FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

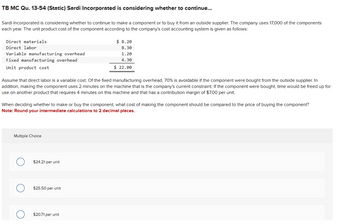

Transcribed Image Text:TB MC Qu. 13-54 (Static) Sardi Incorporated is considering whether to continue...

Sardi Incorporated is considering whether to continue to make a component or to buy it from an outside supplier. The company uses 17,000 of the components

each year. The unit product cost of the component according to the company's cost accounting system is given as follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Unit product cost

Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 70% is avoidable if the component were bought from the outside supplier. In

addition, making the component uses 2 minutes on the machine that is the company's current constraint. If the component were bought, time would be freed up for

use on another product that requires 4 minutes on this machine and that has a contribution margin of $7.00 per unit.

When deciding whether to make or buy the component, what cost of making the component should be compared to the price of buying the component?

Note: Round your intermediate calculations to 2 decimal places.

Multiple Choice

$24.21 per unit

$ 8.20

8.30

1.20

4.30

$ 22.00

$25.50 per unit

$20.71 per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: Cost AccountingPlease answer the given questions. Thank you!arrow_forwardEach year, Basu Company produces 24,000 units of a component used in microwave ovens. An outside supplier has offered to supply the part for $1.17. The unit cost is: Direct materials $0.72 Direct labor 0.25 Variable overhead 0.13 Fixed overhead 2.95 Total unit cost $4.05 Required: 1. What are the alternatives for Basu Company? 2. Assume that none of the fixed cost is avoidable. List the relevant cost(s) of internal production. List the relevant cost(s) of external purchase. 3. Which alternative is more cost effective and by how much? _____ by $___ 4. What if $18,560 of fixed overhead is rental of equipment used only in production of the component that can be avoided if the component is purchased? Which alternative is more cost effective and by how much? ____ by $____arrow_forwardNeed all answeredarrow_forward

- Werner Company produces and sells disposable foil baking pans to retailers for $2.65 per pan. The variable cost per pan is as follows: Direct materials Direct labor Variable factory overhead Variable selling expense Fixed manufacturing cost totals $143,704 per year. Administrative cost (all fixed) totals $19,596. Required: $0.27 0.51 0.69 0.18 Compute the number of pans that must be sold for Werner to break even. pans Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Unit variable cost Unit variable manufacturing cost Which is used in cost-volume-profit analysis? Unit variable cost ✓ How many pans must be sold for Werner to earn operating income of $7,000? pans How much sales revenue must Werner have to earn operating income of $7,000?arrow_forwardYou make widgets, which is a subassembly for you main product of whatsup. An outside vendor has provided you with a quote to supply the widget part for $ 72.00 per unit Your cost records show the following: Your projected production for the widget is 12,500 units Item of Cost Per Unit Cost Direct Material $18.75 Direct Labor $38.00 Variable manufacturing overhead $9.25 Lease on manufacturing facility $36,000.00 per year Depreciation of equipment $2.50 Allocated Corporate Expenses $1.25 If this offer is accepted, you can sublease the manufacturing facility for $15,000 per year All direct and variable costs can be avoided. The equipment has no salvage value How much would net operating income be changed if the outside supplier offer was accepted? Show all calculations for full creditarrow_forwardCalculate the original overhead absorption rate Southpeak plc manufactures two products, Alflon and Bur, in one of its factories. Product Alflon is a high-volume item, sales of which are 15,000 units each year, while Product Bur is a low-volume item, sales of which are only 8,000 units a year. Alflon products require two direct labour hours, and the Bur products require four direct labour hours per unit, which are currently used as the basis for assigning overhead cost to the products. The company’s overhead costs total $1,070,450 each year. Unit selling prices, costs for materials and labour in the factory of the two products are as follows: Product Alflon ($) Product Bur ($) Selling Price 89 115 Direct Labour (at $10 per hour) 20 40 Direct Materials 15 15arrow_forward

- Zion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $13 each. Zion uses 4,400 units of Component K2 each year. The cost per unit of this component is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total $7.84 2.84 1.67 4.00 $16.35 The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 1. What are the alternatives facing Zion Manufacturing with respect to production of Component K2? 2. List the relevant costs for each alternative. If required, round your answers to the nearest cent. Total Relevant Cost Make per unit Buy per unit Differential Cost to Make per unitarrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,320 remotes is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total Cost $ 67,080 $ 56,760 $ 30,960 $ 51,600 $ 206,400 Frannie is approached by Lincoln Company, which offers to make the remotes for $18 per unit. Required: 1. Compute the difference in cost per unit between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 2. Compute the difference in cost per unit between making and buying the remotes if $20,640 of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 3. What is the change in net income if fixed cost of $20,640 can be avoided and Frannie could rent out the factory space no longer in use for $20,640?arrow_forwardMuspest Supplies is currently evaluating the cost of manufacturing some of the components utilised in their products. Currently the company expects to need 6 000 parts each month. A supplier of the part has been identified and the total cost of purchasing the parts on a monthly basis would be $97 000. In analysing the part costs, the direct labour and materials cost would be $64 000 and the variable overheads would be $22 000.Based only on the relevant cost per unit, which would be the preferred option of Muspest Supplies?HD EDUCATIONA. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case, the best option would be to commence purchasing the part.B. Unit costs to produce the part would be $10.67 with the unit cost to purchase of $ 16.17. In this case, the best option would be to continue to make the part.C. None of the other answers D. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education