FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Homework help. Chapter 21 number 6. Need help filling in the missing data on part b. Thanks for the help!

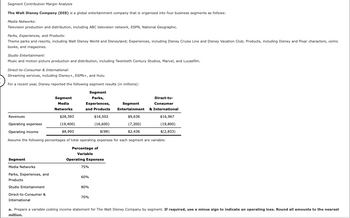

Transcribed Image Text:Segment Contribution Margin Analysis

The Walt Disney Company (DIS) is a global entertainment company that is organized into four business segments as follows:

Media Networks:

Television production and distribution, including ABC television network, ESPN, National Geographic.

Parks, Experiences, and Products:

Theme parks and resorts, including Walt Disney World and Disneyland; Experiences, including Disney Cruise Line and Disney Vacation Club; Products, including Disney and Pixar characters, comic

books, and magazines.

Studio Entertainment:

Music and motion picture production and distribution, including Twentieth Century Studios, Marvel, and Lucasfilm.

Direct-to-Consumer & International:

Streaming services, including Disney+, ESPN+, and Hulu.

For a recent year, Disney reported the following segment results (in millions):

Segment

Parks,

Experiences,

and Products

Revenues

$16,502

Operating expenses

(16,600)

Operating income

$(98)

Assume the following percentages of total operating expenses for each segment are variable:

Segment

Media Networks

Parks, Experiences, and

Products

Studio Entertainment

Direct-to-Consumer &

International

Segment

Media

Networks

$28,393

(19,400)

$8,993

Percentage of

Variable

Operating Expenses

75%

60%

80%

70%

Direct-to-

Consumer

Segment

Entertainment & International

$9,636

(7,200)

$2,436

$16,967

(19,800)

$(2,833)

a. Prepare a variable costing income statement for The Walt Disney Company by segment. If required, use a minus sign to indicate an operating loss. Round all amounts to the nearest

million.

Transcribed Image Text:a. Prepare a variable costing income statement for The Walt Disney Company by segment. If required, use a minus sign to indicate an operating loss. Round all amounts to the nearest

million.

Line Item Description

Sales

Variable operating expenses

Contribution margin

Fixed operating expenses

Operating income/loss

Feedback

Check My Work

Correct

Media Networks

Parks, Experiences, and Products

Studio Entertainment

The Walt Disney Company

Variable Costing Income Statement

(in millions)

Direct-to-Consumer & International

Media

Networks

28,393

14,550 ✔

13,843

4,850

8,993

%

%

%

Parks, Experiences,

and Products

16,502

9,960

X %

6,542

6,640

-98

Studio

Entertainment

9,636

5,760

3,876

1,440

b. Compute the contribution margin ratio for each segment. Round ratios to the nearest tenth of a percent.

Contribution

Margin Ratio

2,436

Direct-to-Consumer &

International

16,967

13,860

3,107

5,940

-2,833

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward9arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- Students Home M Federal Financial Aid Program X Students Home Ch. 7 Hmwk: Invoices, Trade &X A Ch. 7 Hmwk Invoices, Trade & X A webassign.net/web/Student/Assignment-Responses/last?dep3D27277752 Apps M Gmail DYouTube Maps ... ... EReading list 7. [-/1 Points] DETAILS BRECMBC9 7.I1.010. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the net price factor (as a %) and net price (in $) by using the complement method. Round your answer to the nearest cent. List Price Trade Discount Rate Net Price Factor Net Price $3,499.00 35% $4 Need Help? Read It 8. [-/1 Points] DETAILS BRECMBC9 7.J1.014. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the trade discount (in $) and trade discount rate (as a %). Round your answer to the nearest tenth of a percent. List Price Trade Discount Rate Trade Discount Net Price $4,500.00 $3,515.00 Need Help? 11:28 PM 71°F (岁 10/9/2021 P Type here to searcharrow_forward7arrow_forwardBOR Tutor - Solution Page 1 of 1 | Ha X A learn.hawkeslearning.com/Portal/Lesson/lesson_certify#! MSC SSO Login To Do Assignments. E Reading list E Apps BSA Violation Civil... Search FAQS for Indian Trib... CPAJ The Past, Present, a... CPAJ Fraud in a World of... You were asked to answer the following question: Consider a small photography studio with 8 workers and 5 printers. The total cost of labor and capital is $3,300. In order to reduce total operating costs, the owner leases 5 additional printers and fires 5 workers. After these changes, the salary of each worker increases by $30, the cost of using each of the printers (both new and old) remains constant, and the total cost of labor and capital decreases to $2,950. What is the cost of using one printer? The following answer is correct: First, calculate the new total quantities of workers and printers after the changes were made. New quantity of workers= 8-5= 3 workers New quantity of printers = 5 + 5 = 10 printers Assume that C,…arrow_forward

- P Do Homework - Homework 2 - Google Chrome A mylab.pearson.com/Student/PlayerHomework.aspx?homeworkld=617070625&questionld=12&flushed=true&cld=6813423¢erwin=yes BAB110 NII, W22 Question 12, 6.4a HW Score: ! = Homework: Homework 2 Part 1 of 2 O Points: Find the rate of markdown and the markdown. Regular Selling Price $31.20 Rate of Markdown Markdown Sale Price ? $18.70 The rate of markdown is %. (Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardACCTUZ Chapterz Miini Case Microsolt Word AaBbCcD AaBbCcD AaBbC AaBbCc AABI AaBbCcl AaBbCcD AaBbCcC IT Normal T No Spaci. Heading 1 Heading 2 Subtle Em... Title Subtitle Emphasis Styles Ehapter 22 Mini Case When math is required, to receive full credit- SHOW YOUR MATH, otherwise you will not receive credit (even if the answer is correct). You must submit your answer on a word document or spreadsheet. Hand written responses are not acceptable and will not receive credit. Submit on Blackboard, if submitted via email or another source you will not receive credit. If submitted late (after the due date and time) you will not receive credit. Sweet Suites, Inc. operates a hotel property that has 300 rooms. On average, 80% of Sweet Suites, Inc., rooms are occupied on weekday, and 40% are occupied during the weekend. The managerhas asked you to developa budget forthe housekeeping and restaurant staff forweekdays and weekends. You have determined that the housekeeping staff requires 30 minutes…arrow_forwardNot a previously submitted question. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education