FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

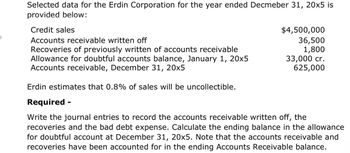

Transcribed Image Text:Selected data for the Erdin Corporation for the year ended Decmeber 31, 20x5 is

provided below:

Credit sales

Accounts receivable written off

Recoveries of previously written of accounts receivable

Allowance for doubtful accounts balance, January 1, 20x5

Accounts receivable, December 31, 20x5

Erdin estimates that 0.8% of sales will be uncollectible.

Required -

$4,500,000

36,500

1,800

33,000 cr.

625,000

Write the journal entries to record the accounts receivable written off, the

recoveries and the bad debt expense. Calculate the ending balance in the allowance

for doubtful account at December 31, 20x5. Note that the accounts receivable and

recoveries have been accounted for in the ending Accounts Receivable balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SISSY Company provided the following information relating to accounts receivable for the current yearAccounts receivable on January 1 1,300,000Credit Sales 5,400,000Collections from customers, 4,750,000Accounts written off 125,000Estimated uncollectible receivables per aging 165,000What is the balance of accounts receivable before allowance for doubtful accounts on December 31?a. 1,825,000b. 1,850,000c. 1,950,000d. 1,990,000arrow_forwardABC Co. has the following information on December 31, 20x1 before any year-end adjustments. Net credit sales 6,300,000 Accounts receivable, December 976,500 Allowance for doubtful accounts, Dec. 31 (before any necessary year-end adjustments) 53,550 Percentage of credit sales 2% The aging of receivables is shown below: Days outstanding Receivable balances % uncollectible 0 – 60 378,000 1% 61 – 120 283,500 2% Over 120 315,000 6% Total accounts receivables 976,500 Additional information: ABC Co. uses the percentage of credit sales in determining bad debts in monthly financial reports and the aging of receivables for its annual financial statements. Accounts written-off during the year amounted to ₱119,700 and accounts recovered amounted to ₱28,350. As of December 31, ABC Co. determined that ₱63,000 accounts receivable from a certain customer included in the “61-120 days outstanding” group is 95% collectible and a ₱31,500 account included in the “Over 120 days outstanding” group is…arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education