FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

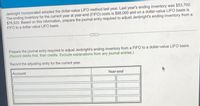

Transcribed Image Text:Jenbright Incorporated adopted the dollar-value LIFO method last year. Last year's ending inventory was $53,700.

The ending inventory for the current year at year-end (FIIFO) costs is $98,000 and on a dollar-value LIFO basis is

$76,520. Based on this information, prepare the journal entry required to adjust Jenbright's ending inventory from a

FIFO to a dollar-value LIFO basis.

Prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis.

(Record debits first, then credits. Exclude explanations from any journal entries.)

Record the adjusting entry for the current year.

Account

Year-end

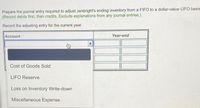

Transcribed Image Text:Prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis

(Record debits first, then credits. Exclude explanations from any journal entries.)

Record the adjusting entry for the current year.

Account

Year-end

Cost of Goods Sold

LIFO Reserve

Loss on Inventory Write-down

Miscellaneous Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the transactions on the "Journal Entry data" tab. Because Chart of Account numbers are not provided, post-reference information is not required. Journal entries should be prepared in proper form. Refer to the "Unadjusted TB Data tab" for proper account titles. The journal must have date, description, credit and debit. Also must be a total of 64 journal entries. And must find the total.arrow_forwardJournalize the entries to correct the following errors: a. A purchase of supplies for $158 on account was recorded and posted as a debit to Supplies for $513 and as a credit to Accounts Receivable for $513. (Record the entry to reverse the error first.) If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - b. A receipt of $4,068 from Fees Earned was recorded and posted as a debit to Fees Earned for $4,068 and a credit to Cash for $4,068. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select -arrow_forwardA seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of merchandise previously purchased on credit on April 13. The seller's cost of the merchandise returned was $480. The merchandise is not defective and is restored to inventory. The seller has not yet received any cash from the customer.arrow_forward

- Pharoah Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The following purchase transactions occurred in March: Pharoah Stores purchases $9,200 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB shipping point. Mar. 1 2 The correct company pays $140 for the shipping charges. 3 21 22 23 30 31 Pharoah returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour. Octagon gives Pharoah a $1,100 credit on its account. Pharoah Stores purchases an additional $11,500 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination. The correct company pays $160 for freight charges. Pharoah returns $500 of the merchandise purchased on March 21 because it was damaged. Octagon gives Pharoah a $500 credit on its account. Pharoah paid Octagon the amount owing for the merchandise purchased on March 1. Pharoah paid Octagon the amount owing for the…arrow_forward12, please read the qestion and answer b1arrow_forwardView Policies Current Attempt in Progress Carla Vista Company manufactures pizza sauce through two production departments: cooking and canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits: Beginning work in process inventory Direct materials Direct labour Manufacturing overhead Costs transferred in Cooking $-0- 26,900 7,350 32,800 Canning $3,750 7,620 7,490 26,000 52,200 I dit ontries Credit account titles are automatically indented when the anarrow_forward

- Journalize the April transactions for Bird Company (the buyer). If an amount box does not require an entry, leave it blank.?arrow_forwardH1.arrow_forwardVaughn Limited, which uses a perpetual inventory system, purchased inventory costing $22,000 on February 1 by issuing a 3-month note payable bearing interest at 6%, with interest and principal due on May 1. The company's year end is on March 31 and the company records adjusting entries only at that time. Your answer is correct. Prepare the journal entry to record the purchase of inventory on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles Feb. 1 (b) Inventory Notes Payable eTextbook and Media List of Accounts Your answer is correct. Mar. 31 Date Account Titles Interest Expense Debit Interest Payable Prepare the journal entry to record the accrual of interest expense on March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education