FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

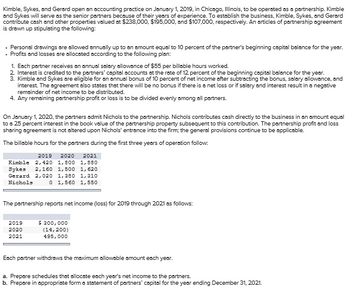

Transcribed Image Text:Kimble, Sykes, and Gerard open an accounting practice on January 1, 2019, in Chicago, Illinois, to be operated as a partnership. Kimble

and Sykes will serve as the senior partners because of their years of experience. To establish the business, Kimble, Sykes, and Gerard

contribute cash and other properties valued at $238,000, $195,000, and $107,000, respectively. An articles of partnership agreement

is drawn up stipulating the following:

. Personal drawings are allowed annually up to an amount equal to 10 percent of the partner's beginning capital balance for the year.

Profits and losses are allocated according to the following plan:

1. Each partner receives an annual salary allowance of $55 per billable hours worked.

2. Interest is credited to the partners' capital accounts at the rate of 12 percent of the beginning capital balance for the year.

3. Kimble and Sykes are eligible for an annual bonus of 10 percent of net income after subtracting the bonus, salary allowance, and

interest. The agreement also states that there will be no bonus if there is a net loss or if salary and interest result in a negative

remainder of net income to be distributed.

4. Any remaining partnership profit or loss is to be divided evenly among all partners.

On January 1, 2020, the partners admit Nichols to the partnership. Nichols contributes cash directly to the business in an amount equal

to a 25 percent interest in the book value of the partnership property subsequent to this contribution. The partnership profit and loss

sharing agreement is not altered upon Nichols' entrance into the firm; the general provisions continue to be applicable.

The billable hours for the partners during the first three years of operation follow:

2019 2020 2021

Kimble 2,420 1,800 1,880

Sykes 2,160 1,500 1,620

Gerard 2,020 1,380 1,310

Nichols

0 1,560 1,550

The partnership reports net income (loss) for 2019 through 2021 as follows:

2019

$ 300,000

2020

2021

(14,200)

495,000

Each partner withdraws the maximum allowable amount each year.

a. Prepare schedules that allocate each year's net income to the partners.

b. Prepare in appropriate form a statement of partners' capital for the year ending December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kimble, Sykes, and Gerard open an accounting practice on January 1, 2022, in Chicago, Illinois, to be operated as a partnership. Kimble and Sykes will serve as the senior partners because of their years of experience. To establish the business, Kimble, Sykes, and Gerard contribute cash and other properties valued at $248,000, $200,000, and $112,000, respectively. An articles of partnership agreement is drawn up stipulating the following: Personal drawings are allowed annually up to an amount equal to 10 percent of the partner's beginning capital balance for the year. Profits and losses are allocated according to the following plan: Each partner receives an annual salary allowance of $55 per billable hours worked. Interest is credited to the partners’ capital accounts at the rate of 12 percent of the beginning capital balance for the year. Kimble and Sykes are eligible for an annual bonus of 10 percent of net income after subtracting the bonus, salary allowance, and interest. The…arrow_forwardJennifer DeVine and Stanley Farrin decide to organize the ALL-Star partnership. DeVine invests $25,000 cash, and Farrin contributes $20,000 cash and equipment having a book value of $5,500. Prepare the entry to record Farrin’s and DeVine’s investment in the partnership, assuming the Ferrin’s equipment has a fair market value of $9,000arrow_forwardAt the beginning of the current year, Cameron and Harold formed the CH Partnership by transferring cash and property to the partnership in exchange for a partnership interest, with each having a 50% interest. Specifically, Cameron transferred property having a $55,000 FMV, a $28,000 adjusted basis, and subject to a $13,000 liability, which the partnership assumed. Harold contributed $60,000 cash to the partnership. The partnership also borrowed $26,000 from the bank to use in its operations. All liabilities are recourse for which the partners have an equal economic risk of loss. During the current year, the partnership earned $27,000 of net ordinary income and reinvested this amount in new property. Read the requirements. Requirement a. What is the partnership's and each partner's gain or loss recognized on the formation of the partnership? (Complete all input fields. Enter a loss with a minus sign or parentheses. If no gain or loss is recognized by a partner or the partnership, enter…arrow_forward

- Barbara Ripley and Fred Nichols decide to organize the ALL-Star partnership. Ripley invests $24,000 cash, and Nichols contributes $10,000 cash and equipment having a book value of $5,120. Prepare the entry to record Nichols's investment in the partnership, assuming the equipment has a fair value of $6.400. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Creditarrow_forwardManjiarrow_forwardJerry and Sherry own and operate a partnership. Jerry’s capital balance is $50,000 and Sherry’s is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/loss equally. Allison intends to contribute $40,000 cash to receive a twenty-five percent interest in the partnership Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner share of the total equity d. Determine the bonus resulting from Allison’s equity of her contribution e. Make journal entries to record Allison’s admission to the partnership. Please solve sub-part e. Show Your Work:arrow_forward

- Bobby Robinson and Nicholas White decide to organize the R&W partnership. Robinson invests $15,000 cash, and White contributes $10,000 cash and equipment having a book value of $4,500. Prepare the entry to record White’s investment in the partnership, assuming the equipment has a fair value of $4,000.arrow_forwardces Gorman and Morton form a partnership on May 1, 2022. Gorman contributes cash of $73,000; Morton conveys title to the following properties to the partnership: Equipment Licensing agreements Book Value $ 26,500 46,500 Fair Value $51,000 59,000 The partners agree to start their partnership with equal capital balances. No goodwill is to be recognized. According to the articles of partnership written by the partners, profits and losses are allocated based on the following formula: Gorman receives a compensation allowance of $1,300 per month. All remaining profits and losses are split 40.60 between Gorman and Morton, respectively. Each partner can make annual cash drawings of $5,000 beginning in 2023. Net income of $22,500 is earned by the business during 2022. Steele is invited to join the partnership on January 1, 2023. Because of her business reputation and financial expertise, she is given a 40 percent interest for $77,000 cash. The bonus approach is used to record this investment,…arrow_forwardDewwy, Screwum, and Howe are forming a partnership. Dewwy is transferring $93,000 of personal cash to the partnership. Screwum owns land worth $27,000 and a small building worth $205,000, which she transfers to the partnership. Howe transfers to the partnership cash of $19,000, accounts receivable of $47,700 and equipment worth $35,000. The partnership expects to collect $45,000 of the accounts receivable. Cash 93000 Dewwy Capital 93000 Equipment 27000 Building 205000 Screwum Capital 232000 Cash 19000 Accounts Recievable 47700 Equipment 35000 Doubtful 2700 Howe Capital 99000 What amount would be reported as total owners’ equity immediately after the investments? I would have expected $99,000 since this was agreed upon. What did I miss in the reading?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education