FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

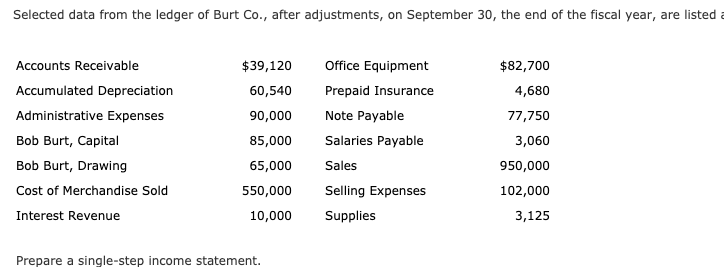

Transcribed Image Text:Selected data from the ledger of Burt Co., after adjustments, on September 30, the end of the fiscal year, are listed a

Accounts Receivable

Accumulated Depreciation

Office Equipment

Prepaid Insurance

$39,120

$82,700

60,540

4,680

Administrative Expenses

Bob Burt, Capital

Note Payable

Salaries Payable

Sales

Selling Expenses

Supplies

90,000

77,750

85,000

3,060

Bob Burt, Drawing

Cost of Merchandise Sold

Interest Revenue

65,000

950,000

550,000

102,000

3,125

10,000

Prepare a single-step income statement.

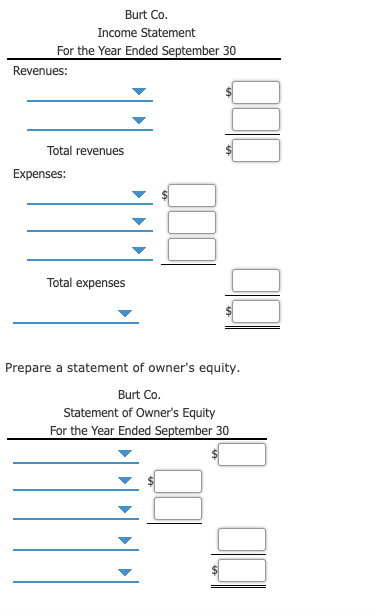

Transcribed Image Text:Burt Co.

Income Statement

For the Year Ended September 30

Revenues:

Total revenues

Expenses:

Total expenses

Prepare a statement of owner's equity.

Burt Co.

Statement of Owner's Equity

For the Year Ended September 30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- 5. Which financial information is found in a company's annual report? A. Employee salaries B. Marketing strategies • C. Financial statements • D. All of the abovearrow_forwardAt December 31 Assets Cash CRUZ, INCORPORATED Comparative Balance Sheets Accounts receivable, net Inventory Prepaid expenses Total current assets Furniture Accumulated depreciation-Furniture Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long-term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity 2021 Sales Cost of goods sold Gross profit $ 91,100 39,100 81,800 5,200 217, 200 105,000 (16,200) $ 306,000 $ 14,400 8,600 1,400 24,400 28,900 53,300 216,400 36,300 $ 306,000 CRUZ, INCORPORATED Income Statement For Year Ended December 31, 2021 Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes expense Net income 2020 $ 22,900 48,600 91,300 4,100 166,900 116, 200 (8,700) $ 274,400 $ 20,200 4,500 2,500 27,200 66,400 93,600 172,100 8,700 $ 274,400 $ 469,700 302,300 167,400 85,900 36,200 45,300 16,500 $ 28,800 Required:…arrow_forward10. Preparing a funds statement; cash flow from operations. You have the following information about the financial affairs of the XYZ Company: 1. Balance sheets: Current Assets: Cash..... Accounts receivable Inventories.. Total Current Assets Beginning of Year $ 2 235 End of Year $ 1 4 6 $10 Land, plant, and equipment, cost. $20 $11 $29 Less: Accum. depreciation Total Assets... Current Liabilities: Accounts payable Taxes payable.... Notes payable.. 8 12 $22 $ 4 1 2 ; 8「: སནྡྷ། 20| $31 $ 3 Total Current Liabilities $ 5arrow_forward

