Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

posting in account

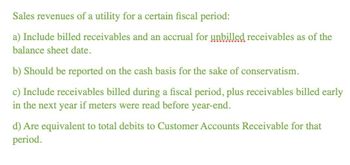

Transcribed Image Text:Sales revenues of a utility for a certain fiscal period:

a) Include billed receivables and an accrual for unbilled receivables as of the

balance sheet date.

b) Should be reported on the cash basis for the sake of conservatism.

c) Include receivables billed during a fiscal period, plus receivables billed early

in the next year if meters were read before year-end.

d) Are equivalent to total debits to Customer Accounts Receivable for that

period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Based on the given, these ar the requirements: How much should be reported as “Uncollectible Accounts Expense” in its fiscal year ending May 31, 2021 statement of comprehensive income? How much is the balance of the “Allowance for Uncollectible Accounts” to be reported in the Statement of Financial Position as at May 31, 2021? How much is the Amortized Cost/Net Realizable Value of the Accounts Receivable at May 31, 2021?arrow_forwardFollowing is some financial information of 250R Corp: 250 CORP Statement of Income For the years ended December 31, 2020 and 2021 Year Ended 31.12.2021 Sales Revenues Cost of Goods Sold Gross Margin Salaries expense Depreciation expense Interest expense Net income Long-term borrowings Accounts receivable Property, plant & equipment (PPE): Cost Accumulated Depreciation $750,000 (300,000) $450,000 (75,000) (70,000) (30,000) $275,000 Some Selected Balance Sheet Data As at 31.12.2021 $300.000 $525,000 $350,000 210,000 Year Ended 31.12.2020 $500,000 (200,000) $300,000 (50,000) (70,000) (30,000) $150,000 As at 31.12.2020 $300.000 $250.000 $350,000 140,000arrow_forwardquestion: how do profit sharing obligation affect interim financial reports?arrow_forward

- From the attached image, which deferred revenue do we need to consider for calculations? I can see two of them one is current and the other one is net of the current portion.arrow_forwardGive me right answer with proper wayarrow_forwardAssume credit sales for 2019 were $312,000 and that on December 31, 10% of credit sales are estimated to be uncollectible. Using the percentage of sales method: Determine the amount to be charged to the uncollectible expense account. Prepare the Allowance for uncollectible account. Prepare the balance sheet extract to show the net realizable value of the Accounts Receivable as at December 31.arrow_forward

- Given the following information, complete the balance sheet shown next Collection period Days' sales in cash Current ratio Assets Current assets: Cash Inventory turnover Liabilities to assets Payables period (All sales are on credit. All calculations assume a 365-day year. The payat Note: Round your answers to the nearest whole dollar. Accounts receivable Inventory Total current assets Net fixed assets Total assets Liabilities and shareholders equity Current liabilities: Accounts payable Short-term debt Total current liabilities 70 days 32 days 2.2 5 70% 36 days Long-term debt Shareholders equity Total liabilities and equity times $ 1,300,000 S S 1,900,000 8,000,000 2.400.000 8.000.000arrow_forwardWhat is the december 31, 2021 net realizable value?arrow_forwardA firm’s Balance Sheet and Income Statement for FY 2021 is displayed below and in the in the attached excel file. Answer the following questions. NOTE: For this question, use the end-of-the year approach (and not the mid-year convention). For example, this means that days receivables = end of FY receivables/daily sales; similarly for the remaining relevant ratios. BALANCE SHEET 2021 Cash and cash equivalents 280 Receivables 2588 Inventory 2516 Other 189 TOTAL CA 5573 Fixed assets 5024 TOTAL ASSETS 10597 Accounts payable 4713 Short term debt 78 TOTAL CL 4790 LT debt 921 Shareh. Equity 4886 TOTAL LIAB. AND SHARH. EQUITY 10597 INCOME STATEMENT 2021 Sales 19418 COGS 13136 Depreciation 354 SG&A 4952 EBIT 976 Interest Expenses 52 Tax 268 Net income 656 Determine the managerial balance sheet for the FY 2021.arrow_forward

- 1))For the years ended December 31, 2018 of your analysis, assume all sales are on credit and then compute the following: · (a) collection period, · (b) accounts receivable turnover, · (c) inventory turnover, and · (d) days' sales in inventory. · (e) Based on your estimates, comment on the changes in the ratios from 2018 year by drawing conclusion regarding efficiency in managing inventory and in collecting receivables (Note: Comment not more than 10 lines). 2))Provide your recommendations for improving the financial condition of your company. (Note: Comment not more than 10 lines).arrow_forwardChoose the letter of answer and solution A company reports the following data relative to accounts receivable: Average accounts receivable of P400,000.00 and P416,000.00 in FYs 2021 and 2020, respectively; and Net Credit Sales of P2,600,000.00 and P3,100,000.00 in FYs 2021 and 2020, respectively. The term of sale are net 30 days. Compute the accounts receivable turnover and the collection period in FY 2021. * a. 6.5 times and 56.2 daysb. 7.45 times and 49 daysc. 7.5 times and 56.2 daysd. 6.5 times and 49 daysarrow_forwardMahal Mo Co. reported revenue of P3,100,000 in its accrual basis income statement for the year ended December 31, 2020. Additional information are as follows: Accounts receivable, December 31, 2019, P700,000 and Accounts receivable, December 31, 2020, P1,100,000. Under the cash basis, how much should Mahal Mo Co. report as revenue for 2020? *arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning