ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

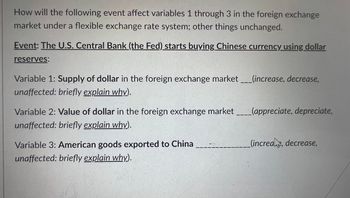

Transcribed Image Text:How will the following event affect variables 1 through 3 in the foreign exchange

market under a flexible exchange rate system; other things unchanged.

Event: The U.S. Central Bank (the Fed) starts buying Chinese currency using dollar

reserves:

Variable 1: Supply of dollar in the foreign exchange market ___(increase, decrease,

unaffected: briefly explain why).

Variable 2: Value of dollar in the foreign exchange market

unaffected: briefly explain why).

Variable 3: American goods exported to China

unaffected: briefly explain why).

(appreciate, depreciate,

(increae, decrease,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Asap plsarrow_forward(1-4) Assume that consumers all around the world only consume Big Macs at MacDonald's. An American tourist found that 50 USD can purchase 30 Big Macs in India, but the same amount of money can only purchase 25 Big Macs in China. The real exchange rate between China and India is A) 1 unit of consumption goods in India = 5/6 unit of consumption goods in China B) 1 unit of consumption goods in China = 5/6 unit of consumption goods in India C) 1 unit of consumption goods in India = 2 unit of consumption goods in China D) 1 unit of consumption goods in India = 1/2 unit of consumption goods in Chinaarrow_forward1.0 Read the following extract and answer the question that follows.South African Rand Carried Higher by Ebbing USD as Double-edged Sword Hangs AboveThe Rand has lifted off two month lows to outperform many others early the new month, leading the Pound-to-Rand exchange rate to explore the land below 20.00 this week in price action that comes alongside an ebbing of the U.S. Dollar, although a double-edged sword now hangs above the South African currency.South Africa’s Rand was higher against all of the most heavily traded developed and emerging market currencies on Tuesday with the exception of the Indonesian Rupiah, continuing a week-long period of outperformance. The performance of the rand reported above is most likely as a result of success in which of the following macroeconomic objectives? a) Price stabilityb) Economic growthc) Balance of payments stabilityd) Inflation targetingarrow_forward

- Assume that Canada and the United States frequently trade with each other. Under the freely floating exchange rate system, low inflation in the U.S. will place ____ pressure on Canadian dollars (versus U.S. dollars), ____ the amount of Canadian dollars available for sale, and result in ____ inflation in Canada. a) upward; reduce; unchanged b) upward; increase; lower c) downward; reduce; lower d) downward; increase; unchanged e) None of the abovearrow_forwardThe figure to the right shows the market for Thailand's currency, the baht Suppose market interest rates on financial assets denominated in baht decline relative to market interest rates on financial assets denominated in other nations' currencies. Moreover, assume a floating exchange rate Using the line drawing tool, show how the market for the baht is impacted by this event. Properly label this line Carefully follow the instructions above, and only draw the required objects. According to your graph, the baht has with respect to the dollar Dollars per Bart 0.000 0.054- 0.040 0.042- 0036- 0.030- 0024- 0.018 0.012 0.000 0 000- Quantity of Baht (bitions) 10arrow_forwardI REALLY NEED HELParrow_forward

- Using information from problems 3 and 4, suppose that the central bank of Mexico has 200 bln dollars of foreign reserves just before the financial crisis began. If the central bank wants to keep the exchange rate at the level described in problem 4, it can do so for _____ weeks before it runs out of reserves (provided supply and demand curves do not change). Question 3 and 4 attached for your information:)arrow_forward2. Consider an example of rate-of-return calculation. Suppose that Foreign bank pays 10% annual interest rate in cF. Right now, the exchange rate is E = 2cH/cF. In one year, you expect the exchange will be 1.8cH/cF. You are now planning depositing 100CH into a foreign bank account using the current exchange rate, wait one year, receive the interest from the bank, withdraw all money in the account, and exchange the money into cH. 2.a. Based on your expected exchange rate, not using the simple rule, answer the exact foreign rate of return. 2.b. Using the simple rule, answer the Foreign rate of return.arrow_forwardUse the money market and FX diagrams to answer the following questions. This question considers the relationship between the Indian rupee (Rs) and the U.S. dollar ($). The exchange rate is in rupees per dollar, ERs/$. On all graphs, label the initial equilibrium point A. a. Illustrate how a permanent increase in India’s money supply affects the money and FX markets. Label your short-run equilibrium point B and your long-run equilibrium point C. b. By plotting them on a chart with time on the horizontal axis, illustrate how each of the following variables changes over time (for India): nominal money supply MIN, price level PIN, real money supply MIN/PIN, interest rate iRs, and the exchange rate ERs/$. c. Using your previous analysis, state how each of the following variables changes in the short run (increase/decrease/no change): India’s interest rate iRs, ERs/$, expected exchange rate EeRs/$, and price level PIN. d. Using your previous analysis, state how each of the…arrow_forward

- 1.10 Read the following extract and answer the question that follows. South African Rand Carried Higher by Ebbing USD as Double-edged Sword Hangs AboveThe Rand has lifted off two month lows to outperform many others early the new month, leading the Pound-toRand exchange rate to explore the land below 20.00 this week in price action that comes alongside an ebbing ofthe U.S. Dollar, although a double-edged sword now hangs above the South African currency.South Africa’s Rand was higher against all of the most heavily traded developed and emerging market currencieson Tuesday with the exception of the Indonesian Rupiah, continuing a week-long period of outperformance.Source: https://www.poundsterlinglive.com/zar/15766-south-african-rand-carried-higher-by-ebbing-usd-asdouble-edged-sword-hangs-aboveAccessed: 20/08/21The performance of the rand reported above is most likely as a result of success in which of the followingmacroeconomic objectives?a) Price stabilityb) Economic growthc) Balance…arrow_forwardQuestion 4 State the impact of each of the following changes (other variables remaining unchanged) on the real exchange rate. (d) The nominal exchange rate moves from 86 to 90 for a U.S. dollar. (e) The nominal exchange rate depreciates by 10 percent at the same time that local inflation is 10 percent and the U.S. price level is stable.arrow_forwardA. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education