Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Salazar inc. Shows the following information on May 31, 2024, the company's fiscal year end:

Sandy bell opened a "zip line" eco-adventure park in july- a new company

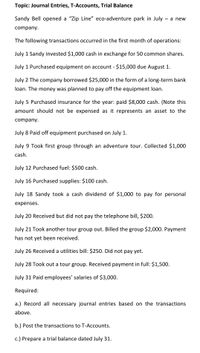

Transcribed Image Text:Topic: Journal Entries, T-Accounts, Trial Balance

Sandy Bell opened a "Zip Line" eco-adventure park in July – a new

company.

The following transactions occurred in the first month of operations:

July 1 Sandy invested $1,000 cash in exchange for 50 common shares.

July 1 Purchased equipment on account - $15,000 due August 1.

July 2 The company borrowed $25,000 in the form of a long-term bank

loan. The money was planned to pay off the equipment loan.

July 5 Purchased insurance for the year: paid $8,000 cash. (Note this

amount should not be expensed as it represents an asset to the

company.

July 8 Paid off equipment purchased on July 1.

July 9 Took first group through an adventure tour. Collected $1,000

cash.

July 12 Purchased fuel: $500 cash.

July 16 Purchased supplies: $100 cash.

July 18 Sandy took a cash dividend of $1,000 to pay for personal

expenses.

July 20 Received but did not pay the telephone bill, $200.

July 21 Took another tour group out. Billed the group $2,000. Payment

has not yet been received.

July 26 Received a utilities bill: $250. Did not pay yet.

July 28 Took out a tour group. Received payment in full: $1,500.

July 31 Paid employees' salaries of $3,000.

Required:

a.) Record all necessary journal entries based on the transactions

above.

b.) Post the transactions to T-Accounts.

c.) Prepare a trial balance dated July 31.

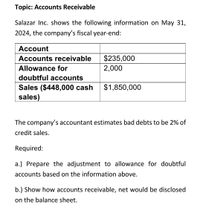

Transcribed Image Text:Topic: Accounts Receivable

Salazar Inc. shows the following information on May 31,

2024, the company's fiscal year-end:

Account

Accounts receivable

$235,000

Allowance for

2,000

doubtful accounts

$1,850,000

Sales ($448,000 cash

sales)

The company's accountant estimates bad debts to be 2% of

credit sales.

Required:

a.) Prepare the adjustment to allowance for doubtful

accounts based on the information above.

b.) Show how accounts receivable, net would be disclosed

on the balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardClovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000 accounts receivable balance at the end of 2018 and $841,000 at the end of 2019. Clovis uses the income statement method to record bad debt estimation at 4% during 2018. To manage earnings more favorably, Clovis changes bad debt estimation to the balance sheet method at 5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Clovis Enterprises in 2019 as a result of its earnings management.arrow_forwardInk Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Bristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts receivable. The uncollectible percentage is 3.1% for the income statement method and 4.5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $17,430; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardFunnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardFortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an $825,000 accounts receivable balance at the end of 2018 and $756,000 at the end of 2019. Fortune uses the balance sheet method to record bad debt estimation at 7.5% during 2018. To manage earnings more favorably, Fortune changes bad debt estimation to the income statement method at 5.5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Fortune in 2019 as a result of its earnings management.arrow_forward

- Michelle Company reports $345,000 in credit sales and $267,500 in accounts receivable at the end of 2019. Michelle currently uses the income statement method to record bad debt estimation at 4%. To manage earnings more efficiently, Michelle changes bed debt estimation to the balance sheet method at 4%. How much is the difference in net income between the income statement and balance sheet methods? A. $3,100 B. $13,800 C. $10,700 D. $77,500arrow_forwardStarlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardDortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000 accounts receivable balance at the end of 2018, and $682,000 at the end of 2019. Dortmund uses the balance sheet method to record bad debt estimation at 8% during 2018. To manage earnings more favorably, Dortmund changes bad debt estimation to the income statement method at 6% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Dortmund Stockyard in 2019 as a result of its earnings management.arrow_forward

- Last year, Nikkola Company had net sales of 2.299.500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardEstimating Bad Debts from Receivables Balances The following information is extracted from Shelton Corporations accounting records at the beginning of 2019: During 2019, sales on credit amounted to 575,000, 557,400 was collected on outstanding receivables and 2,600 of receivables were written off as uncollectible. On December 31, 2019, Shell on estimastes its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Sheltons estimate of bad debt expense for 2019. 2. Prepare the Accounts Receivable section of Shelton's December 31, 2019, balance sheet. 3. Compute Shelton's receivables turnover. (Round to one decimal place.) 4. It Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2?arrow_forwardRogan Companys total sales on account for the year amounted to 327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required Journalize the following selected entries: 2017 Dec.31 Record the adjusting entry. 2018 Mar. 2Write off the account of A. M. Billson as uncollectible, 584. June 6Write off the account of W. H. Gilders as uncollectible, 492. Check Figure Adjusting entry amount, 3,270arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub