FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

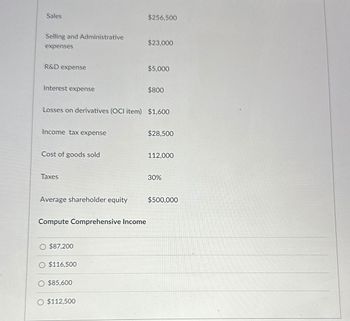

Transcribed Image Text:Sales

$256,500

Selling and Administrative

$23,000

expenses

R&D expense

Interest expense

$5,000

$800

Losses on derivatives (OCI item) $1,600

Income tax expense

$28,500

Cost of goods sold

112,000

Taxes

30%

Average shareholder equity

$500,000

Compute Comprehensive Income

O $87,200

$116,500

O $85,600

O $112,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- CARDO COMPANY Book Value Fair Value Book Value Fair Value Cash P500,000 P500,000 Accounts Payable P450,000 P440,000 Accounts Receivable 250,000 240,000 Mortgage Payable 200,000 220,000 Inventory 155,000 200,000 Ordinary Shares 595,000 - Fixed Assets (Net) 600,000 520,000 Retained Earnings 260,000 - SYANO COMPANY Book Value Fair Value Book Value Fair Value Cash P300,000 P300,000 Accounts Payable P350,000 P340,000 Accounts Receivable 150,000 160,000 Mortgage Payable 200,000 220,000 Inventory 125,000 100,000 Ordinary Shares 250,000 - Fixed Assets (Net) 400,000 420,000 Retained Earnings 175,000 - If CARDO Co purchases the net assets of SYANO Co by issuing 5,000 shares of their P20 par value shares with a fair value of P40 per share, incurs a mortgage loan for P90,000, pays P150,000 cash and paying direct,…arrow_forwardAccounts Payable Notes Payable Long Term Debt Common Stock Retained Earnings Total Liabilities & Equity $ 275,000 $ 315,000 $ 495,000 $ 925,000 $2,450,000 $4,460,000 Pre-Tax Cost of Debt: Intermediate Debt: 4.5% Long Term Debt: 6.5% Tax Rate: 21% Return on Equity: 11% Dividends per share: $0.20 Earnings per share: $0.90 C/S market price: $55 C/S outstanding: 80000 shares This company uses intermediate debt, long-term debt and common equity to finance its operations. With the information presented above: a. Calculate the firm's debt ratio (book value and market value based) b. Calculate the firm's WACC c. Calculate the new firm's WACC if the firm issued 150,000 new common stock at a flotation cost of $1.20 per share. The new issuance generates $4.5 million.arrow_forwardces The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement Net income Assets Total EFN $9,200 -5,520 $3,680 Balance Sheet Debt Equity $26,680 $26,680 Total $10,800 15,880 $26,680 Check my Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $10,212. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forward

- vas.msst Net sales Operating costs except depreciation Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income Other data: Shares outstanding (millions) Common dividends (millions of $) Int rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price $98,000 91.140 1,960 $4,900 960 $3,940 1,576 $2,364 500.00 $827.40 6% 40% $56.74 Refer to Exhibit 4.1. What is the firm's ROA? Do not round your intermediate calculations,arrow_forwardprofit marginarrow_forwardancial Statements Nataro, Incorporated, has sales of $676,000, costs of $338,000, depreciation expense of $82,000, interest expense of $51,000, and a tax rate of 24 percent. What is the net income for this firm? (Do not round intermediate calculations.) Net incomearrow_forward

- Peace Inc. has the following information: Sales P 480,000 Operating expenses 300,000 Net loss (60,000) How much is the entity's cost of sales? A. 340,000B. 360,000C. 240,000D. 420,000arrow_forwardNRH Corp.Common-sizeIncome Statement Sales 100% Cost of goods sold 63 Operating expenses 21 Interest expense 5 Income tax 4 Net income 7% Sales $8,000,000 NRH Corp. Common-size Balance Sheet Cash 5% Accounts receivable 20 Inventory 25 PP&E, net 50 Total assets 100% Short-term debt 20% Long-term debt 35 Common equity 45 Total liabilities and equity 100% Total assets $6,000,000 NRH Corp’s current ratio is closest to: 1.90. 1.20. 2.50. NRH Corp’s times interest earned ratio is closest to: 1.6. 7.0. 3.2.arrow_forwardSales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 You are required to:i) Calculate the operating cash flow ii) Calculate the cash flow to creditors iii) Calculate the cash flow to shareholdersarrow_forward

- Breanna Inc. Accounts receivable$10,700Accumulated depreciation 50,800Cost of goods sold 123,000Income tax expense 8,000Cash 62,000Net sales 201,000Equipment 128,000Selling, general, and administrative expenses 32,000Common stock (8,700 shares) 90,000Accounts payable 14,300Retained earnings, 1/1/19 30,000Interest expense 5,600Merchandise inventory 38,600Long-term debt 38,000Dividends declared and paid during 2019 16,200 Item1 Time Remaining 2 hours 32 minutes 36 seconds 02:32:36 Item 1 Time Remaining 2 hours 32 minutes 36 seconds 02:32:36 The information on the following page was obtained from the records of Breanna Inc.: Accounts receivable $ 10,700 Accumulated depreciation 50,800 Cost of goods sold 123,000 Income tax expense 8,000 Cash 62,000 Net sales 201,000 Equipment 128,000 Selling, general, and administrative expenses 32,000 Common stock (8,700 shares) 90,000 Accounts payable 14,300 Retained earnings, 1/1/19…arrow_forwardLarge Company $ Net sales 379,420 163,100 216,320 Cost of sales Gross profit Selling, general, and administrative $ 146,610 expenses Operating income $ 69,720 Net income 41,610 50,480 Cash and cash equivalents Net receivables 17,400 Inventories 223,430 315,160 Total current assets Property and equipment 81,880 Other assets 66,040 Total assets 463,090 29,540 Accounts payable Stockholder equity 261,130 What is the value of C2C in weeks? (Choose the closest) 31.47 -12.81 -5.82 64.20 4.arrow_forwardAccounts payable $509,000Notes payable $244,000Current liabilities $753,000Long-term debt $1,246,000Common equity $4,751,000Total liabilities and equity $6,750,000 What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm's new debt ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education