- Comparative financial statement data for Carmono Company follow: Assets Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity For this year, the company reported net income as follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Net income This Year $ 11.00 64.00 110.00 185.00 252.00 51.20 200.80 $385.80 $ 66.00 146.00 173.80 $385.80 $ 1,200.00 720.00 480.00 460.00 $ 20.00 Last Year $ 21.00 57.00 97.40 175.40 208.00 38 40 169.60 $345.00 $ 53.00 112.00 180.00 $345.00 This year Carmono paid a cash dividend but it did not sell any property, plant, and equipment or repurchase any of its own stock. Required: 1. Using the indirect method, prepare a statement of cash flows for this year. 2. Compute Carmono's…arrow_forwardSeven metrics The following data were taken from the financial statements of Woodwork Enterprises Inc. for the current fiscal year. Assuming that there are no intangible assets. Property, plant, and equipment (net) Liabilities: Current liabilities Mortgage note payable, 10%, ten-year note issued two years ago Total liabilities Stockholders' equity: Preferred $2 stock, $100 par (no change during year) Common stock, $10 par (no change during year) Retained earnings: Balance, beginning of year Net income Preferred dividends Common dividends Balance, end of year Total stockholders' equity Sales Check My Work $1,440,000 566,000 $27,000 179,000 $225,000 1,125,000 $2,006,000 206,000 $1,800,000 $1,350,000 $1,350,000 1,350,000 1,800,000 $4,500,000 $13,614,650 Previousarrow_forwardThe following transactions pertain to Year 1, the first-year operations of Rooney Company. All inventory was started and completed during Year 1. Assume that all transactions are cash transactions. 1. Acquired $4,900 cash by issuing common stock. 2. Paid $660 for materials used to produce inventory. 3. Paid $1,900 to production workers. 4. Paid $1,078 rental fee for production equipment. 5. Paid $90 to administrative employees. 6. Paid $106 rental fee for administrative office equipment. 7. Produced 340 units of inventory of which 190 units were sold at a price of $13 each. Required Prepare an income statement and a balance sheet in accordance with GAAP.arrow_forward

- The comparative statements of Lily Company are presented here. Net sales Lily Company Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other expenses and losses Interest expense Income before income taxes Income tax expense Net income Assets Current assets Cash Debt investments (short-term) Accounts receivable (net) Inventory Total current assets Plant assets (net) Total assets Lily Company Balance Sheets December 31 Liabilities and Stockholders' Equity Current liabilities Accounts payable Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 282,200 265,700 547,900 $971,800 $1,815,100 1,011,300 2022 803,800 517,400 286,400 2022 267,600 80,016 $ 187,584 $60,100 68,100 18,800 304,000 161,700 465,700 $852,700 116,200 123,100 367,500 604.300 $971,800 $160,300 2021 $64,600 50,200 102,900 114,500 332,200 520,500 $852,700…arrow_forwardWhen a company expenses the cost of maintenance for its heating and cooling system, thatcost will appear on itsa. Income statement.b. Statement of retained earnings.c. Balance sheet.d. Statement of stockholders’ equity.arrow_forwardTimes interest earned A company reports the following: Income before income tax expense $1,271,600 Interest expense 187,000 Determine the times interest earned ratio. If required, round the answer to one decimal place.arrow_forward

- Single-Step Income Statement The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30, 20Y8: Cash $187,875 Retained Earnings $ 571,050 Accounts Receivable 337,500 Dividends 281,250 Inventory 855,000 Sales 8,025,750 Estimated Returns Inventory 78,750 Cost of Goods Sold 4,893,750 Office Supplies 33,750 Sales Salaries Expense 874,800 Prepaid Insurance 27,000 Advertising Expense 103,275 Office Equipment 259,200 Depreciation Expense— Store Equipment 18,675 Accumulated Depreciation— Office Equipment 111,375 Miscellaneous Selling Expense 4,500 Store Equipment 1,150,875 Office Salaries Expense 174,150 Accumulated Depreciation— Store Equipment 420,075 Rent Expense 89,775 Accounts Payable 109,350 Insurance Expense 51,638 Customer Refunds Payable 78,750 Depreciation Expense— Office Equipment 36,450…arrow_forwardPlease do not give image formatarrow_forwardPrinciples Of Accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education