FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

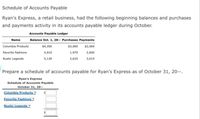

Transcribed Image Text:Schedule of Accounts Payable

Ryan's Express, a retail business, had the following beginning balances and purchases

and payments activity in its accounts payable ledger during October.

Accounts Payable Ledger

Name

Balance Oct. 1, 20-- Purchases Payments

Columbia Products

$4,350

$3,060

$2,060

Favorite Fashions

4,910

1,970

2,600

Rustic Legends

5,130

2,625

3,015

Prepare a schedule of accounts payable for Ryan's Express as of October 31, 20--.

Ryan's Express

Schedule of Accounts Payable

October 31, 20--

Columbia Products

Favorite Fashions

Rustic Legends -

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journal Entries for Merchandise Transactions on Seller’s and Buyer’s Records—Periodic System The following are selected transactions for Jefferson, Inc., during the month of April: April 20 Sold and shipped on account to Lind Stores merchandise for $3,000, with terms of 1/10, n/30. April 27 Lind Stores returned defective merchandise billed at $300 on April 20. April 29 Received from Lind Stores a check for full settlement of the April 20 transaction. Required Prepare the necessary journal entries for (a) Jefferson, Inc., and (b) Lind Stores. Both companies use the periodic inventory system. Sellers journal entries Buyer's journal entries JEFFERSON, INC. GENERAL JOURNAL Date Description Debit Credit Apr. 20 Answer Answer Answer Answer Answer Answer Sold merchandise to Lind Stores terms 1/10, n/30. 27 Answer Answer Answer Answer Answer Answer Merchandise returned by Lind Stores. 29…arrow_forwarden June 12, Music, Incorporated sells $4,000 of goods on account to a credit customer with credit terms of 1/10, n/30. If the custome ays on June 20, select the correct entry to record the receipt of the customer's payment: Multiple Choice Account Name Debit Credit Cash 4,000 Accounts Receivable 4,000 Account Name Debit Credit Cash 3,960 Sales Discounts 40 Accounts Receivable 4,000 Account Namė Debit Credit Accounts Receivable 3,960 Sales Discounts 40 Cash 4,000 ***. MAY 7arrow_forwardFollowing is information from Fredrickson Company for its first month of business. Credit Sales Jan. 10 Stern Company 19 Diaz Brothers 23 Rex Company Required 1 Required 2 1. Journalize the above transactions in the accounts receivable subsidiary ledger. 2. Journalize the accounts receivable balance listed in the general ledger at month's end. Date $4,200 1,700 2,650 Complete this question by entering your answers in the tabs below. Date Journalize the above transactions in the accounts receivable subsidiary ledger. Debit ACCOUNTS RECEIVABLE LEDGER Stern Company Debit Cash Collections Jan. 20 Stern Company 28 Diaz Brothers 31 Rex Company Credit Diaz Brothers Credit $ 2,100 1,700 1,378 Balance Balancearrow_forward

- Purchases and Cash Payments Journals Happy Tails Inc. has a September 1, 20Y4, accounts payable balance of $535, which consists of $340 due Labradore Inc. and $195 due Meow Mart Inc. Transactions related to purchases and cash payments completed by Happy Tails Inc. during the month of September 20Y4 are as follows: Sept. 4. Purchased pet supplies from Best Friend Supplies Inc. on account, $230. Sept. 6. Issued Check No. 345 to Labradore Inc. in payment of account, $340. Sept. 13. Purchased pet supplies from Poodle Pals Inc. on account, $660. Sept. 18. Issued Check No. 346 to Meow Mart Inc. in payment of account, $195. Sept. 19. Purchased office equipment from Office Helper Inc. on account, $2,245. Sept. 23. Issued Check No. 347 to Best Friend Supplies Inc. in payment of account from purchase made on September 4. Sept. 27. Purchased pet supplies from Meow Mart Inc. on account, $350. Sept. 30. Issued Check No. 348 to Jennings Inc. for cleaning expenses, $50. Happy…arrow_forwardbusiness issued a credit memo $235 to NECinc.regarding the sales on oct 1 give journal entryarrow_forwardes Vail Company recorded the following transactions during November. Date General Journal Debit Credit November 5 Accounts Receivable-Ski Shop 5,775 Sales 5,775 November 10 Accounts Receivable-Welcome Incorporated Sales 1,706 1,706 November 13 Accounts Receivable-Zia Company Sales 1,000 1,000 November 21 Sales Returns and Allowances 258 November 30 Accounts Receivable-Zia Company Accounts Receivable-Ski Shop 258 3,557 Sales 3,557 1. Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. 2. Prepare a schedule of accounts receivable. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. General Ledger Accounts Receivable Accounts Receivable Subsidiary Ledger Ski Shop Ending Balance 0 0 Sales Ending Balance 0 0 Zia Company Ending Balance 0 0arrow_forward

- Record the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwardEntries for discounted note payable Instructions Chart of Accounts Instructions Journal A business issued a 45-day note for $84,000 to a creditor on account. The note was discounted at 9% Required: Journalize the entries to record (a) the issuance of the note on March 1 and (b) the payment of the note at maturity. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered Assume a 360-day year. Round your answers to nearest whole dollar.arrow_forwardCurrent Attempt in Progress Presented below is information related to Sheridan Company for its first month of operations. Jan. 06 Jan. 10 Jan. 23 Balance of Credit Purchases Gorst Company Tian Company Accounts Payable $9,000 11,800 Maddox Company 12,300 $ Gorst Company Jan. 11 Determine the balances that appear in the accounts payable subsidiary ledger. What Accounts Payable balance appears in the general ledger at the end of January? $ Jan. 16 Jan. 29 Cash Paid Gorst Company Tian Company Maddox Company Subsidary Ledger Tian Company 69 $6,800 11,800 7,400 $ Maddox Company $ General Ledgearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education