FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do questions 2, 3 and 4 please, I'm excel.

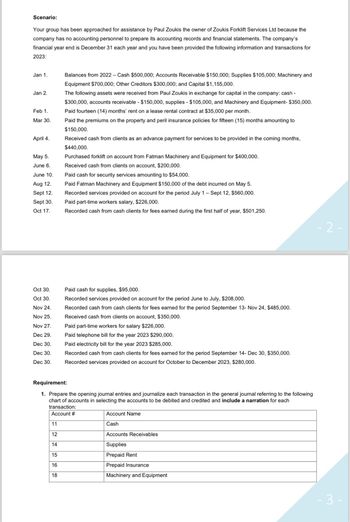

Transcribed Image Text:Scenario:

Your group has been approached for assistance by Paul Zoukis the owner of Zoukis Forklift Services Ltd because the

company has no accounting personnel to prepare its accounting records and financial statements. The company's

financial year end is December 31 each year and you have been provided the following information and transactions for

2023:

Jan 1.

Jan 2.

Feb 1.

Mar 30.

April 4.

May 5.

June 6.

June 10.

Aug 12.

Sept 12.

Sept 30.

Oct 17.

Oct 30.

Oct 30.

Nov 24.

Nov 25.

Nov 27.

Dec 29.

Dec 30.

Dec 30.

Dec 30.

Balances from 2022 - Cash $500,000; Accounts Receivable $150,000; Supplies $105,000; Machinery and

Equipment $700,000; Other Creditors $300,000; and Capital $1,155,000.

The following assets were received from Paul Zoukis in exchange for capital in the company: cash -

$300,000, accounts receivable - $150,000, supplies - $105,000, and Machinery and Equipment- $350,000.

Paid fourteen (14) months' rent on a lease rental contract at $35,000 per month.

Paid the premiums on the property and peril insurance policies for fifteen (15) months amounting to

$150,000.

Received cash from clients as an advance payment for services to be provided in the coming months,

$440,000.

11

12

14

15

16

18

Purchased forklift on account from Fatman Machinery and Equipment for $400,000.

Received cash from clients on account, $200,000.

Paid cash for security services amounting to $54,000.

Paid Fatman Machinery and Equipment $150,000 of the debt incurred on May 5.

Recorded services provided on account for the period July 1 - Sept 12, $560,000.

Paid part-time workers salary, $226,000.

Recorded cash from cash clients for fees earned during the first half of year, $501,250.

Paid cash for supplies, $95,000.

Recorded services provided on account for the period June to July, $208,000.

Recorded cash from cash clients for fees earned for the period September 13- Nov 24, $485,000.

Received cash from clients on account, $350,000.

Paid part-time workers for salary $226,000.

Paid telephone bill for the year 2023 $290,000.

Paid electricity bill for the year 2023 $285,000.

Recorded cash from cash clients for fees earned for the period September 14- Dec 30, $350,000.

Recorded services provided on account for October to December 2023, $280,000.

Requirement:

1. Prepare the opening journal entries and journalize each transaction in the general journal referring to the following

chart of accounts in selecting the accounts to be debited and credited and include a narration for each

transaction:

Account #

Account Name

Cash

Accounts Receivables

Supplies

Prepaid Rent

Prepaid Insurance

Machinery and Equipment

-2-

- 3

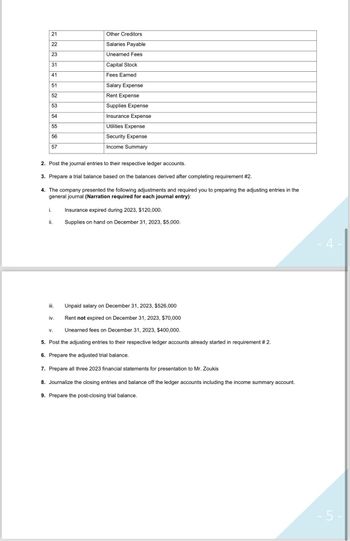

Transcribed Image Text:21

22

23

31

41

51

52

53

54

55

56

57

i.

ii.

2. Post the journal entries to their respective ledger accounts.

3. Prepare a trial balance based on the balances derived after completing requirement #2.

4. The company presented the following adjustments and required you to preparing the adjusting entries in the

general journal (Narration required for each journal entry):

iii.

Other Creditors

Salaries Payable

Unearned Fees

iv.

Capital Stock

Fees Earned

V.

Salary Expense

Rent Expense

Supplies Expense

Insurance Expense

Utilities Expense

Security Expense

Income Summary

Unpaid salary on December 31, 2023, $526,000

Rent not expired on December 31, 2023, $70,000

Unearned fees on December 31, 2023, $400,000.

5. Post the adjusting entries to their respective ledger accounts already started in requirement # 2.

6. Prepare the adjusted trial balance.

7. Prepare all three 2023 financial statements for presentation to Mr. Zoukis

8. Journalize the closing entries and balance off the ledger accounts including the income summary account.

9. Prepare the post-closing trial balance.

Insurance expired during 2023, $120,000.

Supplies on hand on December 31, 2023, $5,000.

4.

-5-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forwardWhere is part 3 answered? Verify that from question 2 jumped to question 4arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- Your answers are incorrect, there are at least 4 blanks to fill in and you only provided 2 or 3. Also please do not use Excel, please use another way to show your work.arrow_forwardQuestion 3 Listen What are the values of r and r² for the below table of data? Hint: Make sure your diagnostics are turned on. Enter the data into L1 and L2. Click STAT, CALC, and choose option 8: Lin Reg(a+bx). A r = -0.862 r2=0.743 B r=0.673 2=0.820 X y 5 C r=0.743 r2=-0.862 8 22 23.9 14 9 14 17 20 5.2arrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forward

- ITS-The Political S A M7: Assignment No.1 10201Ox/aMzlzNzk 1NTQxNDg2/details ВА.. e Home | Edmodo O Spoliarium by Juan.. w You searched for Re.. W Operating Performa... 1 Otn.docxlo. Open with Activity No.: Topic : The Worksheet Problems The following are all the steps in the accounting cycle. List them they should be done. 1. the order in which Closing entries are journalized and posted to the ledger. - An unadjusted trial balance is prepared. - An optional end-of-period spreadsheet (worksheet) is prepared. -A post-closing trial balance is prepared. - Adjusting entries are journalized and posted to the ledger. - Transactions are analyzed and recorded in the journal. Adjustment data are assembled and analyzed. -Financial statements are prepared An adjusted trial balance is prepared Transactions are posted to the ledger 2. 7. 8. 6. 10 The balances for the accounts listed below appeared in the Adjusted Tral Balance columns of the work the Income Statement columns or iobtndicato ther cach…arrow_forwardHello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question. The second attachment is the for the answer. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help. I have marked a yellow x on what i have done already. I DO NOT NEED HELP WITH WHAT IS CROSSED IN YELLOW (PARTS 1-3) I NEED PARTS 4-6. THIS IS IS IS THE ANSWER TO PARTS 1-3 Analysis and Calculation: 1) Gold Medal Athletic Co., Sales Budget: For the month ended March: Product Sales Volume Sale Price per unit Sales, $ Batting helmet 1,200 units $40 $ 48,000 Football helmet 6,500 units $160 $1,040,000 Total revenue from sales $ 1,088,000 2) Production Budget: Batting Football Helmet Helmet Expected units to be sold 1,200 6,500 Add: desired Ending inventory 50 220 Total 1,250 6,720 Less: Beginning estimated inventory 40 240 Total…arrow_forwardYou didnt answer the question 2 and 3 . Please could you give me details.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education