CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Don't use

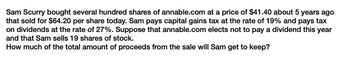

Transcribed Image Text:Sam Scurry bought several hundred shares of annable.com at a price of $41.40 about 5 years ago

that sold for $64.20 per share today. Sam pays capital gains tax at the rate of 19% and pays tax

on dividends at the rate of 27%. Suppose that annable.com elects not to pay a dividend this year

and that Sam sells 19 shares of stock.

How much of the total amount of proceeds from the sale will Sam get to keep?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jayne purchased General Motors stock 6 years ago for $20,000. In the current year, she sells the stock for $35,000. What is Jayne's gain or loss? $15,000 long-term gain $15,000 short-term gain $15,000 ordinary loss $15,000 extraordinary gain No gain or loss is recognized on this transaction.arrow_forwardDevi is the chief executive officer of Nishida Limited. Devi owns 20 percent of the common stock of Nishida. During the current year, Devis salary is 60,000 and he receives a 30,000 bonus. Nishida has taxable income of 200,000 and pays 80,000 in cash dividends. How much gross income does Devi have if a. Nishida is a corporation? b. Nishida is an S corporation?arrow_forwardPlease helparrow_forward

- Need helparrow_forwardPlease help with questionarrow_forwardMr. Chan’s employer gave him a share option in March last year to buy 10,000 shares in X Ltd for $5 each when the market price of the shares was $10. Mr. Chan exercised the share option in March this year when the market price of the shares was $15 each. He sold all the shares yesterday for $20 each. What is the share option gain to be included in the assessable income?arrow_forward

- Al Rodriguez sells 500 shares of Gold Mine Corp. short at $80 per share. The margin requirement is 50 percent. The stock falls to $62 over a three-month time period, and he closes out his position. How much is his initial margin? What is his percentage gain or loss on his initial margin? If he is in a 35 percent tax bracket for short-term capital gains and a 15 percent bracket for long-term capital gains, what is his tax obligation? If the stock went up to $94 instead of down to $62, what would be his dollar loss? Assuming this is his only transaction for the year, how large a tax deduction could he take against other income?arrow_forwardJohn bought $1,000 shares of intel stock on Oct 18,2016, for $30 per share plus $750 commission he paid to his broker. On Dec 12, 2020, he sells the shares for $42.50 per share. He also incurs a $1,000 fee for this transaction. What’s john’s adjusted basis in the 1,000 shares of Intel Stock? What amount does John realize when he sells the 1,000 shares? What is the gain/loss for John on the sale of his Intel stock? What is the character of the gain/loss?arrow_forwardSam spends $10,000 for 500 shares of XYZ, Inc. He sells all of these shares for $7,000 (a $3.000 loss) on December 15, 2020. He purchases another 500 shares of identical XYZ stock for $8,000 on January 10, 2021. What is Sam's investment basis in the XYZ shares he bought on January 10, 2021?arrow_forward

- Liam, a shareholder in Lager, Inc., (a C corporation), would like to sell 800 of his shares of stock in Lager. Since Lager is not traded on an exchange, the only way to sell is the stock is by having Lager redeem the stock. The fair market value of the 800 shares of stock is $200,000. Liam purchased the stock 10 years ago for $95/share. Lager has E&P of $700,000. The corporate stock in Lager is held as follows: Liam 2,000 shares Jennifer (Liam’s sister) 2,000 shares Katherine (Liam’s mother) 2,000 shares Beer Partnerships (Liam has a 30% interest) 4,000 shares 10,000 shares How do you calculate the 800 shares of Liam’s stock to be treated as a qualified stock redemption or will it be treated as a distribution?arrow_forwardJacob Corcoran bought 10,000 shares of Grebe Corporation stock two years ago for $24,000. Last year, Jacob received a nontaxable stock dividend of 2,000 shares in Grebe Corporation. In the current tax year, Jacob sold all of the stock received as a dividend for $18,000. What are the tax consequences of the stock sale.arrow_forwardAl owns 800 shares of The Good Life Co. The company recently issued a statement that it will pay a dividend per share of $0.55 this year and a $0.60 per share liquidating dividend next year. Al wants equal dividend income in both years. Al earns 9 percent on his investments. Ignoring taxes, what will Al's total homemade dividend policy and what will be his dividend income in both years? Support your answer with detailed computations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you