ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

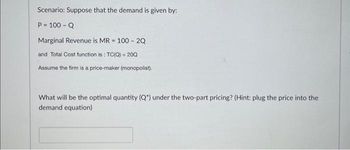

Transcribed Image Text:Scenario: Suppose that the demand is given by:

P = 100 - Q

Marginal Revenue is MR = 100 - 2Q

and Total Cost function is: TC(Q) = 200

Assume the firm is a price-maker (monopolist).

What will be the optimal quantity (Q") under the two-part pricing? (Hint: plug the price into the

demand equation)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In an OLG model with money: Each gen picks 12 banans when young, 0 bananas when old. Central bank prints out 2 units of money, given to gen 0 for free. The real GDP of this economy is ______ bananas each period.arrow_forwardAgK rents out computing services to agricultural producers. The charge a fixed rental payment for the right to unlimited computing at a rate of P USD per minute. There are two types of potential users: 100 farmers and 100 ranchers. Each farmer demand is given by Qf = 20 - Pf, and each rancher's demand is given by Qr = 25 - Pr, where Q is in 1000 minutes per month and P is in USD per minutes. The marginal cost is 5 USD per minute. Suppose that you could separate farmers and ranchers. For ranchers, the optimal rental fee is A) 5 B) 200,000 C) 500 D) 0arrow_forwardThe demand and total cost functions for a monopolistically competitive market are: Q(P) = 300/N – P, where N = number of firms TC(Q) = 50 + Q2 There are currently three firms in this market and they are in a short run equilibrium. c) In the long run, how many firms are in the market (round to the nearest integer)?arrow_forward

- If, in a monopoly market, the demand for a product is p = 195 − 0.10x and the revenue function is R = px, where x is the number of units sold, what price will maximize revenue? (Round your answer to the nearest cent.)arrow_forwardA firm is originally operating as a single-price monopolist that faces a market demand curve P(Q) = 198 –0 and total cost curve equal to TC (q) = 10, 500 + 32Q, with constant MC equal to MC(Q) = 32 for all units produced. Part (a): How much output does the firm produce and at what price is each unit sold for? Part (b): Calculate the firm's profit. The firm now realizes there are actually two distinct groups of consumers that purchase their product, with the following demand functions: P(q1) = 242 – qı P(q2) = 176 – 92 Their total and marginal cost curves have not changed. If the firm wanted to successfully practice third-degree price discrimination: Part (c): How many units of output would they sell to group 1 and how much will each consumer in group 1 pay? Part (d): How many units of output would they sell to group 2 and how much will each consumer in group 2 pay? Part (e): How much profit is earned by the firm when they practice third-degree price discrimination? Part (f): How much…arrow_forwardA monopolist with cost function C(q) = ;q? faces 2 consumers with the following demands: p(q1) = 10 - q1 and p(q2) = 20 – 2q2. Determine prices, quantities to be produced and sold and the monopolist's profits in the following cases: (a) The good can be resold at zero cost among consumers and it is technologically impossible to sell it in bundles of more than 1 unit. b) There is resale at zero cost and bundling in packages of arbitrary size. c) Resale is possible at a cost of "t" per unit. d) The good is a personal and non-transferable service. e) Repeat the above analysis, but this time assuming that costs are C(q) = q with q < 8.arrow_forward

- A monopolist faces an inverse demand curve P(q) = 28 – 3q. The cost curve is C(q) = 10q. What is deadweight loss in this market? (a) DWL = 3 (b) DWL = 27/2 (c) DWL = 19 (d) DWL = 27 (e) None of the above.arrow_forwardPlease answer question d, e and farrow_forwardConsider a monopoly that faces the demand curve P = 20 − Q, and has the marginal cost curve MC = 2. a) Use the demand curve to find the equation of the marginal revenue curve. b) Find the profit-maximizing price and quantity for this monopoly if the monopoly uses uniform pricing. What is the producer surplus? c) Now, suppose the monopoly wants to increase profits using block pricing. The total cost the monopoly incurs is T C = 2Q. Find the optimal quantities, Q1 and Q2, and their corresponding optimal prices, P1 and P2 that maximize profits using a two-block pricing scheme. What is the new producer surplus? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- QUESTION 3 A monopolist has a cost function of c(x) = x so that its marginal cost is constant at $1 per unit. It faces the following demand curve: D(p) = {100/p 100/p if p > 20 if p ≤ 20 A. What is the profit-maximizing choice of output/price for the monopolist? Graphically represent the monopoly market. B. If the government sets a price ceiling on the monopolist in order to force it to act as a competitor, what price should the government set? C. What output would the monopolist produce if forced to behave as a competitor? D. Based on the information in parts A - C, find the consumer-, producer-, and social surpluses before and after the government intervention.arrow_forwardA monopolist serves a market with five potential buyers, each of whom would buy at most one piece of the monopolist's good. Anna would be willing to pay up to £50 for it, Bob up to £70, Chloe up to £90, Dave up to £110 and Elizabeth up to £130. The monopolist's variable cost function is given in below table. [Note: In parts (a) and (b), working outs only need to be shown for at least one result per line of the table.] Quantity 1 Marginal Costs 50 Price Marg. Revenue 2 55 3 60 d) Find the total surplus maximising (i.e., socially optimal) quantity. e) Quantify the Deadweight Loss! 4 65 5 70arrow_forwardThe function Q= 14 - P represent the market demand. The cost function of the monopolist is C= 2Q. a) Find quantity, price and profit of the monopolist. b) Given the results of point (a), what is the firm's percentage mark-up of price over marginal cost? c) Suppose that now we have a market demand with elasticity equal to -2. If the price is 8, what should be the marginal cost of the last unit produced?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education