Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

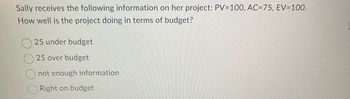

Transcribed Image Text:Sally receives the following information on her project: PV=100, AC=75, EV=100.

How well is the project doing in terms of budget?

25 under budget

25 over budget

not enough information

Right on budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- B D. You will prepare a static master budget, budgeted financial statements and a flexible budget/variance analysis for Karry No Key, Inc. which will sell karaoke machines. 5 Assumptions: You plan to form Karry No Key on April 1 and expect the following: 6 1. Invest in exchange for stock 2. Purchase delivery truck with cash with $0 salvage value and expected useful life in years 9 3. Sales increase per month 100,000 60,000 8 10 2% Collections in month of sale 69% Collections of remainder in following month of sale 2 4. Desired ending inventory (% of next month's expected sales) Payments in month of purchase Payments of remainder in following month of purchase 5 5. Other operating expenses per month to be paid in month incurred 1 31% 20% 3 10% 4 90% 49,000 Requirement 1: Complete the Sales Budget and Cash Collections for April - June and the quarter in total using applicable assumptions above. Sales Budget April May June Total 1st Quarter April Sales in units 1960 Price per unit $ 98.00…arrow_forwardAs sales manager, Joe Batista was given the following static budget report for selling expenses in the Clothing Department of Soria Company for the month of October. Sales in units Variable expenses Sales commissions Advertising expense Travel expense Free samples given out Total variable Fixed expenses Rent (a) Sales salaries Office salaries Depreciation-autos (sales staff) Total fixed Total expenses SORIA COMPANY Clothing Department Budget Report For the Month Ended October 31, 2022 Budget 8,000 $2,400 720 3,600 1,600 8,320 1,500 1,200 800 500 4,000 $12,320 Actual $2,600 850 10,000 2,000 Favorable 4,100 1,400 8,950 1,500 1,200 800 500 4,000 Difference $12,950 Favorable Unfavorable Neither Favorable nor Unfavorable $200 Unfavorable 130 Unfavorable 500 Unfavorable 200 Favorable 630 Unfavorable -0- Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable $630…arrow_forwardPlease solve this and explain the solutionsarrow_forward

- For the following budget sheet fill in the missing blanks. Budgeted Cost Week >>: <<< Description CBC 1 4 6. 7 8. 10 11 WP 1 WP 2 WP 3 WP 4 WP 5 WP 6 WP 7 WP 8 40 10 10 10 10 8 4 4 10 5 10 10 3 3 16 8. 8. 10 5 3 Total 14 14 10 10 10 5 5 A Cumulative 14 28 38 48 58 63 68 A = B= C= D= E= F= DH |의 LL 5, olcolarrow_forwardMan Hours: Budgeted hours: 40 hours Actual hours used: 44 hours Rate is $28 per hour What is the current and projected budget allotted answer? Project Budget allotted =arrow_forwardProduction budget helparrow_forward

- Helparrow_forwardLittle Table of Information (L'TOI) The table reminds you about the difference between finished units (sales volume) and resources units used to produce those sales. Also, BOTH the +2 and SQ must reflect the actual and standard (planned) resource units needed to produce the actual sales volume. Little Table of Information (L'TOI) Flexible Budget Actual Actual Finished Units (FU) Sold 17,000 17,000 x Resource Units per FU 1.00 1.50 = Total Resource Units (RU) (SQ) 17,000 25,500 (AQ) x Price per RU (SP) $8.00 $7.00 (AP) = Total cost $136,000 $178,500 Problem 6.1: In August, Phelps produced 5,000 award medals, 100 more than expected. During the month, the company purchased 1,100 ounces of gold for $875,000. Material standards per medal: 0.21 ounces @ $800 per ounce. The company actually used 1,000 ounces of gold for production. Calculate direct materials price and quantity variances. Problem 6.2: Shevlin Enterprises purchased 60,000 gallons of direct materials during the year at a price…arrow_forwardUnit Activity: Mathematical Models and Consumer Finance Part A Jenna’s monthly monetary income is $1,200. Her total spending last month was $1,400. Why would Jenna need a budget? 15px Space used (includes formatting): 0 / 15000 Part B Maria has $3,000 in the bank, has a home worth $150,000, and has a $75,000 home loan. She also has $10,000 in investments and a $15,000 student loan. What is Maria’s net worth? Show your work. 15px Space used (includes formatting): 0 / 15000 Part C Nina is trying to decide between two jobs. The first job pays $10 an hour. The second job offers a $20,000 a year salary, which would equal a gross pay of $769 every two weeks. Nina would work 40 hours a week at both jobs. Nina decides to take the salaried job because she thinks it pays better. Evaluate Nina’s decision. Explain your answer. 15px Space used (includes formatting): 0 / 15000 Part D Lola is 15 years old and works in a factory every weekend. Why might…arrow_forward

- 28. This is Kate's line graph depicting her electric usage for the first six month of last year in kWh. If electricity costs $0.137 per kWh, how much should her monthly electric budget be? 1000 800 600 400 200 0 Jan Feb Mar Apr May Jun A. $602.80 B. $50.23 C. $109.60 D. $100.47arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education