FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

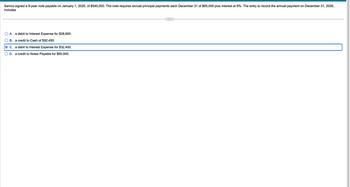

Transcribed Image Text:Samco signed a 9-year note payable on January 1, 2025, of $540,000. The note requires annual principal payments each December 31 of $60,000 plus interest at 6%. The entry to record the annual payment on December 31, 2026,

includes

A. a debit to Interest Expense for $28,800.

B. a credit to Cash of $92,400.

C. a debit to Interest Expense for $32,400.

D. a credit to Notes Payable for $60,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. Wha is the accumulated interest entry if 9 months have passed since note establishment? $1 $2,000,000 $9,360 $2,992.50arrow_forwardPlease provide answer in text (Without image)arrow_forwardOn the first day of the fiscal year, Shiller Company borrowed $26,000 by giving a three-year, 12% installment note to Soros Bank. The note requires annual payments of $10,952, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $3,120 and principal repayment of $7,832. Journalize the entries to record the following: a1. Issued the installment note for cash on the first day of the fiscal year. If an amount box does not require an entry, leave it blank. a2. Paid the first annual payment on the note. If an amount box does not require an entry, leave it blank. b. How would the notes payable be reported on the balance sheet at the end of the fiscal year?arrow_forward

- In January 1, 2020, Mega Corporation issued a $55,000, three-year, 6% installment note from Biggest Bank. The note requires annual payments of $20,576 beginning on December 31, 2020. Use this information to complete the following loan amortization table (round all of your answers to the nearest dollar). Amortization of Installment Note For the Year Ending Jan. 1st Carrying Amount Note Payment (Cash paid) Interest Expense (6%) Decrease in Principal Dec. 31st Carrying Amount 12/31/20 12/31/21 12/31/22arrow_forwardprepare a three-year (monthly) amortization schedule to classify the notes payable into its current and long-term amounts. See October 1, 2020 transaction for details of loan. October 1 - Bought office equipment for $15,000 and signed a three-year promissory note with a local bank. The annual interest rate is 5%, with monthly payments of $449.56 beginning on November 1.arrow_forwardSh5arrow_forward

- On January 1, MM Co. borrows $340,000 cash from a bank and in return signs an 8% installment note for five annual payments of $85,155 each. 1. Prepare the journal entry to record issuance of the note.2. For the first $85,155 annual payment at December 31, what amount goes toward interest expense? What amount goes toward principal reduction of the note?arrow_forwardOn January 1, $30,000 cash is borrowed from a bank in return for a 12% installment note with 36 monthly payments of $996 each. (1) Prepare an amortization table for the first three months of this installment note. (2) Record the entry for issuance of the note. (3) Record the entry for the first interest payment and for the second interest payment. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Record the entry for issuance of the note.arrow_forwardOn December 31, 2023, Sandy Company has a Note Receivable of $6,000. The note will be collected in installments. $1,200 is due on December 31, 2024 and $1,200 is due every year after December 31, 2024. The classification of the note on Sandy Company's balance sheet at December 31, 2023 is : A) $4,800 is a current asset and $1,200 is a long-term asset. B) all $6,000 is a long-term asset. C) all $6,000 is a current asset. D) $1,200 is a current asset and $4,800 is a long-term asset.arrow_forward

- At the end of 2025, the following information is available for Great Adventures. • Additional interest for five months needs to be accrued on the $31,800, 6% note payable obtained on August 1, 2024. Recall that annual interest is paid each July 31. • Assume that $11,800 of the $31,800 note discussed above is due next year. Record the entry to reclassify the current portion of the long-term note. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $26,800 during the year and recorded those as Deferred Revenue. • Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $13,800. • For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $5,800. Requirement General Journal…arrow_forwardOn January 1, 2018, King Inc. borrowed $190,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $47,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.) If an amount box does not require an entry, leave it blank. Jan. 1 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 Dec. 31 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15arrow_forwardTolino Company signed a 5-year note payable on January 1, 2020, of $200,000. The note requires annual principal payments each December 31 of $40,000 plus interest of 6%. The entry to record the annual payment on December 31, 2021, includes:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education