EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Nikul

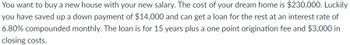

Transcribed Image Text:You want to buy a new house with your new salary. The cost of your dream home is $230,000. Luckily

you have saved up a down payment of $14,000 and can get a loan for the rest at an interest rate of

6.80% compounded monthly. The loan is for 15 years plus a one point origination fee and $3,000 in

closing costs.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please answer the following problem with full working: You wish to purchase a home for $500,000. You will make payments of $30,000 at the end of every year for 30 years. The current rate of interest is 6.5% convertibly quarterly. Find the down payment that will be necessary.arrow_forwardYou purchase a home and secure a 30 year equal payment loan for $200,000 at a interest rate of 5.25% APR compounded monthly. After 5 years the interest rate drops to 4.75% APR compounded monthly. The bank is charging 2 points to originate the new loan. How many months do you need to stay in the house after the refinance to make the refinance a benefit (Round to next month)?arrow_forwardAfter making payments of $901.10 for 8 years on your 30 year loan at 8.3%, you decide to sell your home. What is the loan payoff?arrow_forward

- You'd like to purchase a house. You're monthly take home pay is $4560. You'd like to use one fourth of your take home pay for a house payment. You have $18500 for a down payment. You can get an APR of 4.35% compounded monthly. What is the total cost of a house you can afford with a 15 year mortgage?arrow_forwardYou are thinking about buying a rental property. Because of the difficulty getting a loan, you are going to pay $350,000 in cash for the house today. You think you can rent out the property for the next 10 years, receiving $1,400 in cash each month after your expenses and taxes. At the end of ten years, you believe you will be able to sell the property for $425,000. If your discount rate is 7.2% annually with monthly compounding, what is the NPV of the rental property? (Assume first payment is 1 month from today)arrow_forwardYou borrowed $300,000 to build a home by taking out a 30 year loan that has an interest rate of 12%. What will your annual payments be? PLEASE BREAK DOWNarrow_forward

- You can afford to pay $15,000 at the end of each of the next 30 years to repay a home loan. If the interest rate is 7.50%, what is the most you can borrow?arrow_forwardYou need $15,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires a 8% annual return. What will be your annual loan payments? Round your answer to the nearest cent. Do not round intermediate calculations.arrow_forwardYou need $12,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires an 8% annual return. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answers to the nearest cent. Interest: $ Principal repayment: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT