FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

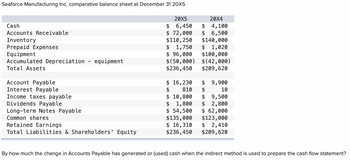

Transcribed Image Text:Seaforce Manufacturing Inc. comparative balance sheet at December 31 20X5

Cash

Accounts Receivable

Inventory

Prepaid Expenses

Equipment

Accumulated Depreciation - equipment

Total Assets

Account Payable

Interest Payable

Income taxes payable

Dividends Payable

Long-term Notes Payable

Common shares

Retained Earnings

Total Liabilities & Shareholders' Equity

20X5

20X4

$ 6,450

$ 4,100

$ 72,000 $ 6,500

$110,250

$ 1,750

$ 96,000 $100,000

$(50,000)

$(42,000)

$236,450

$209,620

$ 16,230

810

$

$ 10,800

$ 1,800

$ 54,500

$135,000

$ 16,310

$236,450

$140,000

$ 1,020

$ 9,900

10

$ 9,500

$ 2,800

$ 62,000

$123,000

$ 2,410

$209,620

By how much the change in Accounts Payable has generated or (used) cash when the indirect method is used to prepare the cash flow statement?

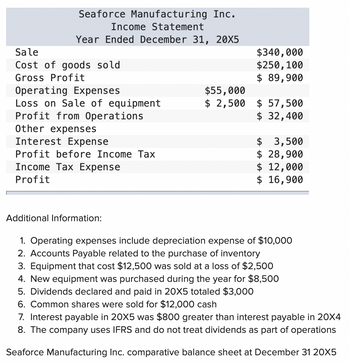

Transcribed Image Text:Seaforce Manufacturing Inc.

Income Statement

Year Ended December 31, 20X5

Sale

Cost of goods sold

Gross Profit

Operating Expenses

Loss on Sale of equipment

Profit from Operations

Other expenses

Interest Expense

Profit before Income Tax

Income Tax Expense

Profit

Additional Information:

$55,000

$ 2,500

$340,000

$250, 100

$ 89,900

$57,500

$ 32,400

$ 3,500

$ 28,900

$ 12,000

$ 16,900

1. Operating expenses include depreciation expense of $10,000

2. Accounts Payable related to the purchase of inventory

3. Equipment that cost $12,500 was sold at a loss of $2,500

4. New equipment was purchased during the year for $8,500

5. Dividends declared and paid in 20X5 totaled $3,000

6. Common shares were sold for $12,000 cash

7. Interest payable in 20X5 was $800 greater than interest payable in 20X4

8. The company uses IFRS and do not treat dividends as part of operations

Seaforce Manufacturing Inc. comparative balance sheet at December 31 20X5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E Balance Sheet Murawski Company Balance Sheet December 31 Current Assets Cash and cash equivalents $330 $360 Accounts receivable (net) 470 400 Inventory 460 390 120 160 Prepaid expenses Total current assets 1.380 1.310 investments 10 10 Property, plant, and equipment 420 380 Intangibles and other assets 530 510 Total assets $2.340 $2.210 Current liabilities $900 $790 410 380 Long term liabilities. Stockholder's equity common 1.030 1,040 Total liabilities and stockholder's equity $2.340 $2.210 Income Statement Murawski Company Income Statement For the Years Ended December 31 2022 2021 $3.460 Sales Revenue Costs and expenses Cost of goods sold 890 Selling and Administrative expens 7.310 interest expense 20 Total costs and expenses 3,240 income before income taxes 220 income tax expense 60 Net Income $134 C 22 V 2022 $3,800 955 7,400 25 3,380 420 126 5294 2021 W Calculate the 2021 Inventory Turnover ratio. Use whole numbers rounded to 2 decimal places, if needed, as seen in the example…arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $446,900 $372,400 Marketable securities 517,400 419,000 Accounts and notes receivable (net) 211,700 139,600 Inventories 1,071,800 807,000 Prepaid expenses 552,200 516,000 Total current assets $2,800,000 $2,254,000 Current liabilities: Accounts and notes payable (short-term) $324,800 $343,000 Accrued liabilities 235,200 147,000 Total current liabilities $560,000 $490,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank…arrow_forwardLydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Stockholders' equity: Common stock, $ 78 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 960,000 0 2,700,000 3,900,000 240,000 7,800,000 9,300,000 $ 17,100,000 $ 3,900,000 3,600,000 7,500,000 7,800,000 1,800,000 9,600,000 $ 17,100,000 $ 1,260,000 300,000 1,800,000 2,400,000 180,000 5,940,000 8,940,000 $ 14,880,000 $ 2,760,000 3,000,000 5,760,000 7,800,000 1,320,000 9,120,000 $ 14,880,000 Sales (all on account) Lydex Company Comparative Income Statement and Reconciliation This Year $ 15,750,000 12,600,000 3,150,000 1,590,000 Last Year $ 12,480,000 9,900,000 2,580,000 Cost of goods sold Gross margin Selling and…arrow_forward

