FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

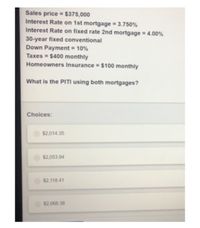

Transcribed Image Text:Sales price = $375,000

Interest Rate on 1st mortgage = 3.750%

Interest Rate on fixed rate 2nd mortgage = 4.00%

30-year fixed conventional

Down Payment = 10%

Taxes = $400 monthly

Homeowners Insurance = $100 monthly

What is the PITI using both mortgages?

Choices:

$2,014.35

$2,053.94

$2,118.41

$2,068.38

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Suppose Bank A offers a $201,000, 20-year, 2.1% fixed rate mortgage with closing costs of $1900 plus 2 points. What are the closing costs associated with this mortgage? Answer to the nearest dollar.arrow_forwardYour bank offers the following options on a $100,000 mortgage: 1. A 15-year, 4% loan with no points 2. A 15-year, 3.5% loan, with 1.5 discount points.. The interest portion of the first payment (INT) is. for option 2. $333.33: $291,67 None of the above. O $4,000; $3,500 O $406.36; $423.21 for option 1, andarrow_forwardConsider a 30-year, fixed-rate mortgage for $120,000 at a nominal rate of 6% with monthly payments. If the borrower pays an additional $120 with each monthly payment, what will be the amount of the last monthly payment? A. $839.46 B. $357.77 C. $843.66 D. $419.85 E. $355.99 F. $420.90 G. $418.81 H. $841.55arrow_forward

- Find the indicated amounts for the fixed-rate mortgages. Purchase price of home $160,000 SO 5.00% 30 Click the icon to view the table of the monthly payment of principal and interest per $1,000 of the amount financed. Down Mortgage Interest payment amount rate Years Monthly payment Mortgage paid for Total payment mortgage per $1,000 ICHHI The mortgage amount is S (Round to the nearest dollar as needed.) The monthly payment per $1,000 is S. (Round to the nearest cent as needed.) The monthly mortgage payment is S The total mortgage payment is S The total interest is $ (Round to the nearest cent as needed.) (Round to the nearest dollar as needed.) (Round to the nearest dollar as needed.) Interest paidarrow_forwardWhat is monthly monthly mortgage insurance premium for following FHA mortgage during the first year of the loan: • Gross loan amount including up-front mortgage insurance premium: $180,000 • Average balance of base loan amount in first year: $178,416 Annual premium rate for FHA mortgage insurance (paid monthly): 0.85% (Input your answer rounded to the nearest whole penny and without the $ sign, e.g., 1000.01).arrow_forwardYou get a 7.125% mortgage loan with front-end loan charges of $3,800. Will your APR be: (a) less than 7.125% (b) exactly 7.125% (c) greater than 7.125%arrow_forward

- please show calculation for both clearly show mortgage schedule clearly answer in text without copy paste need complete and correct answer with full explanationarrow_forwardUsing the residential mortgage-debt to income ratio of 28%, and total-debt to income ratio of 36%, what is the largest loan (with a 30-year FRM at 6%) you can qualify for if you make $38,000 a year and have outstanding debt with $250/month payments? O $113,418 O $140,107 O $150,112 $155,616 O $148,445arrow_forwardThe difference between the monthly payments on a $120,000 mortgage at 6 ½% and at 8% for 25 years is: Multiple Choice $81.12 $151.02 $115.93 $91.12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education