ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

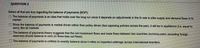

Transcribed Image Text:QUESTION 2

Select all that are true regarding the balance of payments (BOP):

O The balance of payments is an idea that holds over the long run since it depends on adjustments in the fx rate to alter supply and demand flows in fx

market

O Since the balance of payments is market driven rather than policy driven (two opposing policies across the pair), it will be in equilibrium (i.e. equal to

zero), like all markets

The balance of payments theory suggests that the net investment flows and trade flows between two countries (currency pairs, excluding foreign

reserves) should balance to zero (in flows less out flows)

The balance of payments is unlikely to exactly balance since it relies on imperfect arbitrage across international boarders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 4. Use the Mundell-Fleming model to predict what would happen to real GDP, the exchange rate, and net exports under both floating and fixed exchange rate regimes in response to each of the following shocks. Your answers should be in the form of fully-labeled graphs, where any curve shifts and new equilibrium are clearly shown. (a) Consumer confidence in the economy is falling, so consumers start to spend less. (b) Toyota designed a line of stylish new cars, making consumers prefer foreign cars over domestic cars. Banks double the number of ATMs (automatic teller machines) around the economy, reducing the demand for money.arrow_forwardHow will the following event affect variables 1 through 3 in the foreign exchange market under a flexible exchange rate system; other things unchanged. Event: The U.S. Central Bank (the Fed) starts buying Chinese currency using dollar reserves: Variable 1: Supply of dollar in the foreign exchange market ___(increase, decrease, unaffected: briefly explain why). Variable 2: Value of dollar in the foreign exchange market unaffected: briefly explain why). Variable 3: American goods exported to China unaffected: briefly explain why). (appreciate, depreciate, (increae, decrease,arrow_forwardExplanation it very good and clear. Not copy paste from anywhere.and give concept throughoutarrow_forward

- QUESTION 2 In the long run, an increase in the nominal exchange rate is likely to lead to Note: Multiple answers are possible. O A. an increase in exports ) B. a decrease in exports C. an increase in imports D. a decrease in importsarrow_forwardPlease help me with this questions. Thank you 1. Using the IS–LM–FX model, illustrate how an increase in the home country’sgovernment spending affects the home country. Compare the outcome when the homecountry has a fixed exchange rate with the outcome when the home currency floats. Foreach case, state the effect of the increase in the home country’s government spending(increase, decrease, no change, or ambiguous) on the following variables: Y, i, E, C, I,TB. 2. During the 1980s, the United States experienced “twin deficits” in the currentaccount and government budget. Since 1998 the U.S. current account deficit has grownsteadily along with rising government budget deficits. Do government budget deficitslead to current account deficits? Identify other possible sources of the current accountdeficits. Do current account deficits necessarily indicate problems in the economy? 3. Suppose the Japanese government is considering two policies. One policy wouldinvolve increasing government…arrow_forwardIf the forecast UK inflation rate is 5% and the forecast European inflation rate is 2% and the spot exchange rate is €1.20/£1. Then according to relative PPP which of the following statements is correct? Select one: a. O b. The euro is forecast to appreciate by 3% to approximately €1.236/£1 O c. The pound is forecast to depreciate by 3% to approximately €1.1650/£1 O d. The euro is forecast to depreciate by 3% to approximately €1.1650/£1 The pound is forecast to appreciate by 3% to approximately €1.236/£1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education