FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Selected transactions completed by Primo Discount Corporation during the current fiscal year are as follows:

| Jan. | 9 | Split the common stock 3 for 1 and reduced the par from $75 to $25 per share. After the split, there were 1,200,000 common shares outstanding. |

| Feb. | 28 | Purchased 40,000 shares of the corporation’s own common stock at $28, recording the stock at cost. |

| May | 1 | Declared semiannual dividends of $0.80 on 75,000 shares of |

| Jul. | 10 | Paid the cash dividends. |

| Sep. | 7 | Sold 30,000 shares of |

| Oct. | 1 | Declared semiannual dividends of $0.80 on the preferred stock and $0.12 on the common stock (before the stock dividend). In addition, a 2% common stock dividend was declared on the common stock outstanding. The fair market value of the common stock is estimated at $36. |

| Dec. | 1 | Paid the cash dividends and issued the certificates for the common stock dividend. |

Journalize the transactions. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.

CHART OF ACCOUNTSPrimo Discount CorporationGeneral Ledger

| ASSETS | |

| 110 | Cash |

| 120 | |

| 131 | Notes Receivable |

| 132 | Interest Receivable |

| 141 | Inventory |

| 145 | Office Supplies |

| 151 | Prepaid Insurance |

| 181 | Land |

| 193 | Equipment |

| 194 |

| LIABILITIES | |

| 210 | Accounts Payable |

| 221 | Notes Payable |

| 226 | Interest Payable |

| 231 | Cash Dividends Payable |

| 236 | Stock Dividends Distributable |

| 241 | Salaries Payable |

| 261 | Mortgage Note Payable |

| EQUITY | |

| 311 | Common Stock |

| 312 | Paid-In Capital in Excess of Par-Common Stock |

| 315 | Treasury Stock |

| 321 | Preferred Stock |

| 322 | Paid-In Capital in Excess of Par-Preferred Stock |

| 331 | Paid-In Capital from Sale of Treasury Stock |

| 340 | |

| 351 | Cash Dividends |

| 352 | Stock Dividends |

| 390 | Income Summary |

| REVENUE | |

| 410 | Sales |

| 610 | Interest Revenue |

| EXPENSES | |

| 510 | Cost of Goods Sold |

| 515 | Credit Card Expense |

| 520 | Salaries Expense |

| 531 | Advertising Expense |

| 532 | Delivery Expense |

| 533 | Selling Expenses |

| 534 | Rent Expense |

| 535 | Insurance Expense |

| 536 | Office Supplies Expense |

| 537 | Organizational Expenses |

| 562 | Depreciation Expense-Equipment |

| 590 | Miscellaneous Expense |

| 710 | Interest Expense |

Journalize the transactions. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.

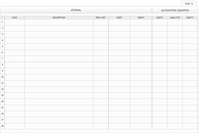

Transcribed Image Text:PAGE 10

JOURNAL

ACCOUNTING EQUATION

LIABILITIES

EQUITY

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

1

11

14

15

16

17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On February 14, Marine Company reacquired 7,500 shares of its common stock at $30 per share. On March 15, Marine sold 4,500 of the reacquired shares at $34 per share. On June 2, Marine sold the remaining shares at $28 per share. Required: Journalize the transactions of February14, March 5, and June 2.arrow_forward3. What is the total shareholders' equity at year-end? * At the beginning of the current year, SCARLET Company's issued and outstanding shares total 100,000 shares of P10 par value, Share Premium of P400,000 and Retained Earnings of P360,000. The following transactions occurred during the year: January 10 Sold 40,000 shares at P15 per share March 27 Purchased 5,000 treasury shares at a cost of P12 per share. October 31 Issued P5,000,000 convertible bonds at 120.The bonds are quoted at 98 without the conversion feature. November 10 Declared a 2 for 1 split when the market value of the share was P16. December 15 Sold 20,000 shares at P10 per share. December 31 Net income for the year was P550,000arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education