7-14 and 7-18

SOLUTION:-

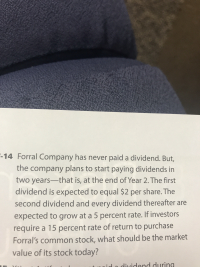

7-14

Present value (PV) = sum of present value of all future cash flows

Assuming returns are generated from dividends only,

After end of 2 years there is a perpetuity model with constant dividend growth which can be calculated using the formula Dividend * (1+ dividend growth rate)/ (return rate - growth rate) which needs to be discounted back from year 2 to year 0 (present value)

PV = 2/(1+15%)^2+ 2*(1+5%)/(15%-5%)/(1+15%)^2

=$17.39

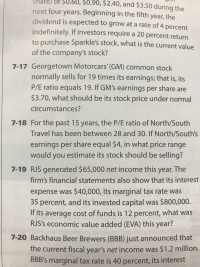

7-18

Price range of stock can be calculated as follows:-

Price earnings ratio of N stock is between 28 and 30. earnings per share are $4

Price range=(Price earning ratio of lower value x EPS to Price earning ratio of higher value x EPS)

=(28 x 4 to 30 x 4)

So the price range is 112 to 120$.

It shows the sum of money you are ready to pay for each dollar worth of the earnings of the company

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- E9.7(a,b2)arrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forwardTo have a times interest earned of 8. Determine whether A. FinancialB. Nonfinancialarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education