Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

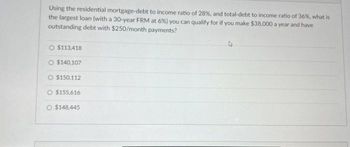

Transcribed Image Text:Using the residential mortgage-debt to income ratio of 28%, and total-debt to income ratio of 36%, what is

the largest loan (with a 30-year FRM at 6%) you can qualify for if you make $38,000 a year and have

outstanding debt with $250/month payments?

O $113,418

O $140,107

O $150,112

$155,616

O $148,445

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You can afford a $1350 per month mortgage payment. You've found a 30 year loan at 8% interest. a) How big of a loan can you afford? $ 142,944 b) How much total money will you pay the loan company? $ 486,012. X c) How much of that money is interest? $ 343,058.82 Xarrow_forwardSuppose you earn a gross income of $2,710.00 per month and apply for a mortgage with a monthly PITI of $501.35. You have other financial obligations totaling $428.18 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% O FHA only O Conventional only O FHA and Conventional O None of the abovearrow_forwardYou own a home that was recently appraised for $370,000. The balance on your existing mortgage is $129,350. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? 2$arrow_forward

- Suppose you earn a gross income of $2,920.00 per month and apply for a mortgage with a monthly PITI of $908.12. You have other financial obligations totaling $169.36 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% A. FHA only B. Conventional only C. FHA and Conventional D. None of the abovearrow_forwardYou can afford a $1000 per month mortgage payment. You've found a 30 year loan at 7% interest. a) How big of a loan can you afford? %24 b) How much total money will you pay the loan company? c) How much of that money is interest? %24arrow_forwardGiven a mortgage of $48,000 for 15 years with a rate of 11%, what are the total finance charges? (Use Table 15.1 in the textbook for the factor.) A. $54,576 B. $50,236.80 C. $5,023.68 D. $545.76arrow_forward

- Suppose you purchase a home and obtain a 15-year fixed-rate loan of $195,000 at an annual interest rate of 6.0%. a) What is your monthly payment? N: months I %: P.V: $ PMT: $ F.V: 0 P/Y: 12 C/Y: 12 b) Of the first month's mortgage payment, how much is interest? HINT: I=Prt Interest: I=$ c) Of the first month's mortgage payment, how much is applied to the principal? HINT: PMT - Interest Amount Applied to Principal: $ d) How much is your outstanding balance after the first month’s payment? HINT: Principal - Amount Applied to Principal Outstanding Balance after first payment: $arrow_forwardYou want to take out a $250,000 mortgage (home loan). The interest rate on the loan is 5% and the loan is for 25 years. How much will your semi- monthly payments be? a. $655 $622 c. $730 O d. $680 e. $752 O b.arrow_forwardYou get a $550,000 mortgage loan with 1¼ points. What dollar amount do you pay for points?arrow_forward

- You can afford a $1150 per month mortgage payment. You've found a 30 year loan at 6% interest.a) How big of a loan can you afford?b) How much total money will you pay the loan company?c) How much of that money is interest?arrow_forwardYour current mortgage payment is $1,558.50 per month, with a balance of $217,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $90; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. a) Calculate the total refinance closing cost (in $). (Round your answer to the nearest cent.)arrow_forwardThe Becker family is getting a home loan to finance a $260,000 mortgage. While looking for a mortgage, they found two alternatives: Mortgage A 30-year loan with an interest rate of 3.611% and a monthly payment of $1,184. Mortgage B 15-year loan with an interest rate of 2.7% Recall: Loan Payment Formula.png| A. Calculate the total amount paid for Mortgage A. B. Calculate the total interest paid for Mortgage A. C. Calculate the monthly payment for Mortgage B. D. Calculate the total amount paid for Mortgage B. E. Calculate the total interest paid for Mortgage B. F. Write a two or more sentences giving the Becker family some advice about which mortgage to choose. G. Why might the Becker family not take your advice from part c)? Answer in one or two sentences.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning