FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

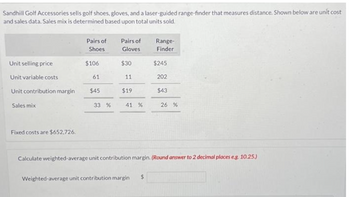

Transcribed Image Text:Sandhill Golf Accessories sells golf shoes, gloves, and a laser-guided range-finder that measures distance. Shown below are unit cost

and sales data. Sales mix is determined based upon total units sold.

Unit selling price

Unit variable costs

Unit contribution margin

Sales mix

Fixed costs are $652,726.

Pairs of

Shoes

$106

61

$45

33 %

Pairs of

Gloves

$30

11

$19

41 %

Range-

Finder

Weighted-average unit contribution margin $

$245

202

$43

26 %

Calculate weighted-average unit contribution margin. (Round answer to 2 decimal places eg. 10.25.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- jagdisharrow_forwardi need the answer quicklyarrow_forwardSmoky Mountain Corporation makes two types of hiking boots—the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Xtreme Pathfinder Selling price per unit $ 132.00 $ 94.00 Direct materials per unit $ 64.60 $ 53.00 Direct labor per unit $ 9.60 $ 8.00 Direct labor-hours per unit 1.2 DLHs 1.0 DLHs Estimated annual production and sales 24,000 units 70,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead $ 2,470,000 Estimated total direct labor-hours 98,800 DLHs Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company’s traditional costing system. 2. The company is considering replacing its traditional costing system with an…arrow_forward

- Product Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $4,400 $2,800 Variable cost of goods sold (2,770) (1,880) Manufacturing margin $1,630 $920 Variable selling expenses (706) (444) Contribution margin $924 $476 Fixed expenses (430) (190) Operating income $494 $286 In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane Sales unit volume 3,600 2,700arrow_forwardProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Sales price Variable cost of goods sold Manufacturing margin Variable selling expenses Contribution margin Fixed expenses Operating income Conquistador Hurricane $5,000 $3,200 Sales unit volume (3,150) $1,850 (700) $1,150 (540) $610 2,700 (2,140) $1,060 $ (420) In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane $640 (260) % $380 1,900 a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Product Line Item Description Conquistador Hurricane $ $ $ % b. What advice would you give to the management of Galaxy…arrow_forwardPowerTrain Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVs), the Mountain Monster and Desert Dragon, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: 1 Mountain Monster Desert Dragon 2 Sales price $5,200.00 $5,300.00 3 Variable cost of goods sold 3,240.00 3,450.00 4 Manufacturing margin $1,960.00 $1,850.00 5 Variable selling expenses 712.00 1,108.00 6 Contribution margin $1,248.00 $742.00 7 Fixed expenses 470.00 320.00 8 Income from operations $778.00 $422.00 In addition, the following sales unit volume information for the period is as follows: Mountain Monster Desert Dragon Sales unit volume 4,800 4,650 Required: a. Prepare a contribution margin by product report. Calculate the contribution margin ratio for each.…arrow_forward

- Total Cost Method of Product Pricing Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 3,500 units of cell phones are as follows: Variable costs per unit: Fixed costs: Direct materials $ 77 Factory overhead $134,700 Direct labor 35 Selling and administrative expenses 47,300 Factory overhead 23 Selling and administrative expenses 19 Total variable cost per unit $154 Smart Stream desires a profit equal to a 14% return on invested assets of $422,300. a. Determine the total costs and the total cost amount per unit for the production and sale of 3,500 cellular phones. Round the cost per unit to two decimal places. Total cost Total cost amount per unit b. Determine the total cost markup percentage for cellular phones. Round your answer to two decimal places. c. Determine the selling price of cellular phones. Round to the nearest cent. per cellular phonearrow_forwardPlease help me with correct answer thankuarrow_forwardPharoah Industries manufactures chairs and tables that are in high demand by local office furniture stores. Following is information for each of these products: Selling price per item Variable cost per item Contribution margin per item Machine hours per item Chairs O $11270 $11520 $10880 O $17390 $78.00 61.00 $17.00 1.60 Tables $95.00 77.00 $18.00 1.60 Pharoah has 1024 machine hours available each month. The demand for chairs is 610 units per month and the demand for tables is 390 units per month. If Pharoah allocates its production capacity between the chairs and tables so that it maximizes the company's contribution margin, what will the total contribution margin be?arrow_forward

- Estela Company produces skateboards and scooters. Their per unit selling prices and variable costs follow. Skateboards require 2 machine hours per unit. Scooters require 3 machine hours per unit. Selling price per unit Skateboards $ 200 Scooters) $ 400 120 310 Variable costs per unit (a) Compute the contribution margin per unit (b) Compute the contribution margin per machine hour (a) Contribution margin pet und Contion margm per machine hour Skateboards Scootersarrow_forwardi need the answer quicklyarrow_forwardProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $5,600 $3,400 Variable cost of goods sold (3,530) (2,280) Manufacturing margin $2,070 $1,120 Variable selling expenses (1,174) (610) Contribution margin $896 $510 Fixed expenses (420) (200) Operating income $476 $310 In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane Sales unit volume 2,100 1,500 a. Prepare a contribution margin by product report. Compute the contribution margin ratio for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Productarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education