FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

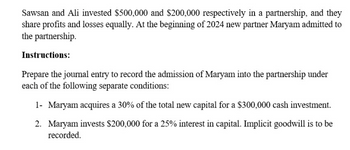

Transcribed Image Text:Sawsan and Ali invested $500,000 and $200,000 respectively in a partnership, and they

share profits and losses equally. At the beginning of 2024 new partner Maryam admitted to

the partnership.

Instructions:

Prepare the journal entry to record the admission of Maryam into the partnership under

each of the following separate conditions:

1- Maryam acquires a 30% of the total new capital for a $300,000 cash investment.

2. Maryam invests $200,000 for a 25% interest in capital. Implicit goodwill is to be

recorded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kimble, Sykes, and Gerard open an accounting practice on January 1, 2019, in Chicago, Illinois, to be operated as a partnership. Kimble and Sykes will serve as the senior partners because of their years of experience. To establish the business, Kimble, Sykes, and Gerard contribute cash and other properties valued at $328.000. $240.000, and $152.000, respectively. An articles of partnership agreement is drawn up stipulating the following: ⚫ Personal drawings are allowed annually up to an amount equal to 10 percent of the partner's beginning capital balance for the year. Profits and losses are allocated according to the following plan: 1. Each partner receives an annual salary allowance of $55 per billable hours worked. 2. Interest is credited to the partners' capital accounts at the rate of 12 percent of the beginning capital balance for the year. 3. Kimble and Sykes are eligible for an annual bonus of 10 percent of net income after subtracting the bonus, salary allowance, and interest.…arrow_forwardAnn, Beth, Chris and Dan are equal partners in the ABCD. They have agreed that all items of partnership income, gain, loss and deduction will be split equally between them. In addition, since Ann is expected to be rendering the majority of the services on behalf of the partnership, the partners have agreed that she will receive $3,000 per month in addition to her 25% distributive share. For the year 2020, the partnership had short-term capital loss of $28,000, long-term capital gain of $54,000 and bottom line ordinary income (before considering the additional payments to Ann) of $21,000. What is the amount and character of partnership income and loss that Ann, Beth, Chris and Dan must include from the ABCD partnership on their 2020 income tax returns?arrow_forwardKimble, Sykes, and Gerard open an accounting practice on January 1, 2022, in Chicago, Illinois, to be operated as a partnership. Kimble and Sykes will serve as the senior partners because of their years of experience. To establish the business, Kimble, Sykes, and Gerard contribute cash and other properties valued at $233,000, $192,500, and $104,500, respectively. An articles of partnership agreement is drawn up stipulating the following: • • Personal drawings are allowed annually up to an amount equal to 10 percent of the partner's beginning capital balance for the year. Profits and losses are allocated according to the following plan: 1. Each partner receives an annual salary allowance of $55 per billable hours worked. 2. Interest is credited to the partners' capital accounts at the rate of 12 percent of the beginning capital balance for the year. 3. Kimble and Sykes are eligible for an annual bonus of 10 percent of net income after subtracting the bonus, salary allowance, and…arrow_forward

- Kimble, Sykes, and Gerard open an accounting practice on January 1, 2022, in Chicago, Illinois, to be operated as a partnership. Kimble and Sykes will serve as the senior partners because of their years of experience. To establish the business, Kimble, Sykes, and Gerard contribute cash and other properties valued at $248,000, $200,000, and $112,000, respectively. An articles of partnership agreement is drawn up stipulating the following: Personal drawings are allowed annually up to an amount equal to 10 percent of the partner's beginning capital balance for the year. Profits and losses are allocated according to the following plan: Each partner receives an annual salary allowance of $55 per billable hours worked. Interest is credited to the partners’ capital accounts at the rate of 12 percent of the beginning capital balance for the year. Kimble and Sykes are eligible for an annual bonus of 10 percent of net income after subtracting the bonus, salary allowance, and interest. The…arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forwardCoburn (beginning capital, $56,000) and Webb (beginning capital $92,000) are partners. During 2022, the partnership earned net income of $69,000, and Coburn made drawings of $17,000 while Webb made drawings of $26,000. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $37,000 to Coburn and $32,000 to Webb, interest of 12% on beginning capital, and the remainder divided 50%–50%. Prepare the journal entry to record the allocation of net income.arrow_forward

- Manjiarrow_forwardJerry and Sherry own and operate a partnership. Jerry’s capital balance is $50,000 and Sherry’s is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/loss equally. Allison intends to contribute $40,000 cash to receive a twenty-five percent interest in the partnership Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner share of the total equity d. Determine the bonus resulting from Allison’s equity of her contribution e. Make journal entries to record Allison’s admission to the partnership. Please solve sub-part e. Show Your Work:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education