FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

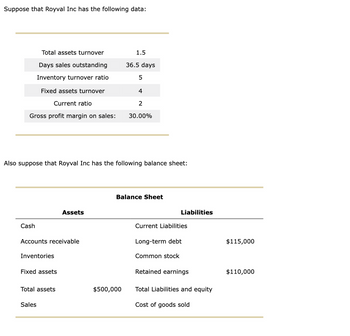

Transcribed Image Text:Suppose that Royval Inc has the following data:

Gross profit margin on sales:

Total assets turnover

Days sales outstanding

Inventory turnover ratio

Fixed assets turnover

Current ratio

Cash

Accounts receivable

Inventories

Also suppose that Royval Inc has the following balance sheet:

Fixed assets

Total assets

Sales

Assets

1.5

36.5 days

$500,000

5

4

2

30.00%

Balance Sheet

Liabilities

Current Liabilities

Long-term debt

Common stock

Retained earnings

Total Liabilities and equity

Cost of goods sold

$115,000

$110,000

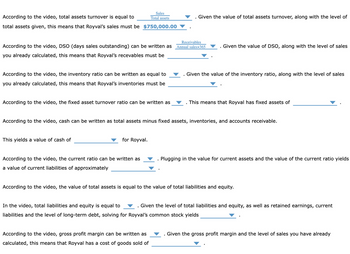

Transcribed Image Text:According to the video, total assets turnover is equal to

total assets given, this means that Royval's sales must be $750,000.00

According to the video, DSO (days sales outstanding) can be written as

you already calculated, this means that Royval's recevables must be

According to the video, the inventory ratio can be written as equal to

you already calculated, this means that Royval's inventories must be

Sales

Total assets

According to the video, the fixed asset turnover ratio can be written as

This yields a value of cash of

for Royval.

According to the video, the current ratio can be written as

a value of current liabilities of approximately

I

According to the video, gross profit margin can be written as

calculated, this means that Royval has a cost of goods sold of

Given the value of total assets turnover, along with the level of

Receivables

Annual salesx365

.

According to the video, cash can be written as total assets minus fixed assets, inventories, and accounts receivable.

Given the value of DSO, along with the level of sales

Given the value of the inventory ratio, along with the level of sales

This means that Royval has fixed assets of

Plugging in the value for current assets and the value of the current ratio yields

According to the video, the value of total assets is equal to the value of total liabilities and equity.

In the video, total liabilities and equity is equal to . Given the level of total liabilities and equity, as well as retained earnings, current

liabilities and the level of long-term debt, solving for Royval's common stock yields

Given the gross profit margin and the level of sales you have already

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- USE THE BELOW INCOME STATEMENT AND INFORMATION TO ANSWER THE NEXT FOUR QUESTIONS AND COMPLETE THE INCOME STATEMENT. Net Sales Cost of Goods Sold Selling Expenses Administrative Expenses Interest Expenses Other Expenses Income before Taxes Income Tax Expenses Net Income ● ● MY Company Income Statement December 31, 2018 (Amounts in thousands) Use the following ratio data to complete FS Company's income statement. Inventory turnover is 4 (beginning inventory was $895: ending inventory was $758). Inventory turnover = cost of goods sold / Average inventory Rate of Return on Sales is 0.15 O $10,500 (a) $2,561 $458 (b) $554 $2,046 (c) (d)arrow_forwardLuxe Mobile Homes reported the following in its financial statements for the year ended December 31, 2024: (Click the icon to view the financial statements) Read the requirements. Requirement 1. Compute the collections from customers. Collections from customers are $ 24.444 Requirement 2. Compute payments for merchandise inventory. Payments for merchandise inventory are $ 18,560 Requirement 3. Compute payments of other operating expenses. Payments of other operating expenses are S 4.324 Requirement 4. Compute acquisitions of property, plant, and equipment (no sales of property during 2024). Acquisitions of property, plant, and equipment are Help me solve this Demodocs example Get more help - f4 f5 # +3 $ 4 do % 5 6 O & 7 Data table M Income Statement Net Sales Revenue Cost of Goods Sold Depreciation Expense Other Operating Expenses Income Tax Expense Net Income Balance Sheet Cash Accounts Receivable Merchandise Inventory Property, Plant, and Equipment, net Accounts Payable Accrued…arrow_forwardWhat effect would each method have on the Balance Sheet? What is the difference in the current ratio, if current libilities was $120,000 and current assets above inventory was $200,000 (no other assets are below inventory), when using the FIFO method vs. the average cost method?arrow_forward

- The following information has been collected from two London-based companies. The accounts are drawn up to 31st December 2021. Profit and Loss Account for the year ended 31st December 2021 (Figures are in £000) Particulars XYZ ABC Sales 3,690 4,586 Less: Cost of Goods Sold (Including purchases) (2,146) (2,690) Gross Profit 1,544 1,896 Less: Selling & Distribution Expenses Less: Depreciation (1,103) (1,253) Earnings before Interest & Tax or Operating Profit 441 643 Less: Interest (225) (192) Earnings before Tax 216 451 Less: Taxes (86) (180) Earnings after Tax or Net Profit 130 271 Balance Sheet as at31st December 2021 (Figures are in £000) Assets XYZ ABC Fixed Assets 4,542 4,790 Current Assets Account Receivables 274 313 Inventory 654 702 Cash 140 163 Total Current Assets 1,068 1,178 Total Assets 5,610 5,968…arrow_forwardP palace provided the following Information:Ending inventory, previous period$95,500Ending inventory, current period$105,500Sales, previous period$450,550Sales, current period$540,450Determine the Inventory turnover for current period, assuming that gross profit for $195,405.3.43 times2.99 times3.27 times3.61 timesarrow_forwardPlease help me evaluate these financial ratios to identify any trends or issues and potential reasons for them. Could Covid have played a role? Please help me interpret the ratios in Group B from managements perspective from period 12/31/19 & 6/30/20arrow_forward

- James Company experienced the following events during its first accounting period: (1) Purchased $10,000 of inventory on account under terms 1/10 n/30. (2) Returned $2,000 of the inventory purchased in Event 1. (3) Paid the remaining balance in account payable for the inventory purchased in Event 1. Based on this information, which of the following shows how paying off the account payable (Event 3) will affect the Company's financial statements? Balance Sheet Income Statement Assets = Liabilities + A. (8,000) B. (7,900) C. (8,000) D. (7,920) Multiple Choice Option A Option D Option C Option B (8,000) (7,900) (8,000) (7,920) Stockholders' Equity n/a n/a n/a n/a Revenue n/a n/a n/a n/a Expense n/a 7,900 8,000 n/a Net Income n/a (7,900) (8,000) n/a Statement of Cash Flows (8,000) Operating Activity (7,900) Operating Activity (8,000) Operating Activity (7,920) Operating Activityarrow_forwardPrinciples Of Accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education