurred in March: Pharoah Stores purchases $9,200 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB shipping point. Mar. 1 2 The correct company pays $140 for the shipping charges. 3 21 22 23 30 31 Pharoah returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour. Octagon gives Pharoah a $1,100 credit on its account. Pharoah Stores purchases an additional $11,500 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination. The correct company pays $160 for freight charges. Pharoah returns $500 of the merchandise purchased on March 21 because it was damaged. Octagon gives Pharoah a $500 credit on its account. Pharoah paid Octagon the amount owing for the merchandise purchased on March 1. Pharoah paid Octagon the amount owing for the…arrow_forwardPlease help me. Thankyou.arrow_forward

- Ch. 3 Classwork Chart of Accounts Common Stock Cash Accounts Receivable Supplies Inventory Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation Accounts Payable Notes Payable Unearned Revenue Retained Earnings Dividends Fees Earned Sales Cost of Goods Sold Depreciation Expense Insurance Expense Rent Expense Supplies Expense Utility Expense Wages Expense M4 Engineering began operations in January of 2020. M4 Engineering provides structural engineering services to local these parks. Listed below are some transaction from the first quarter of 2020. a) On January 1, the owners deposited $200,000 into the business bank account in exchange for Common Stock. b) On January 2, M4 Engineering signed a 1-year lease for an office building in Long Beach. The owner required the rent for the year be paid in advance. M4 Engineering gave the landlord a check for $30,000. c) On January 5, M4 Engineering signed a $75,000 contract to provide engineering services beginning on April 1.…arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardView Policies Current Attempt in Progress Carla Vista Company manufactures pizza sauce through two production departments: cooking and canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits: Beginning work in process inventory Direct materials Direct labour Manufacturing overhead Costs transferred in Cooking $-0- 26,900 7,350 32,800 Canning $3,750 7,620 7,490 26,000 52,200 I dit ontries Credit account titles are automatically indented when the anarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education