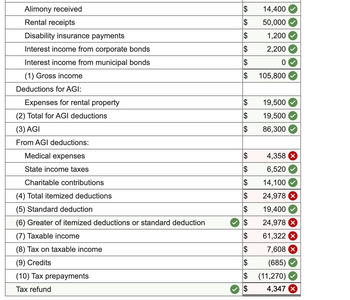

Reba Dixon is a fifth-grade school teacher who earned a salary of $38,000 in 2022. She is 45 years old and has been divorced for four years. She receives $1,200 of alimony payments each month from her former husband (divorced in 2016). Reba also rents out a small apartment building. This year Reba received $50,000 of rental payments from tenants and she incurred $19,500 of expenses associated with the rental.

Reba and her daughter Heather (20 years old at the end of the year) moved to Georgia in January of this year. Reba provides more than one-half of Heather's support. They had been living in Colorado for the past 15 years, but ever since her divorce, Reba has been wanting to move back to Georgia to be closer to her family. Luckily, last December, a teaching position opened up and Reba and Heather decided to make the move. Reba paid a moving company $2,250 to move their personal belongings, and she and Heather spent two days driving the 1,600 miles to Georgia.

Reba rented a home in Georgia. Heather decided to continue living at home with her mom, but she started attending school full-time in January and throughout the rest of the year at a nearby university. She was awarded a $3,360 partial tuition scholarship this year, and Reba helped out by paying the remaining $500 tuition cost. If possible, Reba thought it would be best to claim the education credit for these expenses.

Reba wasn't sure if she would have enough items to help her benefit from itemizing on her tax return. However, she kept track of several expenses this year that she thought might qualify if she was able to itemize. Reba paid $6,520 in state income taxes and $14,100 in charitable contributions during the year. She also paid the following medical-related expenses for herself and Heather:

| Insurance premiums | $ 8,960 |

|---|---|

| Medical care expenses | $ 1,100 |

| Prescription medicine | $ 470 |

| Nonprescription medicine | $ 100 |

| New contact lenses for Heather | $ 200 |

Shortly after the move, Reba got distracted while driving and ran into a street sign. The accident caused $1,020 in damage to the car and gave her whiplash. Because the repairs were less than her insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she received $2,000 from her disability insurance. Her employer, the Central Georgia School District, paid 60 percent of the premiums on the policy as a nontaxable

A few years ago, Reba acquired several investments with her portion of the divorce settlement. This year she reported the following income from her investments: $2,200 of interest income from corporate bonds and $1,740 interest income from City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by $13,510, but she did not sell any of her stocks.

Heather reported $6,400 of interest income from corporate bonds she received as gifts from her father over the last several years. This was Heather's only source of income for the year.

Reba had $11,270 of federal income taxes withheld by her employer. Heather made $1,120 of estimated tax payments during the year. Reba did not make any estimated payments.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

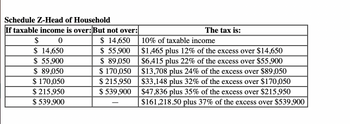

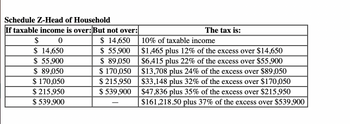

hi! for the tax on taxable income, I used the attached tax table, and found 6415+22%(61422-55900)=7630. Isn't that the way we should calculate the tax?

hi! for the tax on taxable income, I used the attached tax table, and found 6415+22%(61422-55900)=7630. Isn't that the way we should calculate the tax?

- Erin is the landlord of a single-family home, which she leased to Carlos in February 2022. Prior to moving in, Carlos paid $1,000 for the first month's rent and an additional $1,000 for the last month's rent (for a total of $2,000 advance rent). He then paid $10,000 in rent during the remainder of the tax year. What amount does Erin include in gross rental income for this property in 2022?arrow_forwardClark, a widower, maintains a household for himself and his two dependent preschool children. For the year ended December 31, 2015, Clark earned a salary of $32,000. He paid $3,600 to a housekeeper to care for his children in his home, and also paid $1,500 to a kiddie play camp for child care. He had no other income or expenses during 2015. How much can Clark claim as a child and dependent care credit in 2015? a. $910. b. $1,300. c. $1,326. d. $5,100. e. None of the above. Which financial statement reports operating performance for a specific period of time? a. Balance sheet b. Income statement c. Statement of changes in shareholders' equity d. Statement of retained earnings e. Statement of Cash Flowsarrow_forwardJulie and Otto are married and file a joint return. They have a young child who needs care while they work. Otto is a self-employed architect but also does some part time work as an Uber driver. From his self-employment he receives $150,000 and from his Uber driving he receives $10,000. They hire a nanny, aged 19 years to watch their child and pay her $190 per week for 40 weeks during the current year (2020). Required: Calculate Otto’s self-employment tax Calculate the employer’s portion of the nanny tax that they should pay Calculate the nanny’s portion of the tax.arrow_forward