- Complete the following balance sheet based on the information provided ASSETS LIABILITIES & SHAREHOLDERS' EQUITY %$4 Question 2 Accounts payable Cash $63,000 Common stock Accounts receivable %$4 Retained earnings %24 Inventory %24 Plant and equipment, net $56,000 Total liabilities and s135,000 $135,000 Total assets shareholders' equity The values of selected ratios are as follows: Quick ratio 1.40 Average collection period Debt ratio 38 days 0.38 (Asset) Turnover ratio [Answer: Cash = 37,386, AR = 34,434, Inventory = 7,180, AP = 51,300, RE = 20,700] 2.45 %3D %3D %3D %3Darrow_forwardClean Company Balance Sheet Cash 68,200 Accounts payable 113,500 Accounts 295,000 Notes payable 73,900 receivable Other current Inventories 212,000 101,000 liabilities Total Current Total Current 575,200 288,400 assets liabilities PP&E Net 257,400 Long-term debt 226,500 Total Equity 317,700 Total Liabilities + Total Assets 832,600 832,600 Equity Clean Company Income Statement Sales $1,414,600 Cost of sales 1,190,640 Gross profit 223,960 Operating expenses 125,840 Depreciation 36,520 EBIT 61,600 Interest expenses 21,560 Earnings before 40,040 taxes Taxes (40%) 16,016 Net profit 24,024arrow_forwardprepare a balance sheet and income statement from the following information: Cash $625.00 Revenue $21,000.00 Note Payable $5,000.00 Retained Earnings $10,600.00 Expenses $7,000.00 Issued Capital Stock $500.00 Accounts Receivable $2,500.00 Inventory $6,900.00 Accounts Payable $1,000.00 Cost of Goods Sold $10,500.00 Accrued Sales Tax $1,425.00 Prepaid Insurance $12,000.00 Plz answer fast without plagiarism i give up votearrow_forward

- balance sheets Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity Problem 13-5A (Algo) Part 1 $ 19,500 37,400 84,640 5,900 350,000 $ 497,440 $ 33,000 56,400 134,500 6,900 304,400 $ 535,200 $ 68,340 86,800 190,000 152,300 $ 497,440 $ 535,200 $ 91,300 115,000 206,000 122,900 statement Sales Cost of goods sold Interest expense Income tax expense Net income Basic earnings per share Cash dividends per share Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) invent sales in inventory, and () days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company…arrow_forward1. The business was started when the company received $50,000 from the issue of common stock. 2 Purchased equipment inventory of $380,000 on account. 3. Sold equipment for $510,000 cash (not including sales tax). Sales tax of 8 percent is collected when the merchandise is sold. The merchandise had a cost of $330.000. 4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 2 percent of sales. 5. Paid the sales tax to the state agency on $400.000 of the sales. 6. On September 1, Year 1, borrowed $0,000 from the local bank. The note had a 4 percent interest rate and matured on March 1. Year 2. 7. Paid $6.200 for warranty repairs during the year. 8. Paid operating expenses of $78,000 for the year. 9. Paid $250,000 of accounts payable. 10. Recorded accrued interest on the note issued in transaction no. 6. Requlred a. Record the given transactions in a horizontal statements model. b. Prepare the income statement, balance sheet,…arrow_forwardPrior Year Current Year Accounts payable 3,153.00 5,915.00 Accounts receivable 6,935.00 9,046.00 Accruals 5,794.00 6,085.00 Additional paid in capital 19,655.00 13,876.00 Cash. ??? ??? Common Stock 2,850 2,850 COGS 22,169.00 18,794.00 Current portion long-term debt 500 500 Depreciation expense 1,016.00 1,037.00 Interest expense 1,276.00 1,138.00 Inventories 3,041.00 6,672.00 Long-term debt 16,904.00 22,546.00 Net fixed assets 75,987.00 73,861.00 Notes payable 4,002.00 6,534.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,536.00 34,724.00 Sales 46,360 45,799.00 Taxes 350 920 Category ww What is the firm's total change in cash from the prior year to the current year?arrow_forward

- Determining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forwardBreanna Inc. Accounts receivable$10,700Accumulated depreciation 50,800Cost of goods sold 123,000Income tax expense 8,000Cash 62,000Net sales 201,000Equipment 128,000Selling, general, and administrative expenses 32,000Common stock (8,700 shares) 90,000Accounts payable 14,300Retained earnings, 1/1/19 30,000Interest expense 5,600Merchandise inventory 38,600Long-term debt 38,000Dividends declared and paid during 2019 16,200 Item1 Time Remaining 2 hours 32 minutes 36 seconds 02:32:36 Item 1 Time Remaining 2 hours 32 minutes 36 seconds 02:32:36 The information on the following page was obtained from the records of Breanna Inc.: Accounts receivable $ 10,700 Accumulated depreciation 50,800 Cost of goods sold 123,000 Income tax expense 8,000 Cash 62,000 Net sales 201,000 Equipment 128,000 Selling, general, and administrative expenses 32,000 Common stock (8,700 shares) 90,000 Accounts payable 14,300 Retained earnings, 1/1/19…arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $486,400 $392,000 Marketable securities 563,200 441,000 Accounts and notes receivable (net) 230,400 147,000 Inventories 792,000 469,700 Prepaid expenses 408,000 300,300 Total current assets $2,480,000 $1,750,000 Current liabilities: Accounts and notes payable (short-term) $464,000 $490,000 Accrued liabilities 336,000 210,000 Total current liabilities $800,000 $700,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education