FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

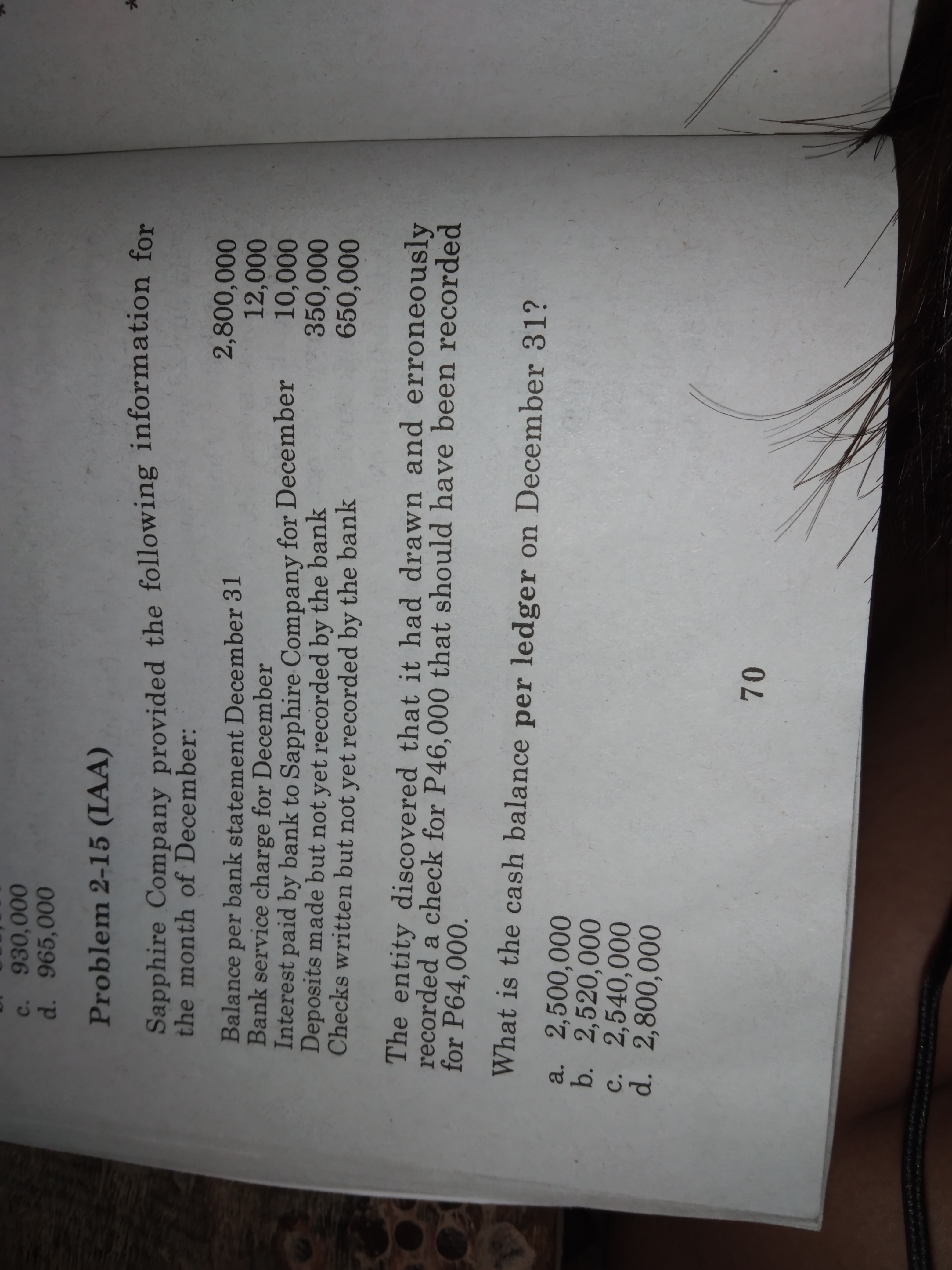

Transcribed Image Text:Sapphire Company provided the following information for

the month of December:

Balance per bank statement December 31

Bank service charge for December

Interest paid by bank to Sapphire Company for December

Deposits made but not yet recorded by the bank

Checks written but not yet recorded by the bank

2,800,000

12,000

10,000

350,000

650,000

The entity discovered that it had drawn and erroneously

recorded a check for P46,000 that should have been recorded

for P64,000.

What is the cash balance per ledger on December 31?

a. 2,500,000

b. 2,520,000

C. 2,540,000

d. 2,800,000

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SMU Tax Services gathered the following information to prepare their bank reconciliation for the month of October, 2021 Cash Balance according to the bank statement at Oct. 31, 2021 = $11,935 Cash Balance according to the company’s records at Oct. 31, 2021 = $11,185 Deposits in transit at Oct. 31, 2021 = $1,125 Outstanding checks at Oct. 31, 2021 = $2,080 A deposit of $20 was incorrectly recorded by the company as $200 The bank assessed a service charge of $25arrow_forwardXYZ Inc is preparing the October month-end Bank Reconciliation. The balance in the cash ledger on October 31 was $1,900. Some adjustments to this cash ledger balance were recorded on the Bank Reconciliation Report, as follows: • Bank service charge $55 NSF cheque: $375 • Cheque # 40 was correctly written and processed for $3,030 however the XYZ bookkeeper recorded the cheque amount for $3,300. What is the adjusted cash balance for October 31, for the Bank Reconciliation Report? Show your basic math.arrow_forwardThe following Information Is available for Trinkle Company for the month of June: 1. The unadjusted balance per the bank statement on June 30 was $56,344. 2. Deposits In transit on June 30 were $2,340. 3. A debit memo was Included with the bank statement for a service charge of $23. 4. A $5,099 check written In June had not been pald by the bank. 5. The bank statement Included a $1,450 credit memo for the collection of a note. The principal of the note was $1,405, and the Interest collected amounted to $45. Required Determine the true cash balance as of June 30. (Hint: It is not necessary to use all of the preceding Items to determine the true balance.) True cash balancearrow_forward

- On December 31, Reed Company's bank statement had a balance of $26,500. Analysis of the bank statement and comparison of the statement and records indicated the following: Deposits in transit at the end of December Outstanding checks at the end of December Bank service charge Customer's returned check, NSF Bank collection of note on our behalf Interest received on note Adjusted balance of Cash: $ 14,685 6,310 X 5 1,240 4,610 In reviewing the records, Reed Company also discovered the following error: A check for $190 in legal expense was incorrectly recorded on the books as $910. Required: Compute the adjusted balance of Cash per bank statement. $0 230arrow_forwardBelow is the bank reconciliation of CPA Company for July 2021: Balance per Bank, July 31, 2021 Add: Deposit in Transit P 750,000 120,000 P 870,000 Total Deduct: Outstanding Checks Erroneous Bank Credit Cash Balance per books, July 31, 2021 P 140,000 50,000 190,000 P 680,000 The bank statement for August 2021 contains the following data: Total deposits – P550,000; Total charges (including non-sufficient fund check of P40,000 and service charge of P2,000) – P480,000. All outstanding checks on July 31, 2021 including the bank credit were cleared in the bank in August 2021. There were outstanding checks of P150,000 and deposits in transit of P190,000 on August 31, 2021. How much were the cash disbursements per books during August 2021?arrow_forwardUsing the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $6,988 Book balance: $8,923 Deposits in transit: $1,875 Outstanding checks: $569 and $1,423 Bank service charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $123 but posted in the accounting records as $213. This check was expensed to Utilities Expense. If an amount box does not require an entry, leave it blank.arrow_forward

- When the bank statement is received on July 3, it shows a balance, before reconciliation, of $6,120 as of June 30. After reconciliation, the adjusted balance is $3,650. If one deposit in transit amounted to $1,470, what was the total of the outstanding checks assuming that no other adjustments would be made to the bank statement?arrow_forwardThese data pertain to St. Luke Company as of December 31, 2020: Bank service charge not recorded by St. Luke Bank statement, December 31 Checks outstanding (including certified check of P20,000) Customer note collected by bank for St. Luke Deposit in transit Error made by the bank in recording check issued by St. Lucas Error made by the company in recording check that cleared the bank in December (check was drawn in December for P30,000 but recorded at P80,000) Technically defective checks of customers returned by bank 20,000 4,000,000 500,000 150,000 300,000 40.000 50,000 200,000 What is the cash balance per ledger on December 31, 2020? A. 3,980,000 B. 3,880,000 C. 3,860,000 D. 3,800,000arrow_forwardThe following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31 $19,850. Cash balance according to the bank statement at July 31, $20,970. Checks outstanding, $4,030. Deposit in transit, not recorded by bank, $3,240. A check for $590 in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown in Exhibit 14. Mathers Co. Bank Reconciliation July 31 Cash balance according to bank statement $ Adjusted balance $ Cash balance according to company's records $ Adjusted balance $ b. If the balance sheet is prepared for Mathers Co. on July 31, what amount should be reported for cash?$ c. Must a bank reconciliation always balance (reconcile)?arrow_forward

- The following information is available for Trinkle Company for the month of June: 1. The unadjusted balance per the bank statement on June 30 was $59,935. 2. Deposits in transit on June 30 were $2,600. 3. A debit memo was included with the bank statement for a service charge of $27. 4. A $4,463 check written in June had not been paid by the bank. 5. The bank statement included a $700 credit memo for the collection of a note. The principal of the note was $665, and the interest collected amounted to $35. Required Determine the true cash balance as of June 30. (Hint: It is not necessary to use all of the preceding items to determine the true balance.) True cash balancearrow_forwardJerome Company provided the following information for the month of December 2022: Balance per bank statement Balance per ledger Outstanding checks Deposit in transit Service Charge Proceeds of bank loan Customer's check charged back by the bank due to absence of signature Deposit of P100,000 incorrectly recorded by bank as NSF Check Note collected by the bank Erroneous debit memo of December 28, 4,000,000 2,700,000 600,000 475,000 10,000 940,000 Prepare bank reconciliation statement. 50,000 10,000 150,000 435,000 to charge company's account 200,000 Deposit from supplier made after bank's cutoff 300,000arrow_forwardA review of the March 30 bank statement and other data of Sangster Aviation revealed a $16,220 balance at March 31 on the bank statement and S15,940 as the balance in the cash account in the company's ledger. In addition, the following information was determined: 1.NSF Check from J. Beiber in payment of account .$ 180 2.Collection of a customer electronic payment by the bank .2,200 3.Deposits in transit at March 31 4.Outstanding checks at March 31 5.A check written by Sangster to Copytronics for a copy machine repair on March 13 was recorded at $1,320 but correctly cleared the bank at $1,230. 6.A check drawn on the account of Halen Electronics for $650 was mistakenly charged against Sangster's account by the bank. Instructions: As of March 31, prepare: 1. The bank reconciliation for the month of March (omit heading) 2. Related journal entries ..2,920 .1,740 1.BANK RECONCILIATION: AmountAmount Balance per bank statement$16,220Balance per books$15,940 Adjusted balance per banks Adjusted…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education