- Noah and Olivia Anderson are a married couple in their early 20s living in Dallas. Noah Anderson earned $73,000 in 2018 from his job as a sales assistant. During the year, his employer withheld $4,975 for income tax purposes. In addition, the Andersons received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2018, the Andersons sold two stocks, A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1,500 and had been purchased three years earlier for $1,100. Their only child, Logan, age 2, received (as his sole source of income) dividends of $200 from Hershey stock. Although Noah is covered by his company’s pension plan, he plans to contribute $5,000 to a traditional deductible IRA for 2018. Here are the amounts of money paid out during the year by the Andersons: Medical and dental expenses (unreimbursed) $ 200State and local property…arrow_forwardJohn, age 52, and Lucy, age 49, are married filing jointly. Both are self employed and report their business income on Schedule C. John’s Schedule C showed $12,500 in profits during 2022 while Lucy had a loss of $4,200 on her Schedule C. Lucy also earned $5,600 from a seasonal part-time job at Target. Together, they own a residential rental property that earned $45,000 in passive income for the year. What is the maximum allowable IRA contribution for each in 2022?arrow_forwardDonald Jefferson and his wife, Maryanne, live in a modest house located in a Los Angeles suburb. Donald has a job at Pittsford Cast Iron that pays him $50,000 annually. In addition, he and Maryanne receive $2,500 interest from bonds that they purchased 10 years ago. To supplement his annual income, Donald bought rental property a few years ago. Every month he collects $3,500 in rent from all of the property he owns. Maryanne manages the rental property, and she is paid $15,000 annually for her work. During 2015, Donald had to have the plumbing fixed in the houses that he rents as well as the house in which he and Maryanne live. The plumbing bill was $1,250 for the rented houses and $550 for the Jeffersons’ personal residence. In 2015, Donald paid $18,000 for mortgage interest and property taxes—$12,650 was for the rental houses, and the remaining $5,350 was for the house occupied by him and his wife. The couple has three children who have graduated from medical school and now are…arrow_forward

- Sandy and John Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2022, Sandy worked as a computer technician at a local university, earning a salary of $152,000, and John worked part time as a receptionist for a law firm, earning a salary of $29,000. Sandy also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume that in the previous year, Fergusons got the full benefit of deducting the entire amount of their state income taxes. Use Exhibit 8-10. Tax Rate Schedule. Dividends and Capital Gains Tax Rates. 2022 AMT exemption for reference. The Fergusons reported making the following payments during the year: • State income taxes of $4,400. Federal tax withholding of…arrow_forwardIn 2021, Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $75,900 and incurred $10,675 of child care expenses. Determine amount of Ivanna and Sergio's child and dependent care credit.arrow_forwardAndrew, who is single, retired from his job this year. He received a salary of $26,000 for the portion of the year that he worked, tax-exempt interest of $2,600, and dividends from domestic corporations of $3,700. On October 1, he began receiving monthly pension payments of $700 and Social Security payments of $500. Assume an exclusion ratio of 40% for the pension. Andrew owns a duplex that he rents to others. He received rent of $11,000 and incurred $16,000 of expenses related to the duplex. He continued to actively manage the property after he retired from his job. Requirement Compute Andrew's adjusted gross income. Salary Dividend income 26,000 3,700 Rental income 11,000 Social security income (taxable portion) ? Pension income (taxable portion) Gross income Minus: Deductions for Adjusted gross income Rental income Adjusted gross income -16,000arrow_forward

- Jenny, single, age 42, earns $50,000 working in 2022. She has no other income. Her medical expenses for the year total $5,000. During the year, she suffered a nonbusiness casualty loss of $7,500 when her apartment is damaged by flood waters (part of a Federally declared disaster area). Jenny contributed $10,000 to her church. She is trying to decide whether to contribute $1,000 to a traditional IRA. Fill in the table below to see if the IRA contribution reduces taxable income. Don't forget to apply the floors to the medical expenses. The deductible casualty loss has been calculated for you. We will look at personal (nonbusiness) casualty losses in another chapter; note that the nonbusiness casualty loss calculation involves 2 floors. 1. Complete the table to show the effect the IRA contribution would have on Jenny's itemized deductions. Without IRA Contribution Gross Income Contribution to IRA AGI Itemized Deductions Charitable contribution Medical expense deduction Casualty loss…arrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forwardces Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance $580 545 Advertising expense Mortgage interest Property taxes 4,550 960 Repairs & maintenance Utilities 1,160 Depreciation 720 9,700 During the year, Tamar rented out the condo for 81 days, receiving $23,500 of gross income. She personally used the condo for 57 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering deductions…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education