FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

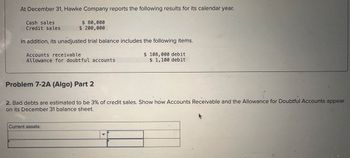

Transcribed Image Text:At December 31, Hawke Company reports the following results for its calendar year.

Cash sales

Credit sales

$ 80,000

$ 200,000

In addition, its unadjusted trial balance includes the following items.

Accounts receivable

Allowance for doubtful accounts

$ 108,000 debit

$ 1,100 debit

Problem 7-2A (Algo) Part 2

2. Bad debts are estimated to be 3% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear

on its December 31 balance sheet.

Current assets:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The unadjusted trial balance of ABC Company reports the following balances at the end of the year: Dr Cr Accounts receivable $50,000Allowance for doubtful accounts $ 2,000 Sales (all on credit) 100,000Sales returns and allowances 25,000Sales discounts 5,000Instructions:Prepare the journal entry to record bad debt expense assuming that bad receivables are estimated to be 5% of ending accounts receivable.arrow_forwardSelected data for the Erdin Corporation for the year ended Decmeber 31, 20x5 is provided below: Credit sales Accounts receivable written off Recoveries of previously written of accounts receivable Allowance for doubtful accounts balance, January 1, 20x5 Accounts receivable, December 31, 20x5 Erdin estimates that 0.8% of sales will be uncollectible. Required - $4,500,000 36,500 1,800 33,000 cr. 625,000 Write the journal entries to record the accounts receivable written off, the recoveries and the bad debt expense. Calculate the ending balance in the allowance for doubtful account at December 31, 20x5. Note that the accounts receivable and recoveries have been accounted for in the ending Accounts Receivable balance.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 80,000 Credit sales $ 200,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable $ 108,000 debit Allowance for doubtful accounts $ 1,100 debit 2. Bad debts are estimated to be 3% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet.arrow_forward

- Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1,353,500 of merchandise on credit (that had cost $979,500), terms n/30. b. Wrote off $18,100 of uncollectible accounts receivable. c. Received $671,300 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible. Year 2 e. Sold $1,556,800 of merchandise (that had cost $1,295,500) on credit, terms n/30. f. Wrote off $26,000 of uncollectible accounts receivable. g. Received $1,394,400 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 3.00% of accounts receivable would be uncollectible. Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized…arrow_forwardAlpesharrow_forwardA business has the following balances at the beginning of the year: Accounts receivable: 235000 Allowance for doubtful accounts: -15250The following summary transactions occurred during the year.Sales for the year, 100% on credit: 450000Cash collected on accounts receivable for the year: 445200Write-offs of uncollectable accounts receivable : 28200Received a cheque from a customer whose account was previously written off: 2820The overall rate used to estimate the allowance for doubtful accounts at year end: 8%Using the information above, answer the following questions.What is the balance in the accounts receivable account at year end? 1. What is the balance in the accounts receivable account at year end? 2. What is the balance in the allowance for doubtful accounts at year end? 3. What is the balance in the bad debt expense account at year end?arrow_forward

- Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. $ 1,905,000 $ 5,682,000 In addition, its unadjusted trial balance includes the following items. Cash sales Credit sales Accounts receivable Allowance for doubtful accounts. $ 1,270, 100 debit $ 16,580 debit 2. Bad debts are estimated to be 1.5% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet.arrow_forwardRequired information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $ 280,000 $ 700,000 In addition, its unadjusted trial balance includes the following items. $ 210,000 debit $ 2,500 debit Accounts receivable Allowance for doubtful accounts 2. Bad debts are estimated to be 2% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet. Current assets: $ 0arrow_forwardAt December 31, Hawke Company reports the following results for its calendar year. Cash sales $ 320,000 Credit sales $ 800,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable $ 432,000 debit Allowance for doubtful accounts $ 4,300 debit 2. Bad debts are estimated to be 3% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet.arrow_forward

- Credit sales during the year were $425,000, the Allowance for Uncollectible Accounts had a beginning of year balance of $2,500 debit, accounts written off during the year were $2,200. It is estimated that 2% of all credit sales are eventually uncollectible. What is the ending balance in the Allowance for Uncollectible Accounts? $8,500 $8,800 $3,800 $8,200arrow_forwardMc Graw Hill Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. $ 400,000 $ 1,000,000 Cash sales Credit sales In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 3% of credit sales. b. Bad debts are estimated to be 2% of total sales. c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). View transaction listarrow_forwardPercent of sales method At year-end, December 31, Ying Company estimates its bad debts as 0.5% of its annual credit sales of $975,000. Ying records its Bad Debts Expense for that estimate. 1. Prepare the journal entry to record bad debts. 2. Compute the ending balance of the Allowance for Doubtful Accounts if it has a $5,000 beginning credit balance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education