FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

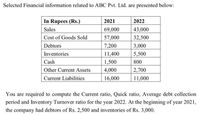

Transcribed Image Text:Selected Financial information related to ABC Pvt. Ltd. are presented below:

In Rupees (Rs.)

2021

2022

Sales

69,000

43,000

Cost of Goods Sold

57,000

32,500

Debtors

7,200

3,000

Inventories

11,400

5,500

Cash

1,500

800

Other Current Assets

4,000

2,700

Current Liabilities

16,000

11,000

You are required to compute the Current ratio, Quick ratio, Average debt collection

period and Inventory Turnover ratio for the year 2022. At the beginning of year 2021,

the company had debtors of Rs. 2,500 and inventories of Rs. 3,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Given the data in the following table, accounts receivable in 2023 was…arrow_forward4. A Company has Net Sales of 2,000,000 for 2020, Accounts Recitable for 500,000 in 2020, and Accounts Receivable of 350,000 in 2019. Calculate the Accounts Receivable Turnover Ratio.arrow_forwardBarger Corporation has the following data as of December 31, 2024: Total Stockholders' Equity Total Current Liabilities Total Current Assets $ 36,210 58,200 181,630 Other Assets Long-term Liabilities Property, Plant, and Equipment, Net Compute the debt to equity ratio at December 31, 2024. (Round your answer to two decimal places, X.XX.) = = C $? 45,600 269,640 Debt to equity ratioarrow_forward

- Given the following information, calculate the debt ratio percentage: Liabilities $24,000 Liquid assets $4,400 Monthly credit payments $300 Monthly savings $260 Net worth $72,000 Current liabilities $1,100 Take-home pay $1,800 Gross income $3,000 Monthly expenses $1,540 a) 33.3 b) 4 c) 2.86 O d) 16.67 O e) 8.67arrow_forwardPlease do not give solution in image format and show all calculation thankuarrow_forwardplease anwer all the questions i have mentioned below : - A company has the following items for the fiscal year 2020: Cash = 2 million Marketable securities = 3 million Account receivables (A/R) = 1.5 million Inventories = 8.5 million Total current liabilities = 8 million Calculate the company’s current ratio and quick ratio 2. Write the formula for the following ratios and what each ratio measures: Asset turnover Inventory Turnover and Days Inventory Receivable Collection Period 3. Write down the DuPont framework. How would you explain to your non-MBA non-Finance friend about the DuPont framework and why it is important?arrow_forward

- Calculate the 2020 current ratio using the following information: Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable Total Current Assets Total Assets Current Liabilities Long Term Debt Shareholders Equity Income Statement Interest Expense Net Income Before Income Taxes 1.17 0.60 1.40 0.80 2020 5,000 15,000 10,000 40,000 70,000 50,000 10,000 10,000 7,500 45,000arrow_forwardPlease input numbers in boxes below based on data provided for year 2018. Current assets - current liabilities = net working capitalarrow_forwardFILLING IN THE RATIOS .. THE LEFT SIDE IS 2019 THE RIGHT SIDE IS 2020 IN THE IMAGE. Jergan CorporationBalance SheetsDecember 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan CorporationIncome StatementFor the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900…arrow_forward

- Suppose the 2020 adidas financial statements contain the following selected data (in millions). Current assets $4,510 Interest expense $170 Total assets 9,060 Income taxes 145 Current liabilities 2,200 Net income 229 Total liabilities 4,983 Cash 770 Compute the following values:arrow_forward2.The following information is from Dejlah, Inc.s, financial statements. Sales (all credit) were AED 800 million for 2020. Sales to total assets... 2 times Total debt to total asset: 30% Current ratio........ 3.0 times Inventory turnover 5.0 times Average collection period 18 days Fixed asset turnover ... 5.0 times Fill in the balance sheet: Cash. Current debt .. Accounts receivable. Long-term debt. Inventory Total debt . Total current assets Equity... Fixed asset: Total debt and equity Total assetsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education