FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:education.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/a

Help

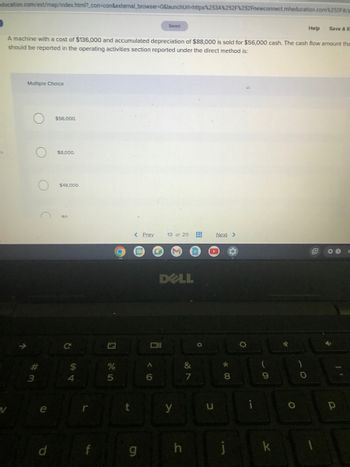

A machine with a cost of $136,000 and accumulated depreciation of $88,000 is sold for $56,000 cash. The cash flow amount the

should be reported in the operating activities section reported under the direct method is:

Multiple Choice

#的

3

C

e

d

$56,000.

$8,000.

$48,000.

с

$

4

f

2

%

5

C

t

< Prev

g

A

6

Saved

13 of 20

DELL

y

C

&

7

O

u

Next >

80

11

i

O

9

k

✓

O

O

E

Save & E

p

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Equipment that had been acquired several years ago by a special revenue fund at a cost of $40,000 was sold for $15,000 cash. Accumulated depreciation of $30,000 existed at the time of the sale. What would be journal entry that should be made in the special revenue fund (in debit and credit form)?arrow_forwardInformation has been collected regarding Orange Company’s cash-generating unit that includes goodwill. At 31 December 20X5, the assets of the Orange Company’s cash-generating unit are shown as follows (in millions) on the company’s SFP: Cost Accumulated Depreciation Net Book Value Goodwill $ 1,360 $ 0 $ 1,360 Equipment 4,850 3,150 1,700 Building 7,320 2,330 4,990 Patent rights 1,290 320 970 $ 14,820 $ 5,800 $ 9,020 An impairment test indicates that the recoverable amount assigned to the assets of this CGU is $6,200 million. The assets are not separable—they must be operated or sold together as a group.Required:1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate percentage answers to the nearest whole number (i.e.…arrow_forwardA machine with a cost of $138,000 and accumulated depreciation of $93,000 is sold for $54,000 cash. The amount that should be reported as a source of cash under cash flows from investing activities is: Multiple Choice $54,000. $9,000. $45,000. Zero. This is a financing activity. Zero. This is an operating activity.arrow_forward

- What is the statement of cash flows for this? Revenues = $304000 COGS = 164000 Depreciation = 24000 Other expenses = 28000 Loss of sale on land = 20000 Net income = 68000arrow_forwardPatterson Company’s Depreciation Expense is $20,400 and the beginning and ending Accumulated Depreciation balances are $150,200 and $155,200, respectively. What is the cash paid for depreciation?arrow_forwardNonearrow_forward

- Information has been collected regarding Orange Company’s cash-generating unit that includes goodwill. At 31 December 20X5, the assets of the Orange Company’s cash-generating unit are shown as follows (in millions) on the company’s SFP: Cost Accumulated Depreciation Net Book Value Goodwill $ 1,360 $ 0 $ 1,360 Equipment 4,850 3,150 1,700 Building 7,320 2,330 4,990 Patent rights 1,290 320 970 $ 14,820 $ 5,800 $ 9,020 An impairment test indicates that the recoverable amount assigned to the assets of this CGU is $6,200 million. The assets are not separable—they must be operated or sold together as a group.Required:1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate percentage answers to the nearest whole number (i.e.…arrow_forwardTJ Industries has revenue of $400,000 and expenses of $250,000. The depreciation cost is $80,000 and marginal tax rate is 35%. Calculate cash flow from operation. Group of answer choices a.$150,000 b.$45,500 c.$125, 500 d.$135,000arrow_forwardA truck with an original with an original cost of $ 22,000 and book value of $5,000 was sold for $4000 cash. The loss on sale would be reflected on the cash flow statement as a $22,000 subtraction under investing activities. $1000 subtraction under investing activities. $4,000 addition under operating activities. $1,000 addition under operating activities.arrow_forward

- Wildhorse Company reported a loss of $1586 for the sale of equipment for cash. The equipment had a cost of $39040 and accumulated depreciation of $35990. How much will Wildhorse report in the cash flows from investing activities section of its statement of cash flows?arrow_forwardReno Company's net income of $30,000 includes a charge for depreciation expense of $20,000. Its estimated net annual cash flow would be OA) $10,000 B) $12,500 OC) $25,000 D) $50,000 E) none of the abovearrow_forwardInformation has been collected regarding Orange Company's cash-generating unit that includes goodwill. At 31 December 20X5, the assets of the Orange Company's cash-generating unit are shown as follows (in millions) on the company's SFP: Goodwill Equipment Building Patent rights Cost $ 1,240 4,400 6,640 2,040 $14,320 Accumulated Depreciation $ 2,900 2,170 290 $5,360 Net Book Value $1,240 1,500 4,470 1,750 $8,960 An impairment test indicates that the recoverable amount assigned to the assets of this CGU is $5,600 million. The assets are not separable-they must be operated or sold together as a group. Required: 1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate percentage answers to the nearest whole number (i.e. 0.12 should be considered as 12%) and final answers to the nearest whole dollar amount. Enter the amounts in millions.) View…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education