FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

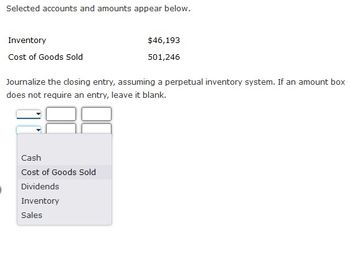

Transcribed Image Text:Selected accounts and amounts appear below.

Inventory

Cost of Goods Sold

Journalize the closing entry, assuming a perpetual inventory system. If an amount box

does not require an entry, leave it blank.

Cash

Cost of Goods Sold

$46,193

501,246

Dividends

Inventory

Sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the journal entries to record the following transactions on Wildhorse Company’s books using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) On March 2, Windsor Company sold $947,600 of merchandise to Wildhorse Company on account, terms 3/10, n/30. The cost of the merchandise sold was $534,200. (b) On March 6, Wildhorse Company returned $105,700 of the merchandise purchased on March 2. The cost of the merchandise returned was $68,600. (c) On March 12, Windsor Company received the balance due from Wildhorse Company. No. Date Account Titles and Explanation Debit Credit (a) choose a transaction date March 2March 6March 12 enter an account title…arrow_forwardSheridan Corporation uses a periodic inventory system and the gross method of accounting for purchase discounts. (a) (b) (c) No. Prepare all necessary journal entries for Sheridan. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) (a) (1) (a) (2) (b) On July 1, (1) Sheridan purchased $69,000 of inventory, terms 2/10, n/30, FOB shipping point. (2) Sheridan paid freight costs of $1,095. O On July 3, Sheridan returned damaged goods and received credit of $6,900. On July 10, Sheridan paid for the goods. Date July 1 July 1 July 3 July 10 V Account Titles and Explanation Inventory Accounts Payable Freight-In Cash Accounts Payable Inventory Accounts Payable Inventory Debit 69000 1095 6900 Credit 69 1 6arrow_forwardinventory as your base numper and adjust the couss amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) \table[[Date,, \table [[Purchases/Transportation - In /], [(PurchaseReturns/Discounts)]], \table [[Cost of Goods Sold/(Returns to], [Inventory)]], Balance in Inventory], [Units, Cost/Unit, Total $, Units, Cost/Unit, Total $, Units, \table[[Avg], [ Cost/Unit]], Total $], [Mar., Brought Forward,,r, 61, $, 93.00, $, 5, 673.00 Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the inventory sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods…arrow_forward

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardSold merchandise inventory to Hayes Company,5500,on account .Term3/15, n/35.Cost of goods ,2,530. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expenses related to the sale. We will do that in the following step.arrow_forwardIdentify which of the following statement is correct for perpetual inventory system? Under the perpetual Inventory system, on the purchase of Inventory purchase account is debited. When valuing ending Inventory under a perpetual Inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. When valuing ending Inventory under a perpetual Inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. 09/03/2024 15:01 When valuing ending Inventory under a perpetual inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic Inventory system.arrow_forward

- A company that uses a perpetual inventory system purchased inventory on account and later returned goods worth $900.00 to the vendor. Which of the following would be the correct journal entry to record these returns? OA. Accounts Payable 900 Merchandise Inventory 900 OB. Accounts Payable 900 Purchase Returns 900 OC. Merchandise Inventory 900 Accounts Payable 900 OD. Purchase Returns 900 Accounts Payable 900arrow_forwardJenbright Incorporated adopted the dollar-value LIFO method last year. Last year's ending inventory was $53,700. The ending inventory for the current year at year-end (FIIFO) costs is $98,000 and on a dollar-value LIFO basis is $76,520. Based on this information, prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis. Prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the adjusting entry for the current year. Account Year-endarrow_forwardWhat is the inventory system called that discloses the amount of inventory on hand ONLY at the end of the accounting period when a physical count is taken? Group of answer choices retail physical periodic perpetualarrow_forward

- Required information [The following information applies to the questions displayed below.] Nix'lt Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances (Nix'lt uses the perpetual inventory system). Merchandise inventory т. Nix, Capital T. Nix, Withdrawals Sales Sales discounts $ 46,800 133,300 7,000 163,600 4,700 $ 4,700 110,400 12,100 41,500 5,000 Sales returns and allowances Cost of goods sold Depreciation expense Salaries expense Miscellaneous expenses A physical count of its July 31 year-end inventory discloses that the cost of the merchandise inventory still available is $44,750.arrow_forwardBremmer uses a periodic inventory system and the following information is available: Sales Beginning Inventory Ending Inventory Purchases What is the cost of goods sold? Select one: Oa. $230,400 Ob. $96,800 Oc. $133,600 Od. $132,200 $ 230,400 21,200 19,800 132,200arrow_forwardWhen a company uses the perpetual inventory system in accounting for its merchandise inventory, which of the following is true? Multiple Choice The inventory account is updated after each sale The inventory account is updated throughout the year as purchases are made. Cost of goods sold is computed at the end of the accounting period rather than at each sale. None of the other alternatives are correct Purchases are recorded in the cost of goods sold account.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education