FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

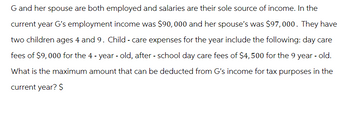

Transcribed Image Text:G and her spouse are both employed and salaries are their sole source of income. In the

current year G's employment income was $90,000 and her spouse's was $97,000. They have

two children ages 4 and 9. Child - care expenses for the year include the following: day care

fees of $9,000 for the 4-year-old, after - school day care fees of $4,500 for the 9 year-old.

What is the maximum amount that can be deducted from G's income for tax purposes in the

current year? $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Diana and Ryan Workman were married on January 1 of last year. Ryan has an eight-year-old son, Jorge, from his previous marriage. Diana works as a computer programmer at Datafile Incorporated (DI) earning a salary of $96,000. Ryan is self- employed and runs a day care center. The Workmans reported the following financial information pertaining to their activities during the current year. a. Diana earned a $96,000 salary for the year. b. Diana borrowed $12,000 from Dl to purchase a car. DI charged her 2 percent interest ($240) on the loan, which Diana paid on December 31. DI would have charged Diana $720 if interest had been calculated at the applicable federal interest rate Assume that tax avoidance was not a motive for the loan. c. Ryan received $2,000 in alimony and $4,500 in child support payments from his former spouse. They divorced in 2016. d. Ryan won a $900 cash prize at his church-sponsored Bingo game. e. The Workmans received $500 of interest from corporate bonds and $250 of…arrow_forwardNed is a head of household with a dependent son, Todd, who is a full-time student. This year Ned made the following expenditures related to Todd's support: Auto insurance premiums $ 1,700 Room and board at Todd’s school 2,200 Health insurance premiums (not through an exchange) 600 Travel (to and from school) 350 What amount can Ned include in his itemized deductions?arrow_forwardAa.43. Adrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $2,050 in child care expenses so that she would be able to work. Of this amount, $540 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $1,100 from her jewelry business. In addition, she received child support payments of $20,100 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forward

- John, age 52, and Lucy, age 49, are married filing jointly. Both are self employed and report their business income on Schedule C. John’s Schedule C showed $12,500 in profits during 2022 while Lucy had a loss of $4,200 on her Schedule C. Lucy also earned $5,600 from a seasonal part-time job at Target. Together, they own a residential rental property that earned $45,000 in passive income for the year. What is the maximum allowable IRA contribution for each in 2022?arrow_forwardBhaarrow_forwardAdrienne is a single mother with a 6-year-old daughter who lived with her during the entire year. Adrienne paid $2,500 in child care expenses so that she would be able to work. Of this amount, $500 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $2,000 from her jewelry business. In addition, she received child support payments of $21,100 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forward

- savitaarrow_forwardSarah and Suzannah are friends who take turns babysitting each other's children every month or two. Jamie and Jenna are also friends who each own businesses. Jenna does Jamie's taxes each year in exchange for Jamie providing 10 hours of free consulting services to Jenna each year. Which of the following is true? a) Neither group of women has to recognize any income from these trades/exchanges b) Both groups of women have to recognize income from these trades/ exchanges c) Jamie and Jenna likely do not have to recognize any income from these exchanges but Sarah and Suzannah do d) Sarah and Suzannah likely do not have to recognize any income from these exchanges but Jamie and Jenna doarrow_forward2. Lee is 30 years old and single. Lee paid all the costs of maintaining his household for the entire year. Determine Lee's filing status in each of the following alternative situations: Filing Status Lee is Ashton's uncle. Ashton is 15 years old and has gross income of $5,000. Ashton lived in Lee's home from April 1 through the end of the year. Lee is Ashton's uncle. Ashton is 20 years old, not a full-time student, and has gross income of $7,000. Ashton lived in Lee's home from April 1 through the end of the year. Lee is Ashton's uncle. Ashton is 22 years old and was a full-time student from January through April. Ashton's gross income was $5,000. Ashton lived in Lee's home from April 1 through the end of the year. Lee is Ashton's cousin. Ashton is 18 years old, has gross income of $3,000, and is not a full-time student. Ashton lived in Lee's home from April 1 through the end of the year.arrow_forward

- Kyle (44) and Elise (39) Terry have four children. Kyle works for Lockheed Martin as a flight engineer and Elise is a freelance writer/editor. Their family is covered by a qualified High Deductible Health Insurance Plan. Kyle's gross pay is $120,000 nd Elise's net earnings from self-employment is $75,000. Their children are Jacob(16), Katie(14), Rachael(12), and Luke(10). For the current tax year, Kyle and Elise prepared for retirement. Kyle's plan is a profit sharing plan and Elise utilizes a SEP IRA. Kyle's employer contributes 14% of his gross pay to the profit sharing plan. Kyle pays the health insurance premiums through his employer's cafeteria plan, his portion of the health insurance premiums are $7,000 per year. Kyle also incurred the following expenses during the year: $1,900 in student loan interest, $4,000 contribution to Utah's 529 plan ($1,000 for each child, kyle lives in Georgia); State income taxes of $12,000; property taxes of $4,000; mortgage interest of $10,000; and…arrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 11,400 Real estate taxes 1,200 Utilities 1,350 Mortgage interest 3,200 Depreciation 6,000 Repairs and maintenance 810 equired: What is Sandra’s net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.arrow_forwardStephanie is 12 years old and often assists neighbors on weekends by babysitting their children. Calculate the 2022 standard deduction Stephanie will claim under the following independent circumstances (assume that Stephanie's parents will claim her as a dependent). b. Stephanie reported $1,995 of earnings from her babysitting. Standard deductionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education