FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

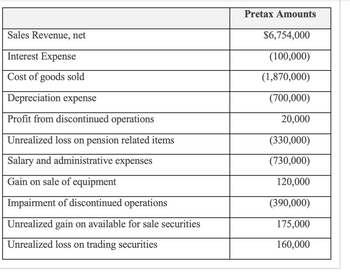

A. Prepare a multistep income statement and determine each of the following subtotals for 20x8 using the information above. Apply a 40% effective tax rate where applicable:

Transcribed Image Text:Sales Revenue, net

Interest Expense

Cost of goods sold

Depreciation expense

Profit from discontinued operations

Unrealized loss on pension related items

Salary and administrative expenses

Gain on sale of equipment

Impairment of discontinued operations

Unrealized gain on available for sale securities

Unrealized loss on trading securities

Pretax Amounts

$6,754,000

(100,000)

(1,870,000)

(700,000)

20,000

(330,000)

(730,000)

120,000

(390,000)

175,000

160,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the marginal tax rate chart to answer the question. Tax Bracket Marginal Tax Rate $0–$10,275 10% $10,276–$41,175 12% $41,176–$89,075 22% $89,076–$170,050 24% $170,051–$215,950 32% $215,951–$539,900 35% > $539,901 37% Determine the effective tax rate for a taxable income of $95,600. Round the final answer to the nearest hundredtharrow_forwardd cion The table given below shows the absolute tax amounts under five different tax policies for respective income levels. Table 19.2 Annual Pretax Income Tax Policy Alpha O Gamma. Alpha. SO $0 $0 $0 $0 $10,000 $1,000 $1,000 $1,000 $1,000 $1,000 $50,000 $5,000 $6,000 $4,000 $1,000 $900 $100,000 $10,000 $15,000 $6,000 $1,000 $800 Beta. O Eta. Refer to Table 19.2. The tax structure which leads to maximum income inequality is: Delta. Tax Policy Beta Question 18 Tax Policy Gamma 27 Tax Policy Delta Tax Policy Eta $0 tv 9 N 4.nts. Narrow_forward1arrow_forward

- A taxable investment produced interest earnings of $2,800. A person in a 26 percent tax bracket would have after-tax earnings of: (Round your answer to the nearest whole number.) Multiple Choice $2,800. $728. $1,347. $2,072. $2,285.arrow_forwardI am working on creating an excel sheet using tax brackets. Can you please assist me with an excel formula that would automatically calculate the tax with the following bracket: Cumulative Tax Income Less than 22,000 22,000 89,450 190,750 364,200 462,500 693,750 Rate 10% 12% 22% 24% 32% 35% 37% $2,200 10,294 32,580 74,208 105,664 186,602 My objective is to determine net income after taxes. I need to determine the formula so I can automatically calculate tax based on the respective tax rates when typing in their income. I have figured out the other part, but am not sure with the IF/Then formula. Thank you! Taxable Income 72,300 Federal Income Tax ??????arrow_forwardExercise 3-23 (Algorithmic) (LO. 6) Compute the 2023 tax liability and the marginal and average tax rates for the following taxpayers. Click here to access the 2023 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (l.e., .67073 would be rounded to .6707 and entered as 67.07%). a. Chandler, who files as a single taxpayer, has taxable income of $157,600. Tax liability: Marginal rate: Average rate: 14,934 X 19.78 X % % b. Lazare, who files as a head of household, has taxable income of $72,000. Tax liability: Marginal rate: Average rate: % %arrow_forward

- In step 2 how did you get the excess income tax of 19,520.00?arrow_forwardAssume the following information to complete this question. Total Gross Sales $100,000 Total Full Deduction $60,000 Total Sales Tax rate of 9% Calculate the amount of District Tax that would be reported. Knowledge of the statewide base rate is needed to figure out ONLY the district tax amount. It may be helpful to use the sales tax return as your guide.arrow_forward5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education