FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

I do not understand the PV and cannot find the appropriate table for this?

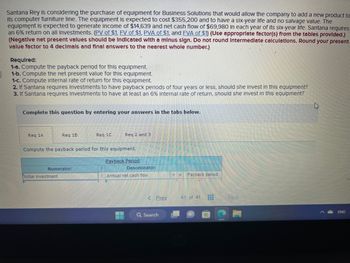

Transcribed Image Text:Santana Rey is considering the purchase of equipment for Business Solutions that would allow the company to add a new product to

Its computer furniture line. The equipment is expected to cost $355,200 and to have a six-year life and no salvage value. The

equipment is expected to generate income of $14,639 and net cash flow of $69,980 in each year of its six-year life. Santana requires

an 6% return on all Investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

(Negative net present values should be Indicated with a minus sign. Do not round Intermediate calculations. Round your present

value factor to 4 decimals and final answers to the nearest whole number.)

Required:

1-a. Compute the payback period for this equipment.

1-b. Compute the net present value for this equipment.

1-c. Compute internal rate of return for this equipment.

2. If Santana requires Investments to have payback periods of four years or less, should she invest in this equipment?

3. If Santana requires Investments to have at least an 6% Internal rate of return, should she invest in this equipment?

Complete this question by entering your answers in the tabs below.

Req 1A

Re

Numerator:

Initial investment

eq 1C

Compute the payback period for this equipment.

Req 2 and 3

1

Payback Period

Denominator:

Annual net cash flow

< Prev

Q Search

Payback period

41 of 41 H

H

Next

ENG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is Descartes's account of error? How do we make one and how can we avoid making one?arrow_forwardThe inputs to a model may have different roles. Among the choices, which should be excluded? Choices: A.decision variables B.intermediate calculation C.No choice given D.conversion factors E.historical dataarrow_forwardI don’t know how to solve for thisarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education