FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

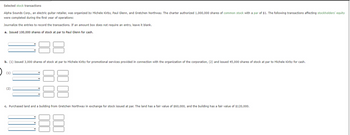

Transcribed Image Text:Selected stock transactions

Alpha Sounds Corp., an electric guitar retailer, was organized by Michele Kirby, Paul Glenn, and Gretchen Northway. The charter authorized 1,000,000 shares of common stock with a par of $1. The following transactions affecting stockholders' equity

were completed during the first year of operations:

Journalize the entries to record the transactions. If an amount box does not require an entry, leave it blank.

a. Issued 100,000 shares of stock at par to Paul Glenn for cash.

b. (1) Issued 3,000 shares of stock at par to Michele Kirby for promotional services provided in connection with the organization of the corporation, (2) and issued 45,000 shares of stock at par to Michele Kirby for cash.

(1)

(2)

c. Purchased land and a building from Gretchen Northway in exchange for stock issued at par. The land has a fair value of $60,000, and the building has a fair value of $120,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- please answerarrow_forwardIssuing stock Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 27,000 shares of preferred 2% stock, $100 par, and 600,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations: July 1. Issued 213,000 shares of common stock at par for cash. 1. Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. 7. Issued 69,400 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $149,100, $505,120 and $164,700 respectively. Sept. 20. Issued 17,600 shares of preferred stock at $105 for cash. Required: Journalize the transactions. Refer to the chart of accounts for the exact wording of the account titles CHART OF ACCOUNTS Ergonomics Supply Inc. General Ledger ASSETS 110 Cash 120 Accounts Receivable 131 Notes…arrow_forwardIssuing Stock Work Place Products Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 50,000 shares of 2% preferred stock, $55 par and 400,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. July. 1. Issued 130,000 shares of common stock at par for cash. July. 1 July. 1 Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. July. 1 Aug. 7. Issued 23,500 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $43,000, $234,000, and $52,000, respectively. For a compound transaction, if an amount box does not require an entry, leave it blank. Aug. 7 Sept. 20. Issued 20,000 shares of preferred stock at…arrow_forward

- Issuing Stock Professional Products Inc., a wholesaler of office products, was organized on February 5 of the current year, with an authorization of 100,000 shares of preferred 3% stock, $50 par and 700,000 shares of $15 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. If an amount box does not require an entry, leave it blank. Feb. 5. Issued 75,000 shares of common stock at par for cash. Feb. 5. Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Apr. 9. Issued 18,500 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $51,000, $276,000, and $61,500, respectively. June 14. Issued 35,000 shares of preferred stock at $65 for cash.arrow_forwardJournalize the following selected transactions completed during the current fiscal year: Date Transaction February 1 The board of directors declared a stock split that reduced the par of common shares from $100 to $20. This action increased the number of outstanding shares to 500,000. February 11 Purchased 25,000 shares of the company's own stock at $44, recording the treasury stock at cost. May 1 Declared a dividend of $2.50 per share on the outstanding shares of common stock. May 15 Paid the dividend declared on May 1. October 19 Declared a 2% stock dividend on the common stock outstanding (the fair market value of the stock to be issued is $55). November 12 Issued the certificates for the common stock dividend declared on October 19. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.arrow_forwardSubject :- Accountingarrow_forward

- Issuing Stock Professional Products Inc., a wholesaler of office products, was organized on February 5 of the current year, with an authorization of 100,000 shares of preferred 1% stock, $50 par and 250,000 shares of $20 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. If an amount box does not require an entry, leave it blank. Feb. 5. Issued 160,000 shares of common stock at par for cash. Feb. 5. fill in the blank 448da3f27ff0040_2 fill in the blank 448da3f27ff0040_3 fill in the blank 448da3f27ff0040_5 fill in the blank 448da3f27ff0040_6 Feb. 5. Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Feb. 5. fill in the blank b1e61509bfd401e_2 fill in the blank b1e61509bfd401e_3 fill in the blank b1e61509bfd401e_5 fill in the blank b1e61509bfd401e_6 Apr. 9. Issued 20,500 shares of common…arrow_forwardEntries for treasury stock On May 27, Mama Mia Inc, reacquired 79,000 shares of its common stock at $10 per share. On August 3, Mama Mia sold 53,000 of the reacquired shares at $13 per share. On November 14, Mama Mia sold the remaining shares at $8 per share. Journalize the transactions of May 27, August 3, and November 14. If an amount box does not require an entry, leave it blank. May 27 Treasury Stock Cash Aug. 3 Cash Treasury Stock Paid-In Capital from Sale of Treasury Stock Nov. 14 Cash Paid-In Capital from Sale of Treasury Stock Treasury Stock °arrow_forwardIssuing and Repurchasing Stock Redbird, Inc., had the following transactions related to its common and preferred stock: March 22 Sold 50,000 shares of $0.50 par common stock for $12 per share. Sold 2,000 shares of $10 par preferred stock at $14 per share. Repurchased 3,040 shares of the common stock at $20 per share. November 9 Required: Prepare the journal entries for these transactions. If an amount box does not require an entry, leave it blank. Mar. 22 Nov. 9 00 00arrow_forward

- Create journal entries for the followingarrow_forwardSelected Stock Transactions Alpha Sounds Corp., an electric guitar retailer, was organized by Michele Kirby, Paul Glenn, and Gretchen Northway. The charter authorized 400,000 shares of common stock with a par of $1. The following transactions affecting stockholders' equity were completed during the first year of operations. Journalize the entries to record the transactions. If an amount box does not require an entry, leave it blank. a. Issued 7,000 shares of stock at par to Paul Glenn for cash. b. (1) Issued 600 shares of stock at par to Michele Kirby for promotional services provided in connection with the organization of the corporation, and (2) issued 19,000 shares of stock at par to Michele Kirby for cash. c. Purchased land and a building from Gretchen Northway in exchange for stock issued at par. The building is mortgaged for $469,000 for 20 years at 7% and there is accrued interest of $6,500 on the mortgage note at the time of the purchase. The corporation agreed to…arrow_forwardSelected Stock Transactions Alpha Sounds Corp., an electric guitar retailer, was organized by Michele Kirby, Paul Glenn, and Gretchen Northway. The charter authorized 250,000 shares of common stock with a par of $1. The following transactions affecting stockholders' equity were completed during the first year of operations. Journalize the entries to record the transactions. If an amount box does not require an entry, leave it blank. a. Issued 8,500 shares of stock at par to Paul Glenn for cash. Cash 8,500 Common Stock 8,500 Feedback Check My Work b. (1) Issued 750 shares of stock at par to Michele Kirby for promotional services provided in connection with the organization of the corporation, and (2) issued 21,000 shares of stock at par to Michele Kirby for cash. (1) Organizational Expenses 750 Common Stock 750 (2) Cash 21,000 Common Stock 21.000 Feedback Check My Work c. Purchased land and a building from Gretchen Northway in exchange for stock issued at par. The building is mortgaged…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education