FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

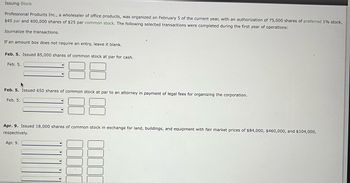

Transcribed Image Text:Issuing Stock

Professional Products Inc., a wholesaler of office products, was organized on February 5 of the current year, with an authorization of 75,000 shares of preferred 1% stock,

$45 par and 400,000 shares of $25 par common stock. The following selected transactions were completed during the first year of operations:

Journalize the transactions.

If an amount box does not require an entry, leave it blank.

Feb. 5. Issued 85,000 shares of common stock at par for cash.

Feb. 5.

▸

Feb. 5. Issued 650 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation.

Feb. 5.

Apr. 9. Issued 18,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $84,000, $460,000, and $104,000,

respectively.

Apr. 9.

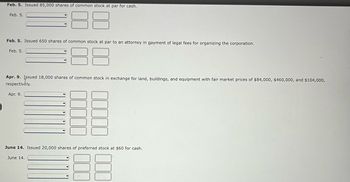

Transcribed Image Text:Feb. 5. Issued 85,000 shares of common stock at par for cash.

Feb. 5.

Feb. 5. Issued 650 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation.

Feb. 5.

Apr. 9. Issued 18,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $84,000, $460,000, and $104,000,

respectively.

Apr. 9.

Y

June 14. Issued 20,000 shares of preferred stock at $60 for cash.

June 14.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kk.348. Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 par value. During its first year, the following selected transactions were completed: Issued 5,300 shares of common stock for cash at $23 per share. Issued 1,300 shares of common stock for cash at $26 per share. Required: Complete the table below, indicating the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with aarrow_forwardon may 15, the simple corporation issued 6,000 common shares of $8 par value stock for land valued at $120,000. common stock will be credited $48,000arrow_forwardBandit, Inc., issued for $19 per share 5,000 shares of $10 par value common stock. The entry to record this transaction includes: Select one: a. Increase Cash for 95,000; and increase Common Stock for 95,000 b. Increase Cash for 95,000; increase Common Stock for 50,000 and increase Paid-in Capital in Excess of Par Value for 45,000 c. Increase Cash for 95,000; increase Common Stock for 50,000 and increase Retained Earnings for 45,000 d. Increase Cash for 95,000; increase Common Stock for 50,000 and increase Gain on Sale of Stock for 45,000 e. None of the abovearrow_forward

- D Company had the following transactions pertaining to stock investments. Feb. 1 Purchased 600 shares of G common stock (4%) for $6,000 cash, plus brokerage fees of $400. July 1 Received cash dividends of $2 per share on Goetz common stock. Sept. 1 Sold 300 shares of G common stock for $4,600, less brokerage fees of $100. Dec. 1 Received cash dividends of $1 per share on G common stock. Instructions: Journalize the transactions.arrow_forwardEhrlichCo. had the following transactions during the current period. Mar. 2 Issued 5,000 shares of $5 par value common stock to attorneys in payment of a bill for $40,000 for services performed in helping the company to incorporate.June 12 Issued 60,000 shares of $5 par value common stock for cash of $365,000.July 11 Issued 1,000 shares of $100 par value preferred stock for cash at $110 per share. Aug. 15 Issued 20,000 shares of common stock for a building with an asking price of $150,000 and a fair value of $140,000Nov. 28 Purchased 2,000 shares of treasury stock for $80,000. Dec. 15 Sold 500 shares of the treasury stock for $45 per shareInstructions: 1. Journalize the transactions. 2. Prepare the stockholders' equity section of the balance sheet. Use the following example as a guide. For Retained Earnings for this example, you can use $1,050,000. Stockholders’ equity Paid-in capital: Capital stock: 9% preferred stock, $100 par value,…arrow_forwardsarrow_forward

- Required information [The following information applies to the questions displayed below.] Tarrant Corporation was organized this year to operate a financial consulting business. The charter authorized the following stock: common stock, $11 par value, 11,900 shares authorized. During the year, the following selected transactions were completed: a. Sold 7,000 shares of common stock for cash at $22 per share. b. Sold 2,200 shares of common stock for cash at $27 per share. c. At year-end, the company reported net Income of $6,100. No dividends were declared. Required: 1. Prepare the journal entries required to record the sale of common stock in (a) and (b). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 2 1 Sold 7,000 shares of common stock for cash at $22 per share. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit…arrow_forwardHh1.arrow_forwardApr. 16 Purchased 6,000 shares of Kohler Co. stock at $29 per share. July 7 Purchased 4,500 shares of JCW Co. stock at $54 per share. 20 Purchased 2,000 shares of Ontario Co. stock at $21 per share. Aug. 15 Received an $1.40 per share cash dividend on the Kohler Co. stock. 28 Sold 3,600 shares of Kohler Co. stock at $32 per share. oct. 1 Received a $5.00 per share cash dividend on the JCW Co. shares. Dec. 15 Received a $1.70 per 31 Received a $4.40 per General Journal Requirement share cash dividend on the remaining Kohler Co. shares. share cash dividend on the JCW Co. shares. General Ledger Trial Balance Fair Value Adj For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. Apr. 16) Purchased 6,000 shares of…arrow_forward

- Vishnuarrow_forwardDec 1: ABC Inc. repurchased 15,000 shares of stock when the market price was $1 per share. Dec 5: ABC Inc. resold 4,000 shares of the reacquired stock when the market price was $1.50 per share. Dec 23: ABC Inc. resold 5,000 shares of the reacquired stock when the market price was $0.25 per share. Prepare any necessary journal entries.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education